Contributions

The minimum contribution level required for an automatic enrolment scheme is based on qualifying earnings.

There is a minimum total amount that has to be contributed by the employee, the employer, and the government in the form of tax relief.

What are qualifying earnings?

Qualifying earnings include;

- salary & wages

- overtime

- bonuses

- commissions,

- statutory sick pay

- statutory maternity pay

- ordinary or additional statutory paternity pay

- statutory adoption pay

For 2015/16 the qualifying earnings start at £5,824 up to a limit of £42,385.

So if you were earning £18,000 a year, your contribution would be a percentage of £12,176 (the difference between £5,824 and £18,000).

The qualifying earnings bands are expected to change each tax year.

Contribution Rates

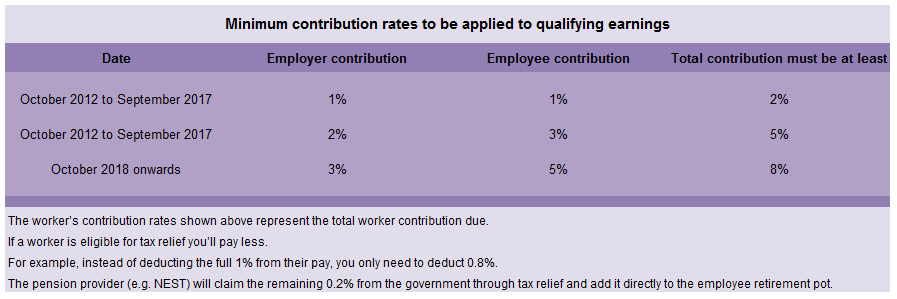

To allow you to spread the cost of your employer duties you can phase in the minimum contributions from 2013 to 2018.

There is a minimum total amount that has to be contributed by the employee, the employer, and the government in the form of tax relief.

Need help? Support is available at 0345 9390019 or [email protected].