Importing Pay Data from a CSV File

To access this utility, go to Payroll:

Importing Periodic Basic Amounts

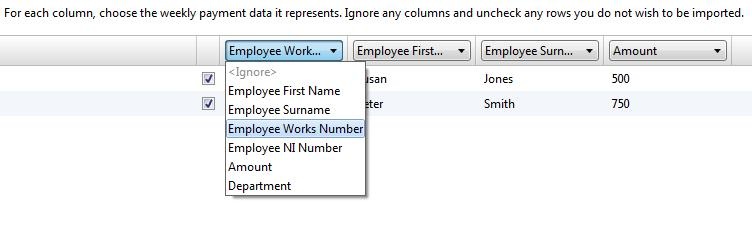

To import set basic amounts, go to Payroll > More > Import from CSV File > Import Weekly/ Monthly/ Fortnightly/ 4-weekly Payments:

1) Browse to the location of your CSV File

2) Select the required file and click 'Open'

3) Your employee data will be displayed on screen. For each column, choose the payment data it represents. Ignore any columns and uncheck any rows you do not wish to be imported:

4) Click Import to complete the import of your payment information.

Fields which can be imported into BrightPay using the Payment Import File are:

Employee First Name

Employee Surname

Employee Works Number

Employee NI Number

Amount

Department

Importing Daily Payments

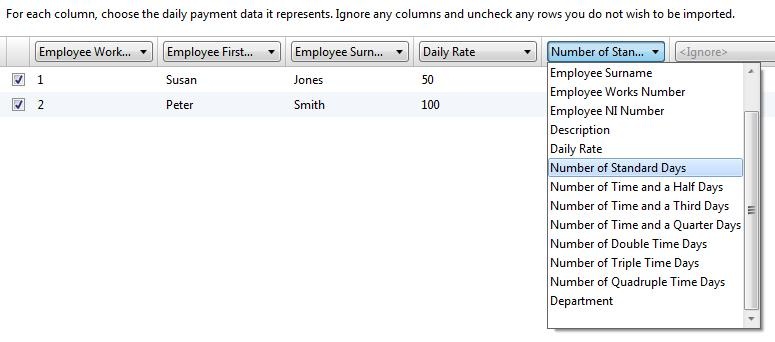

To import daily payments, go to Payroll > More > Import from CSV File > Import Daily Payments:

1) Browse to the location of your CSV File

2) Select the required file and click 'Open'

3) Your employee data will be displayed on screen. For each column, choose the payment data it represents. Ignore any columns and uncheck any rows you do not wish to be imported:

4) Click Import to complete the import of your payment information.

Fields which can be imported into BrightPay using the Daily Payments Import File are:

Employee First Name

Employee Surname

Employee Works Number

Employee NI Number

Description

Daily Rate

Number of Standard Days

Number of Time and a Half Days

Number of Time and a Third Days

Number of Time and a Quarter Days

Number of Double Time Days

Number of Triple Time Days

Number of Quadruple Time Days

Department

Importing Hourly Payments

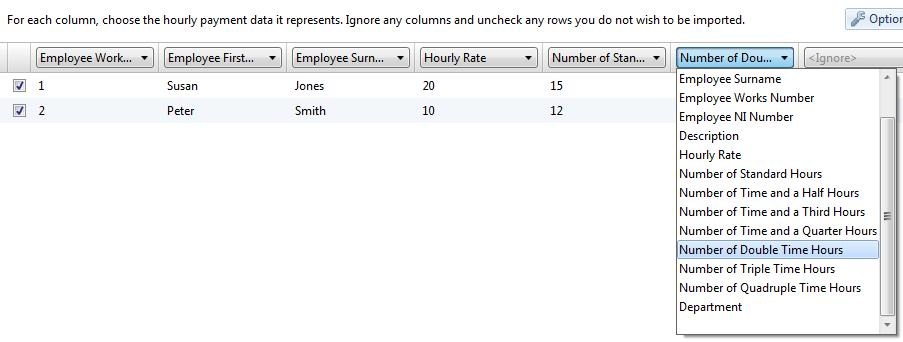

To import hourly payments, go to Payroll > More > Import from CSV File > Import Hourly Payments:

1) Browse to the location of your CSV File

2) Select the required file and click 'Open'

3) Your employee data will be displayed on screen. For each column, choose the payment data it represents. Ignore any columns and uncheck any rows you do not wish to be imported:

4) Click Import to complete the import of your payment information.

Fields which can be imported into BrightPay using the Hourly Payments Import File are:

Employee First Name

Employee Surname

Employee Works Number

Employee NI Number

Description

Hourly Rate

Number of Standard Days

Number of Time and a Half Hours

Number of Time and a Third Hours

Number of Time and a Quarter Hours

Number of Double Time Hours

Number of Triple Time Hours

Number of Quadruple Time Hours

Department

Importing Additions

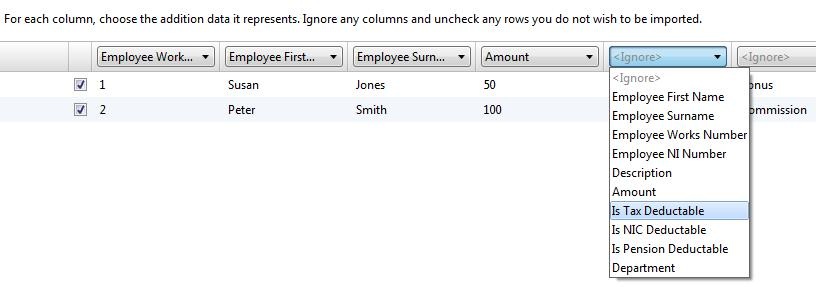

To import additions, go to Payroll > More > Import from CSV File > Import Additions:

1) Browse to the location of your CSV File

2) Select the required file and click 'Open'

3) Your employee data will be displayed on screen. For each column, choose the payment data it represents. Ignore any columns and uncheck any rows you do not wish to be imported:

4) Click Import to complete the import of your payment information.

Fields which can be imported into BrightPay using the Additions Import File are:

Employee First Name

Employee Surname

Employee Works Number

Employee NI Number

Description

Amount

Is Tax Deductable

Is NIC Deductable

Is Pension Deductable

Department

Importing Deductions

To import deductions, go to Payroll > More > Import from CSV File > Import Deductions:

1) Browse to the location of your CSV File

2) Select the required file and click 'Open'

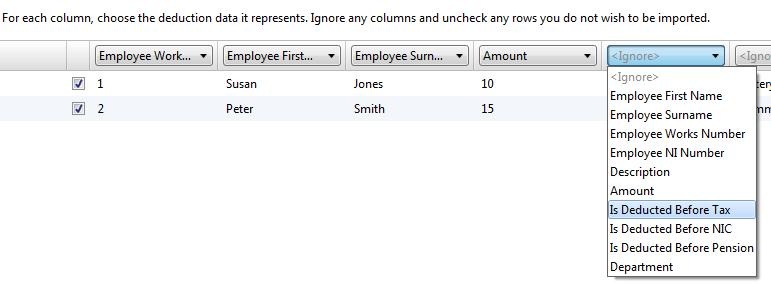

3) Your employee data will be displayed on screen. For each column, choose the payment data it represents. Ignore any columns and uncheck any rows you do not wish to be imported:

4) Click Import to complete the import of your payment information.

Fields which can be imported into BrightPay using the Deductions Import File are:

Employee First Name

Employee Surname

Employee Works Number

Employee NI Number

Description

Amount

Is Deducted Before Tax

Is Deducted Before NIC

Is Deducted Before Pension

Department

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.