New for 2014-15 - Hourly Band Amendments

Reporting Contracted Hours - Hourly Bands for FPS

For the Full Payment Submission (FPS) employers must indicate, at each employee level, into which HMRC predetermined list of hourly bands the employees normal working week falls.

This reports the number of weekly contracted hours the employee is contracted to work as opposed to the actual hours worked per week, therefore this field should not require amendment unless there is an amendment to the employees contract.

For 2013/14 HMRC issued the hourly bands to use as;

A Up to 15.99 hours

B 16 to 29.99 hours

C 30 hours or more

D Other

You should only select 'D Other' if your employee does not have a regular pattern of employment, or if the payment relates to an occupational pension or annuity.

It is important to record the correct number of hours your employee has worked to help ensure they receive the right amount of benefits and tax credits they are entitled to.

From 06th April 2014 (2014/15) the number of bands will increase from 4 to 5 - the new bands are:

A Up to 15.99 hours

B 16 to 23.99 hours

C 24 to 29.99 hours

D 30 hours or more

E Other

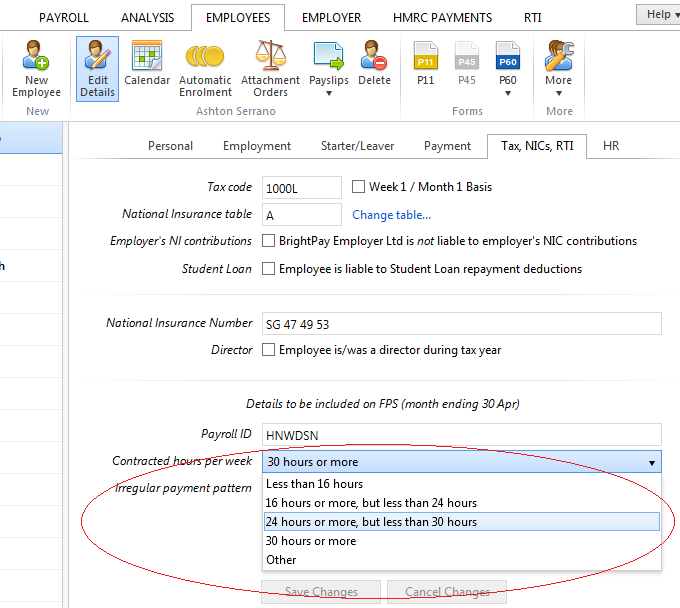

On each employee record if you have assigned the 2013/14 hourly band of B 16 to 29.99 hours, on import, BrightPay will automatically assign these employees into the 2014/15 hourly band of C 24 to 29.99 hours. If this is incorrect you must change this for each employee.

To amend;

- Choose the Employee menu

- Select the employee from the employee listing on the left menu.

- Once the employee is selected, choose Tax, NICs, RTI option within the employee record.

- There is a dedicated field called Contracted Hours per week, this displays the HMRC hourly bands. Choose the appropriate band for the employee, this will indicate on the FPS submission for RTI purposes.

- Whichever hourly band is selected within this field has no bearing on the actual payroll hours paid to the employee.

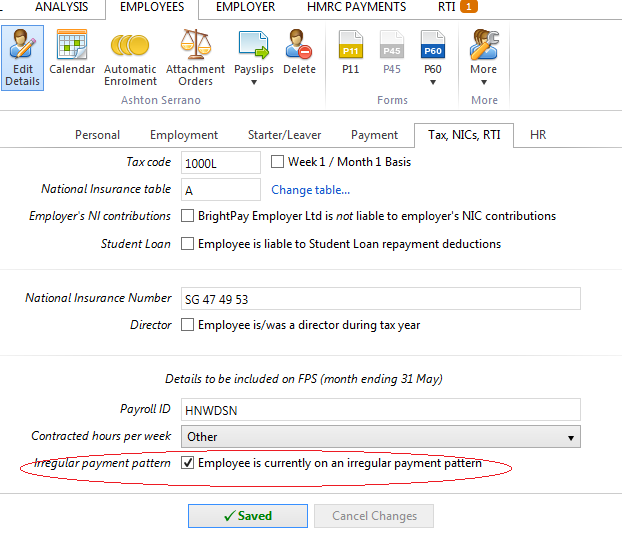

Irregular payment patterns

From the HMRC listing of hourly bands, band E Other applies to employees who are not paid on a regular basis for example:

- casual or seasonal employees

- employees on maternity leave

- employees on long term sick leave

- any employee who for any reason will not be paid for a period of three months or more

HMRC will check if an employee has not been paid for a certain period of time and will treat them as having left that employment. Setting this indicator on every FPS submitted for that employee avoids that happening.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.