Pension File Submissions

Currently BrightPay supports the direct export of a file with the necessary pension information in accordance with the NEST file specifications.

BrightPay also supports the preparation of contribution files compliant with NOW:Pensions, The Peoples Pension and Scottish Widows.

Other Pension File specifications will follow throughout the year.

In-year upgrades will be released as new pension file types are made available.

NEST Enrolment File Submission

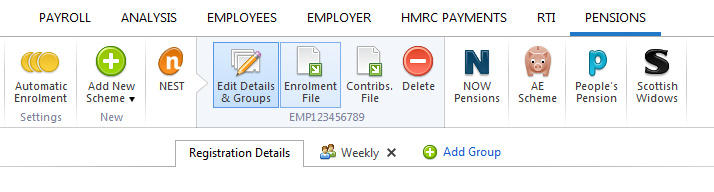

To create the Enrolment File for upload into NEST's web portal select the PENSION menu.

- Select NEST on the menu toolbar followed by Enrolment File:

- Select the employees you wish to include in the file and click Next

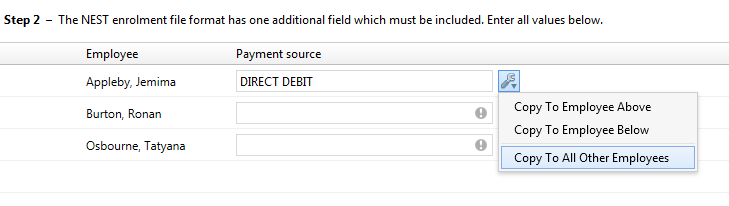

- Enter the Payment Source for each employee as set up with NEST - to copy this payment source to each individual, click the Edit button and copy as required:

- On the next screen, click Save File to save the enrolment file to a location of your choice for upload into NEST, as required.

NEST Contributions File Submission

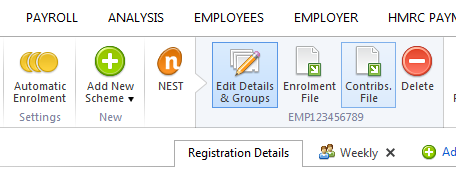

To create the Contributions File for upload into NEST's web portal select the PENSION menu.

Select NEST on the menu toolbar followed by Contributions File:

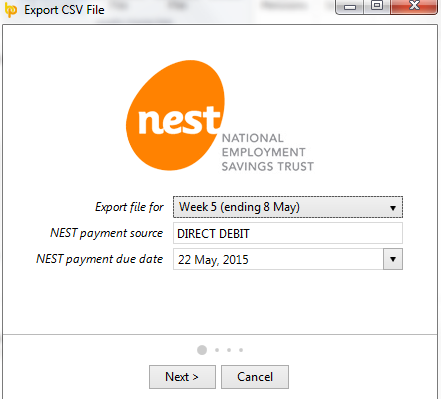

- Select the pay period for your Export File

- Enter your Payment Source

- Select your NEST Payment Due Date

- Select the employees you wish to include in the file and click Next

- Reason for partial payment/ non-payment of contributions & Effective date - complete these two additional fields, if applicable to any of your employees

- On the next screen, click Save File to save the contributions file to a location of your choice for upload into NEST, as required.

Need help? Support is available at 0345 9390019 or [email protected].