Importing from HMRC Basic PAYE Tools

BrightPay provides a quick and seamless import utility to bring across your company and employee details from HMRC Basic PAYE Tools.

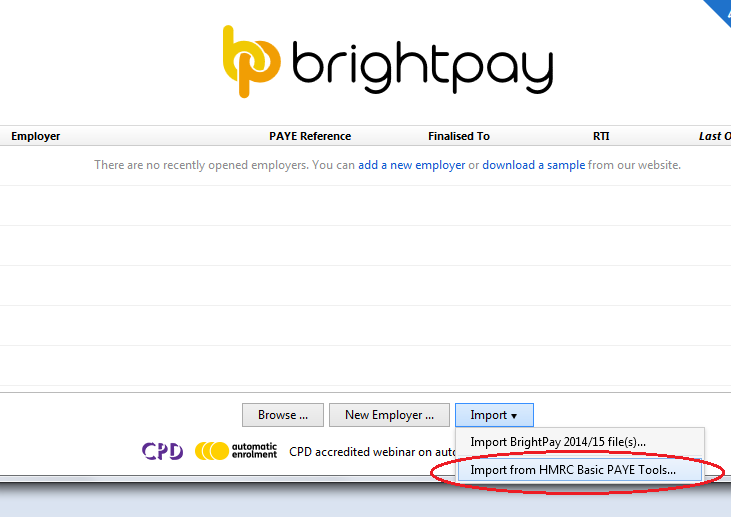

- To begin the import, simply click on the ‘Import’ button at the bottom of the ‘Open Employer’ screen and select 'Import from HMRC Basic PAYE Tools...'.

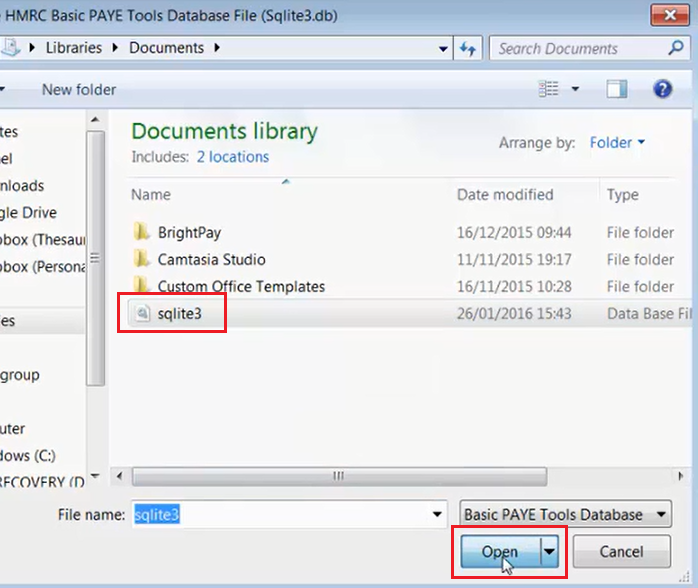

- The location of your HMRC Basic PAYE Tools database will open on screen.

- Select the 'SQLite3' database file and select 'Open'.

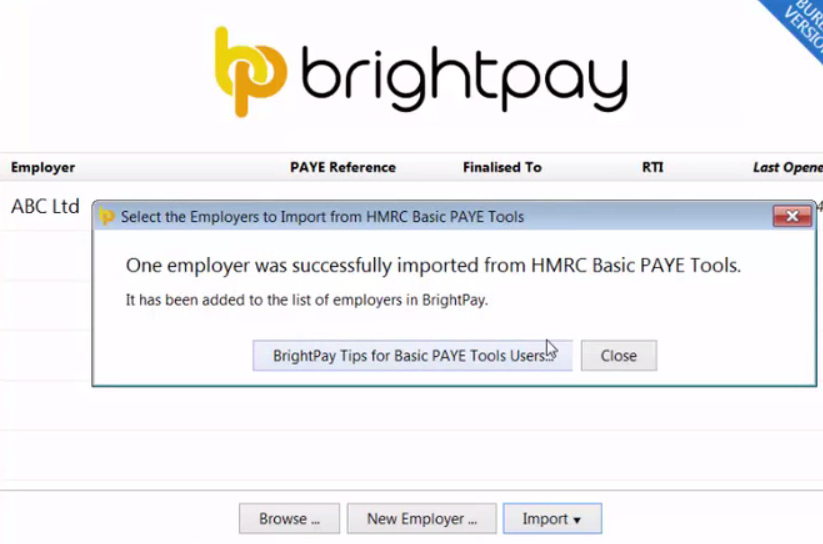

- If you have more than one company set up on HMRC Basic PAYE Tools, you will be given the option of which companies you wish to import. If you only have one company, this will import automatically.

- Once the import process is completed, simply open your new BrightPay company file and you are ready to begin processing payroll.

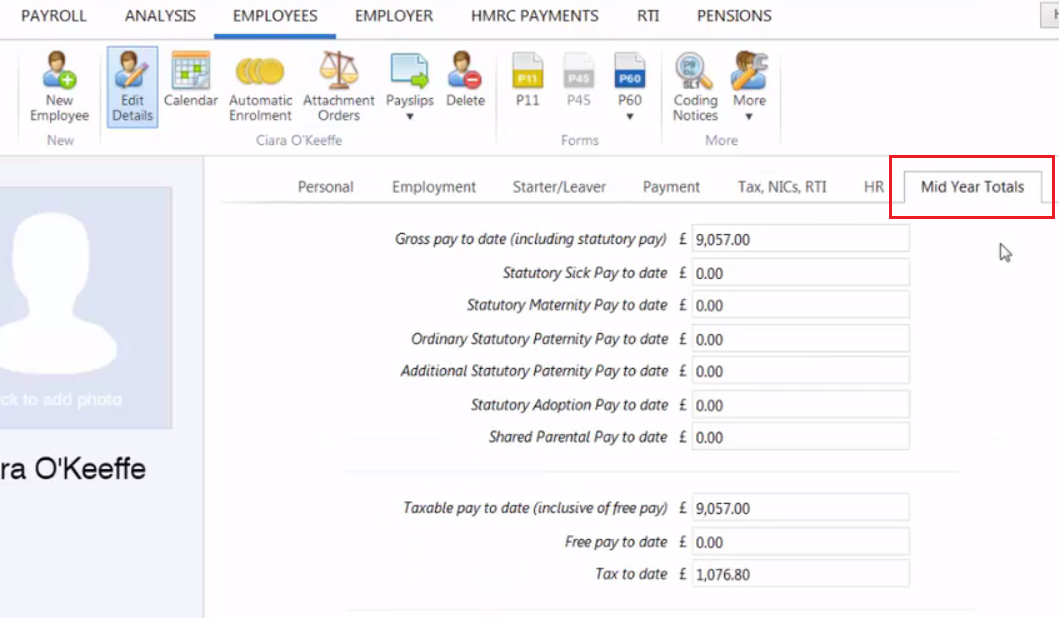

Please note: if you are migrating to BrightPay mid tax-year, BrightPay will automatically import your employees' mid year totals to date.

These can be viewed in each employee's 'Mid Year Totals' within each employee's record.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.