Council Tax AEO

Council Tax Attachment of Earnings Order (CTAEO)

WHAT IS A COUNCIL TAX ATTACHMENT OF EARNINGS ORDER?

Where there is non-payment of council tax the local authority can apply to a magistrates' court for a liability order against the defaulter. If a court grants a liability order an authority has a number of options for recovering the outstanding amount. One of these is a Council Tax AEO (CTAEO).

The CTAEO will be in a form prescribed in the regulations. It contains the name of the debtor, his payroll number (if known) and the local authority reference. It confirms that the named person is liable for council tax and specifies the amount of council tax that has still to be paid. Deductions in line with the order should be made as soon as possible after the order has been received.

What the employer must do?

On receiving a CTAEO the employer must:

- seek to make deductions from the employee's net earnings under the CTAEO as soon as possible

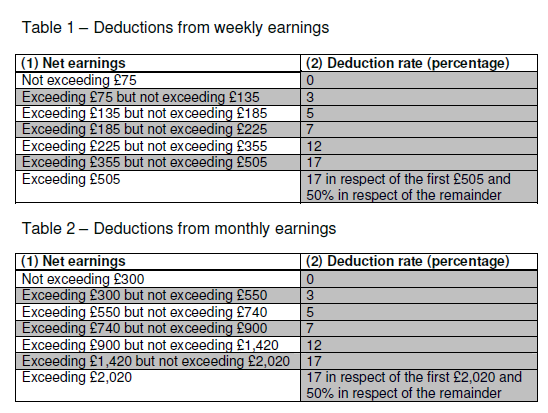

- calculate the deductions using the tables in the regulations

- tell the employee the total deductions made under the order, normally at the same time as his pay statement is issued

- pay the deductions to the local authority no later than the 18th day of the month following the month in which the deduction was made

BrightPay will automatically calculate the employee's periodic deduction based on the below tables:

Attaching an Order to an Employee within BrightPay

1)Go to Payroll, and select the employee from the listing

2) Under Additions & Deductions, click the Add button

3) Select Attachment Orders…

4)Click ‘Add Attachment Order’ and select the appropriate Attachment Order from the listing.

Setting up the Order

TYPES AND DATES

1) Enter a description for the Attachment Order.

2) Enter the reference number of the Attachment Order, which can be found on the documentation received.

3) Enter the date the Order was made.

4) Enter the date to apply the Order from.

5) Enter the date to stop – the Order should only be stopped once the full amount of the Order has been paid or you have received notification from the Courts to stop it.

AMOUNTS AND STATUS

1) Priority – tick the box provided if the Order is a priority order.

2) Admin Charge – tick the box provided if you, the employer, wish to deduct £1 as an administration charge for operating the Order.

3) Enter the total amount to be paid.

4) Cumulative amount paid at start - if the employee has already paid some of the attachment (for example in a previous employment) enter the amount here.

5) Enter any Year to Date deductions, if applicable

6) Click Save.

BrightPay will now apply the Attachment Order on the employee’s payslip from the relevant period.

Need help? Support is available at 0345 9390019 or [email protected].