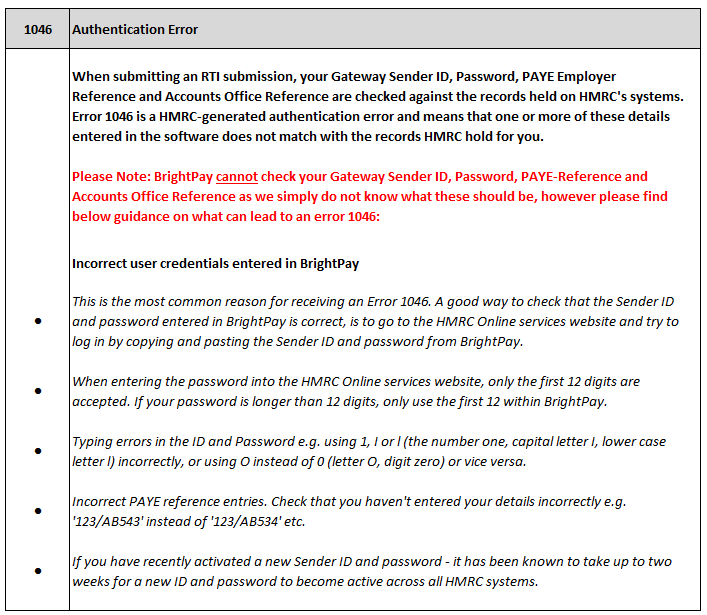

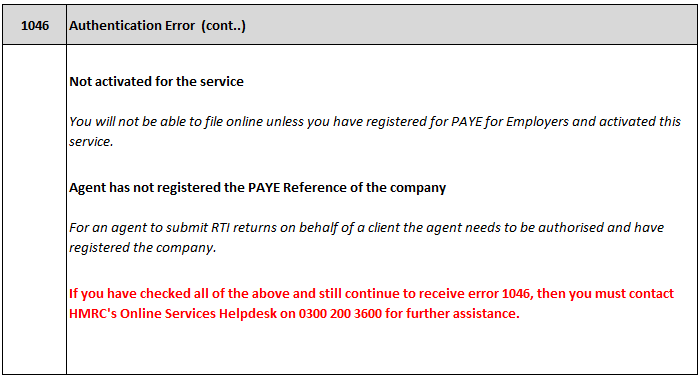

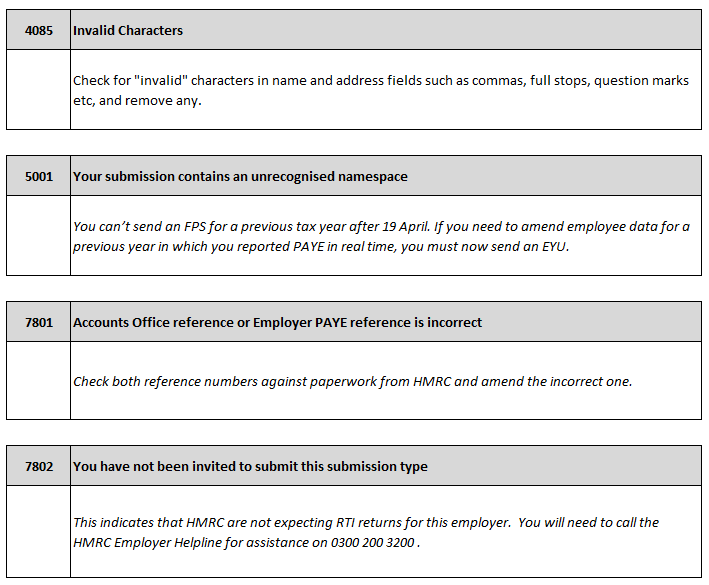

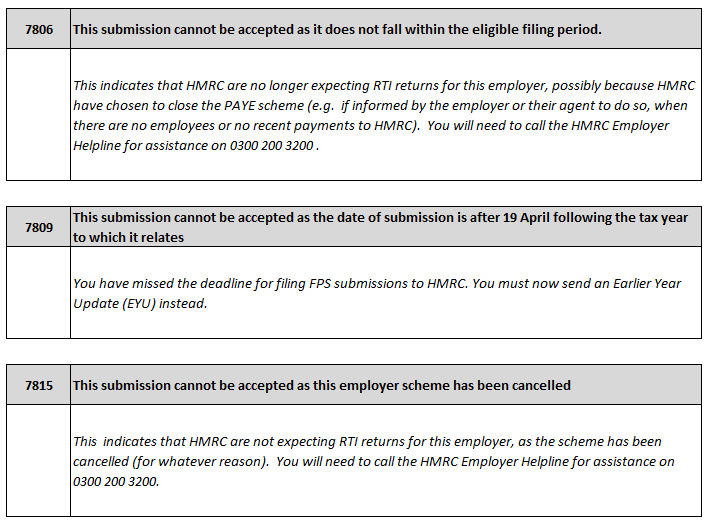

Common HMRC Error Messages

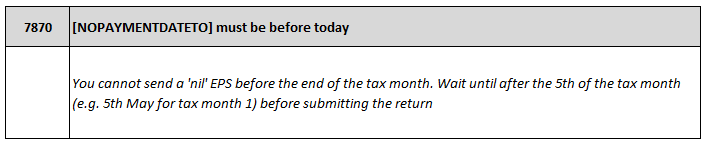

Please find below guidance on the most common error messages that you may receive when sending payroll information using RTI to HMRC.

Please note: These error messages are generated by HMRC and not by BrightPay. If you require further assistance, please call the HMRC Employer Helpline on 0300 200 3200.

Need help? Support is available at 0345 9390019 or [email protected].