Enrolling Entitled Workers in BrightPay

Once the Staging Date is entered BrightPay will initiate the Auto Enrolment process by employee.

Flagging individual workers status

As an employer, your duties around Automatic Enrolment apply to everyone working for you who:

- is aged between 16 and 74

- works in the UK

- for whom you deduct income tax and National Insurance contributions from their wages.

These workers are split into three classes of workers for Automatic Enrolment purposes, the actual duties of the employer is dependent on the category of worker;

- Eligible Jobholder

- Non-Eligible Jobholder

- Entitled Workers

Once the employer reaches their staging date BrightPay will automatically categorise each employee for Automatic Enrolment purposes informing the employer as to the next step in the Automatic Enrolment process.

Entitled Workers

Workers who are not eligible for automatic enrolment but are "entitled" to join a pension scheme. These include workers who either:

- are aged between 16 and 74

- are working or ordinarily work in the UK under their contract

- do not have qualifying earnings payable by the employer in the relevant pay reference period

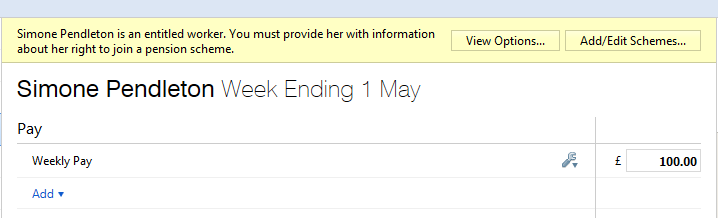

BrightPay will indicate the Entitled Workers status in the Payroll screen to create notification to the employer when processing payroll that the employee may join a pension scheme.

Simply select View Options to start the communication process with the entitled worker.

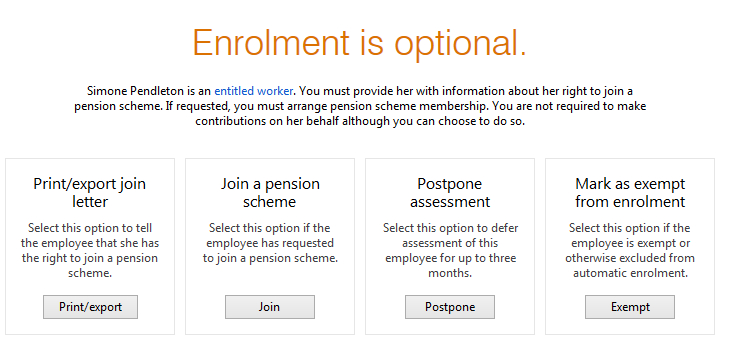

You must now choose the next appropriate action to take for this employee:

- Communicate with the worker - Notification letter to advise the worker that they can join a pension scheme.

- Join

- Postpone them

- Exempt them

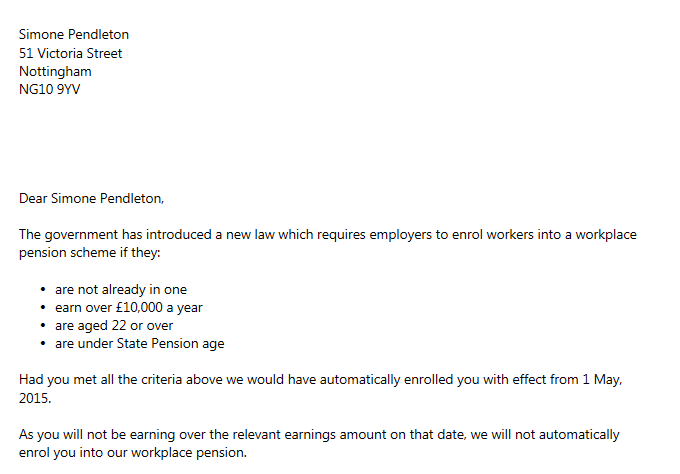

Communicate with the Entitled Worker

An employer must first provide an entitled worker with information about their right to opt-in to a qualifying AE scheme. BrightPay will automatically prepare this letter for you and will include the following information:

- Right to join the company/employer pension scheme

- How to notify the employer about joining

- Details of the available scheme (provider etc)

- Contact details for pension provider

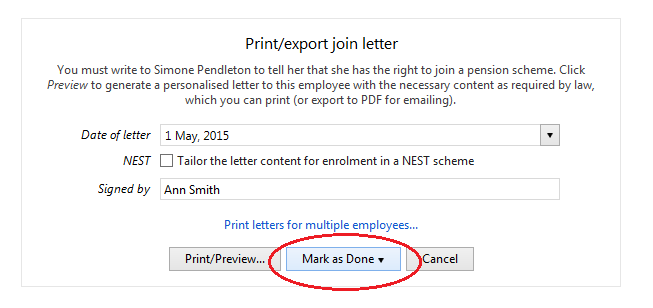

Choose to PRINT/EXPORT the letter.

BrightPay will ask for a date and the signatory to be added to the letter.

Once this letter has been given or emailed to the employee, simply Mark as Done:

JOIN - ENROL IN THE PENSION SCHEME

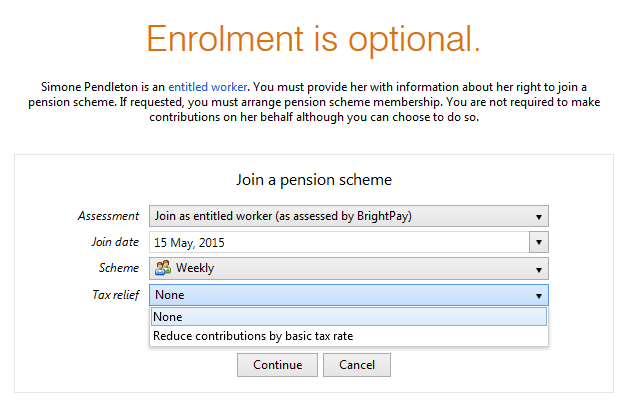

Entitled workers may choose to join the company pension scheme - to add these workers to the pension scheme select JOIN:

1) Select the correct Assessment for the employee

2) Enter the correct Join Date

3) Select the AE Scheme required from the drop down listing

4) Select the applicable Tax Relief from the drop down listing - If the tax relief at the basic tax rate is to be applied directly at employee contribution level then simply indicate so and the percentage deductions will be adjusted by 0.2%.

5) Press Continue

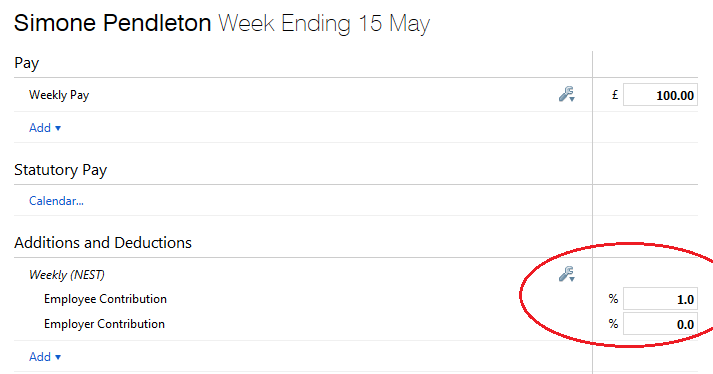

The pension contribution rate and earnings bands attached to the pension scheme selected will be attached to this employee's payroll and the necessary deductions applied to each subsequent pay period.

Please note: for Entitled Workers there is no obligation on the employer to make any contributions towards the employee's pension.

PENSION CONTRIBUTIONS

Once joined into the pension scheme, pension contribution deductions start from the current open or subsequent pay period.

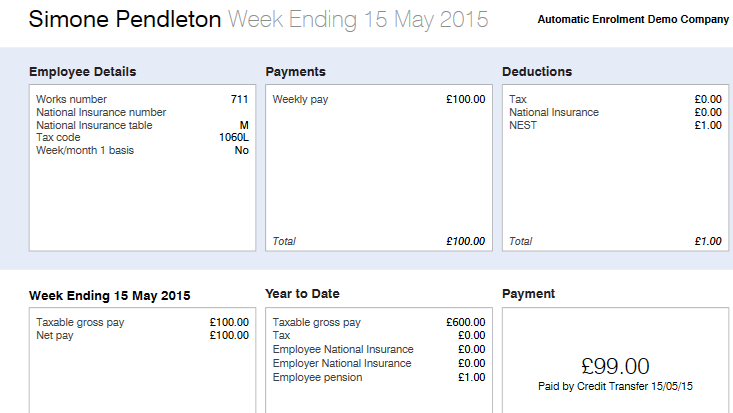

Payslip - Notification to Employees of Pension contribution deductions made

All Pension Contributions deducted from an employees pay in each pay period is itemised on the payslip. Employees should be issued with a payslip for each pay period.

BrightPay facilitates the printing and emailing of payslips.

POSTPONE

You can use postponement on your staging date to delay the automatic enrolment process for some or all employees for up to three months. This means you won’t need to assess the workforce to identify what duties you have for them until the last day of the postponement period, at which point you must automatically notify non-eligible workers of their right to opt in to be enrolled in the Pension Scheme.

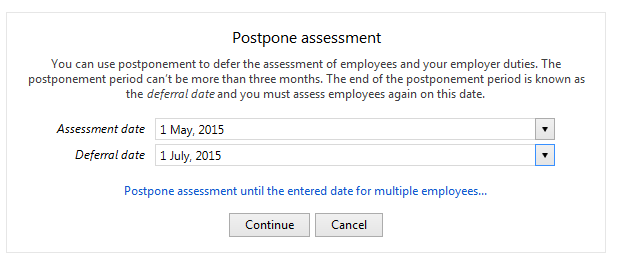

To postpone an employee, select Postpone and enter the assessment date and deferral date applicable to the employee:

BrightPay will validate the date entered to ensure that it is no more than 3 months from the staging date.

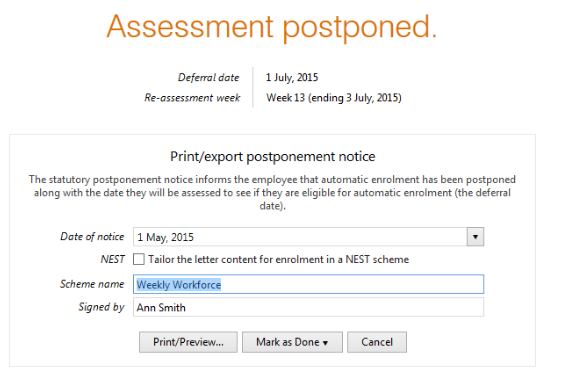

If postponement is used, you must provide the employee with a statutory postponement notice which BrightPay will automatically generate for you to give or email to the employee. Simply click Print and enter the date and signatory to be added to the letter:

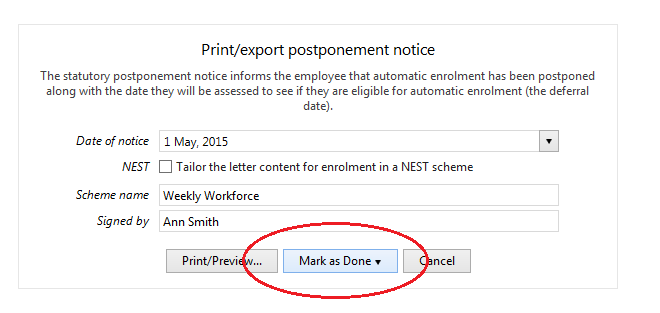

Select Print/ Preview to view, print or export the employee's postponement notice. Once the postponement notice has been given or emailed to the employee, simply Mark As Done:

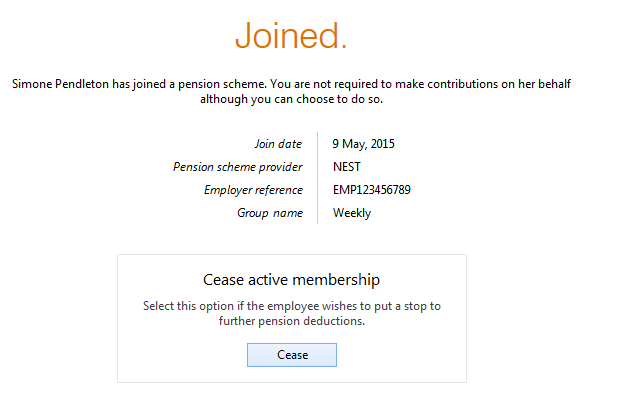

Ceasing Membership

An enrolled entitled worker may choose to cease active membership of the company pension scheme. This may be for varying reasons for example:

- Multiple Employments - actively enrolled and meeting the minimum contributions in secondary employment

- Personal Pension Plans - the jobholder may have a private pension plan which fulfills their pension requirements.

If the worker notifies you that they wish to cease active membership then simply choose the CEASE option.

Once membership is ceased, then pension contribution deductions will stop from that point on-wards. Workers are not entitled to, nor will the employer refund, previously deducted pension contributions.

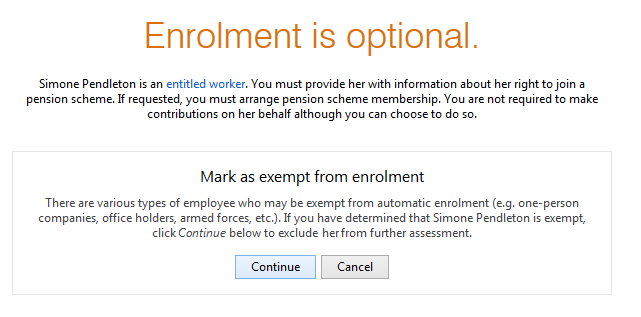

MARK AS EXEMPT

The following are not considered members of the workforce for automatic enrolment obligations;

- members of the armed forces

- directors of companies unless they have a contract of employment to work for that company and there is someone else employed by the company under a contract of employment.

Need help? Support is available at 0345 9390019 or [email protected].