Enrolling Non-Eligible Jobholders in BrightPay

Once the Staging Date is entered BrightPay will initiate the Auto Enrolment process by employee.

Flagging individual workers status

As an employer, your duties around Automatic Enrolment apply to everyone working for you who:

- is aged between 16 and 74

- works in the UK

- for whom you deduct income tax and National Insurance contributions from their wages.

These workers are split into three classes of workers for Automatic Enrolment purposes, the actual duties of the employer is dependent on the category of worker;

- Eligible Jobholder

- Non-Eligible Jobholder

- Entitled Workers

Once the employer reaches their staging date BrightPay will automatically categorise each employee for Automatic Enrolment purposes informing the employer as to the next step in the Automatic Enrolment process.

Non-Eligible Jobholder

Workers who are not eligible for automatic enrolment but can choose to opt in to a pension scheme. These include workers who either:

- are aged between 16 and 74

- are working or ordinarily work in the UK under their contract

- have qualifying earnings payable by the employer in the relevant pay reference period but below the earnings trigger for automatic enrolment

or

- are aged between 16 and 21, or state pension age and 74

- are working or ordinarily work in the UK under their contract

- have qualifying earnings payable by the employer in the relevant pay reference period that are above the earnings trigger for automatic enrolment.

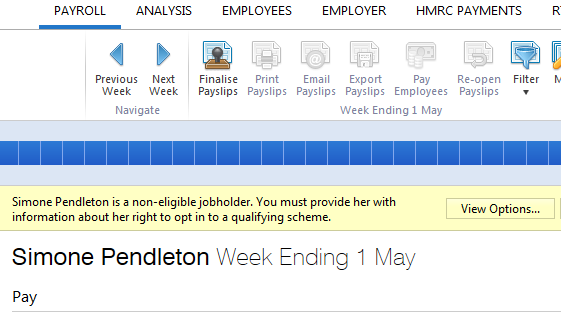

BrightPay will indicate the Non-Eligible jobholder status in the Payroll screen to create notification to the employer when processing payroll that the employee may now avail of enrolment and the employer must now notify the worker of their right to opt in to a qualifying scheme.

Simply select View Options to start the opt in notification process.

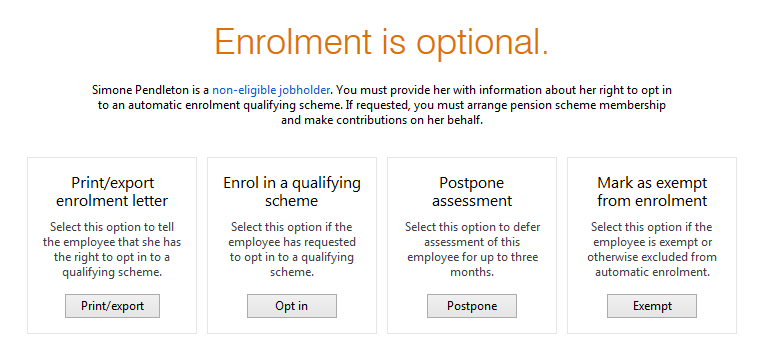

You must now choose the next appropriate action to take for this employee;

- Communicate with the worker - Notification letter to worker of the right to opt in

- Opt In

- Postpone Enrolment

- Exempt from Enrolment

Communicate with the Employee

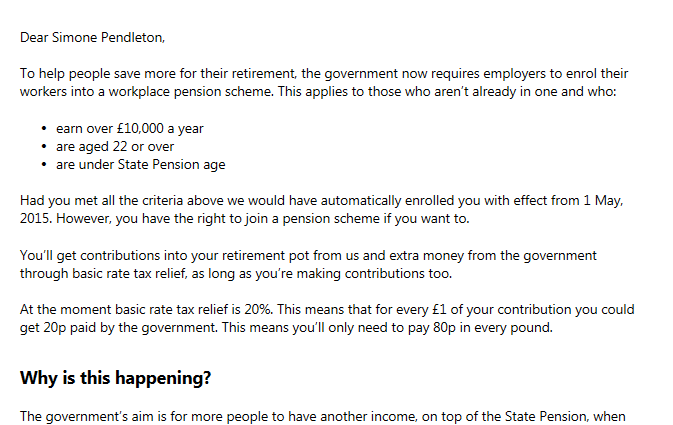

An employer must first provide a non-eligible jobholder with information about their right to opt-in to a qualifying AE scheme. BrightPay will automatically prepare this letter for you and will include the following information:

- Right to Opt in to the company/employer pension scheme

- How to Opt in

- Details of the available scheme (provider etc)

- Contribution rates

- Earnings bands within which pension contributions will be deducted

- Contact details for pension provider

Choose to PRINT/EXPORT the letter.

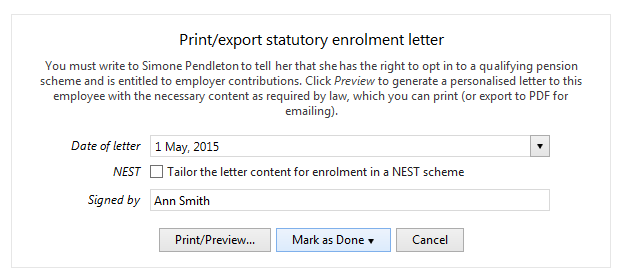

BrightPay will ask for a date and the signatory to be added to the letter.

Once this letter has been given or emailed to the employee, simply Mark as Done:

OPT IN - ENROL IN THE PENSION SCHEME

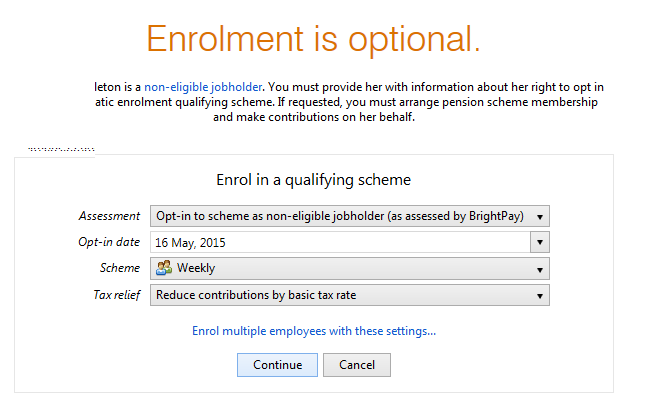

To enrol non-eligible workers into the pension scheme who notify you that they wish to opt in, simply select OPT IN

1) Select the correct Assessment for the employee

2) Enter the correct Opt-in date

3) Select the AE Scheme required from the drop down listing

4) Select the applicable Tax Relief from the drop down listing - If the tax relief at the basic tax rate is to be applied directly at employee contribution level then simply indicate so and the percentage deductions will be adjusted by 0.2%.

5) Press Continue

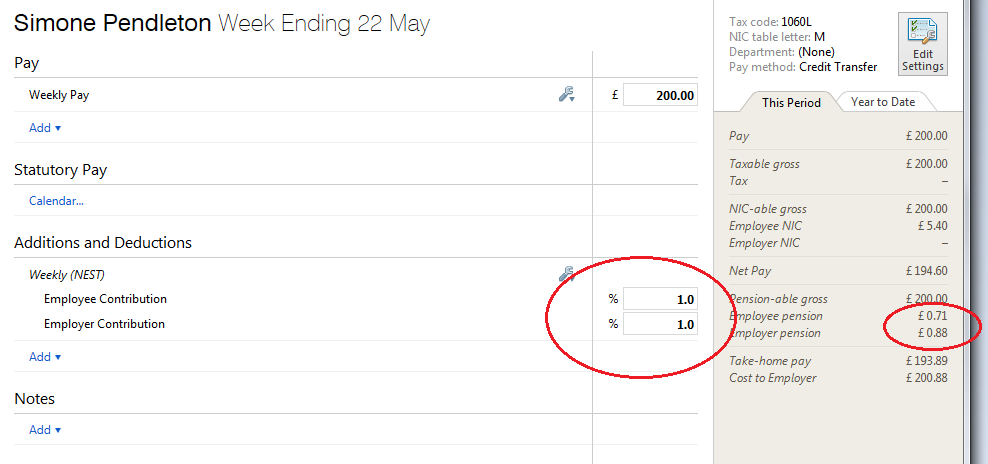

The pension contribution rate and earnings bands attached to the pension scheme selected will be attached to this employee's payroll and the necessary deductions applied to each subsequent pay period.

PENSION CONTRIBUTIONS

Once opted into a pension scheme, pension contribution deductions start from the current open or subsequent pay period.

Non-eligible workers are only enrolled once they notify the employer that they are opting in, deductions commence thereafter.

The deduction applied to the the payslip is made in accordance with the contribution and earnings bands setup with the pension Group at employer level.

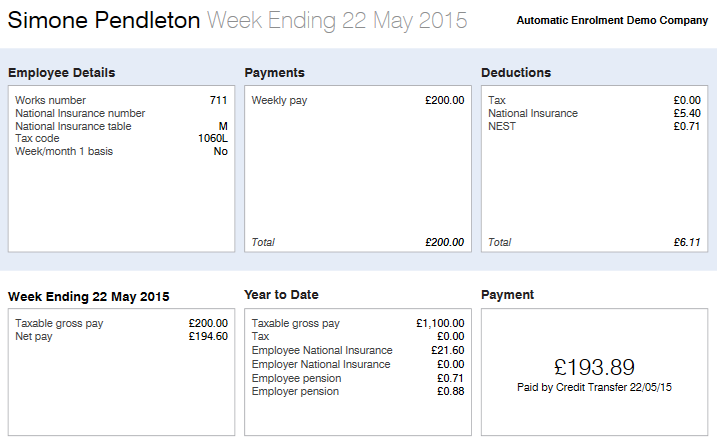

Payslip - Notification to Employees of Pension contribution deductions made

All Pension Contributions deducted from an employee's pay in each pay period is itemised on the payslip. Employees should be issued with a payslip for each pay period.

BrightPay facilitates the printing and emailing of payslips.

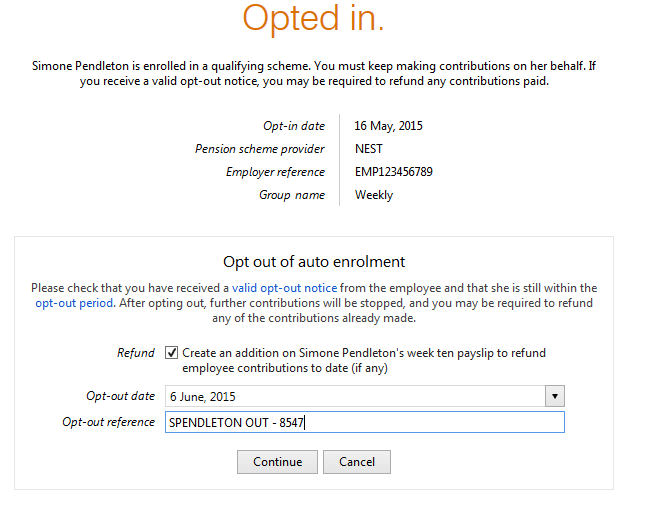

Opting Out

If the non-eligible jobholder subsequently opts out within the opt out period by notifying the pension provider, then the employer can refund any contributions deducted within the opt out period.

BrightPay will facilitate the refund of previously deducted contributions - simply indicate in processing the opt-out within BrightPay that you wish to make the refund.

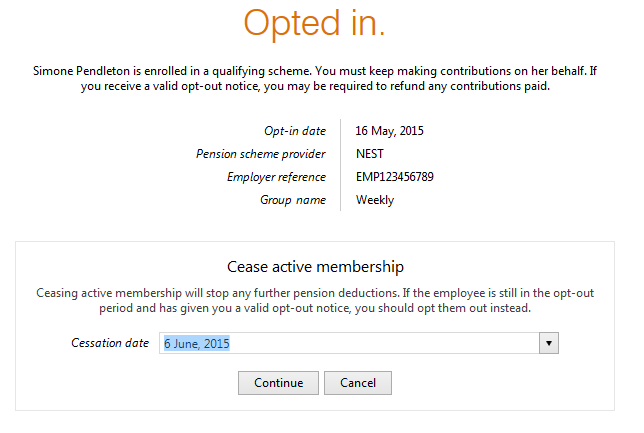

Ceasing Membership

An enrolled non-eligible jobholder may choose to cease active membership of the company pension scheme. This may be for varying reasons for example;

- Multiple Employments - actively enrolled and meeting the minimum contributions in secondary employment

- Personal Pension Plans - the jobholder may have a private pension plan which fulfills their pension requirements.

If the jobholder notifies you that they wish to cease active membership then simply choose the CEASE option.

Once membership is ceased then pension contribution deductions will stop from that point on-wards. Jobholders are not entitled to, nor will the employer refund, previously deducted pension contributions.

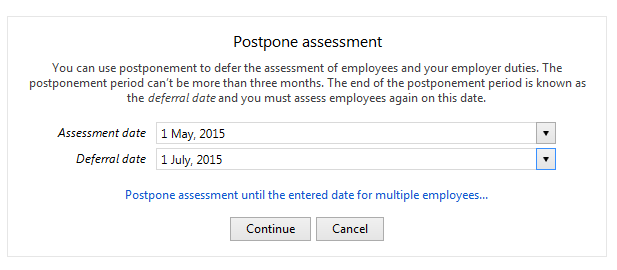

POSTPONE

You can use postponement on your staging date to delay the automatic enrolment process for some or all employees for up to three months. This means you won’t need to assess the workforce to identify what duties you have for them until the last day of the postponement period, at which point you must automatically notify non-eligible workers of their right to opt in to be enrolled in the Pension Scheme.

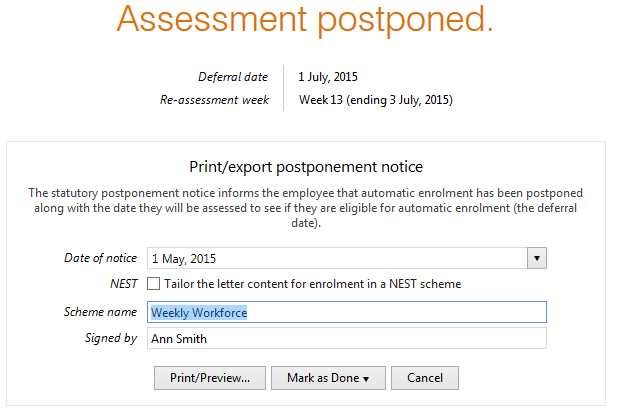

To postpone an employee, select Postpone and enter the assessment date and deferral date applicable to the employee:

BrightPay will validate the date entered to ensure that it is no more than 3 months from the staging date.

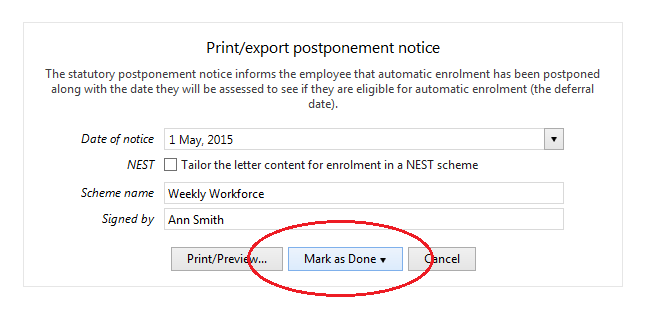

If postponement is used, you must provide the employee with a statutory postponement notice which BrightPay will automatically generate for you to give or email to the employee. Simply click Print and enter the date and signatory to be added to the letter:

Select Print/ Preview to view, print or export the employee's postponement notice. Once the postponement notice has been given or emailed to the employee, simply Mark As Done:

MARK AS EXEMPT

The following are not considered members of the workforce for automatic enrolment obligations;

- members of the armed forces

- directors of companies unless they have a contract of employment to work for that company and there is someone else employed by the company under a contract of employment.

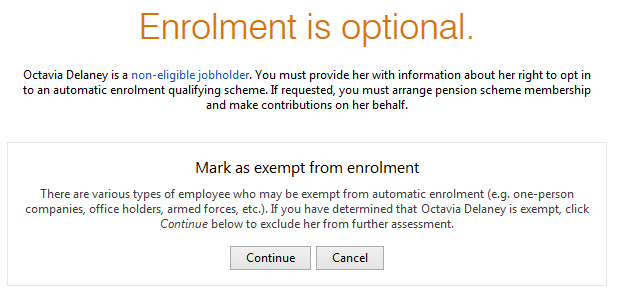

To mark an employee as exempt, select the Exempt option and click Continue to exclude the employee from future assessment:

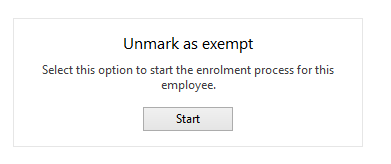

To subsequently Unmark as Exempt, click Start to start the enrolment process again for the employee:

Need help? Support is available at 0345 9390019 or [email protected].