New for 2014-15 - Late Reporting

Late Reporting Reasons

HMRC has announced that existing employers with nine or fewer employees, who need more time to adapt, can report PAYE information on or before the last payday in the month until April 2016. This means that micro employers who are still finding it difficult to report PAYE information on or before the date they pay their employees will have more time to adapt their arrangements so that their business is ready for full real time reporting from April 2016.

The change is narrower than the current relaxation which comes to an end on 5th April 2014. This new relaxation will only apply to existing employers with nine or fewer employees - all new employers, as well as existing employers with 10 or more employees, will need to report PAYE information in real time from 06th April 2014.

This support for existing micro employers will mean micro businesses and their agents have up to a further two years to change their processes and their arrangements to enable them to adapt to reporting in real time. HMRC recommends employers change their processes as soon as they can to ensure they're ready, in time for April 2016, when all employers must report PAYE information each time they pay their employees.

To facilitate this, from April 2014 if you send a 2014/15 FPS to report a correction and the 'payment date' on the FPS is earlier than the date of the FPS submission you must include a late reporting reason within the submission.

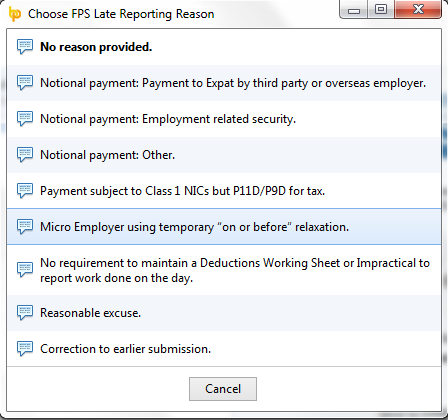

The late reporting reason contained within the FPS must be selected from the HMRC predetermined list;

A Notional payment: Payment to Expat by third party or overseas employer

B Notional payment: Employment related security

C Notional payment: Other

D Payment subject to Class 1 NICs but P11D/P9D for tax

E Micro employer using temporary “on or before” relaxation

F No requirement to maintain a Deductions Working Sheet / Impractical to report work done on the day

G Reasonable excuse

H Correction to earlier submission

You should report the reason for each payment being reported after it was made separately and only where one of the above conditions is applicable.

HMRC will use the reason supplied to help determine whether any late filing penalties are due, so it is very important that you select the correct reason.

How to include a later reporting reason in an FPS

BrightPay will recognise a late submission if the payment date for which the FPS is created is earlier than the actual date that it is being sent.

For example;

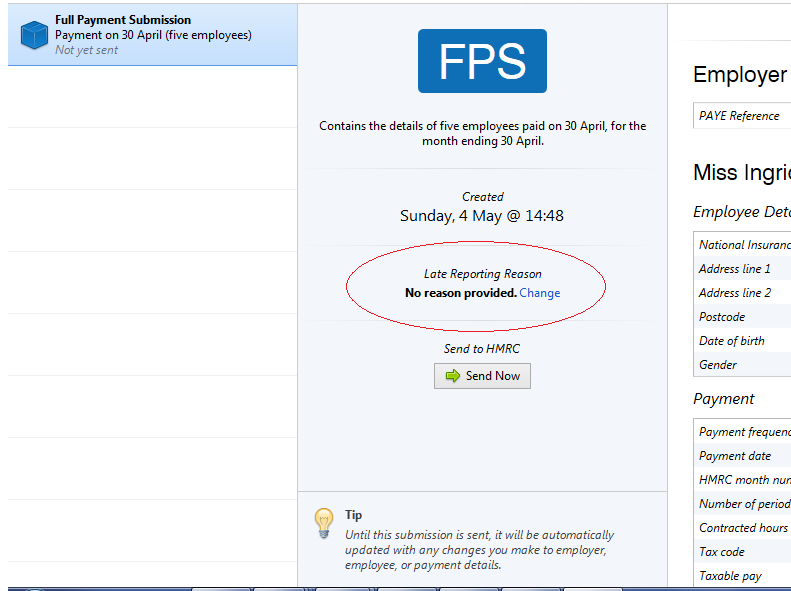

The payslips for Tax Month 1 are finalised on 05th May 2014 with a payment date of 30th April 2014

The FPS is submitted on 04th May 2014.

BrightPay will recognise that the date of submission, 04th May 2014, is later than the date of payment, 30th April 2014.

Accordingly the FPS an additional field for the late reporting reason will generate, as shown

BrightPay offers the listing of late reporting reasons. You must select the most appropriate reason for the delayed submission as appropriate to your circumstances.

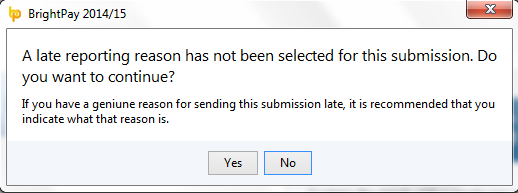

BrightPay will not allow the submission of the FPS without selecting a late reporting reason.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.