Allocating An Employee's Pay across Departments

If you have employees assigned to more than one department, their pay can be allocated across these. This will facilitate accurate departmental analysis at the reporting stage.

Within the ‘Payroll’ function, select the employee’s name from the summary list to access their payslip.

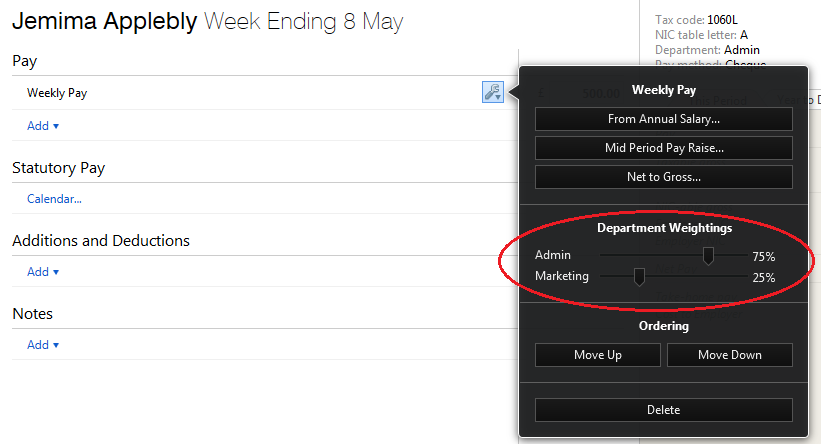

1) If the employee is paid a basic amount, click the ‘Edit’ button within the ‘Pay’ section and set the employee’s weighting in each department by dragging the bars to the percentage required:

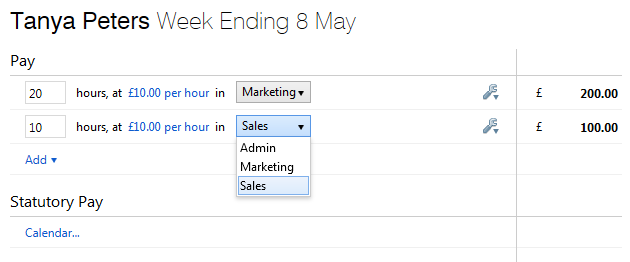

2) Alternatively, if the employee is paid by the hour, departments can be assigned to each hourly rate so that the number of hours spent in each department will be captured instead:

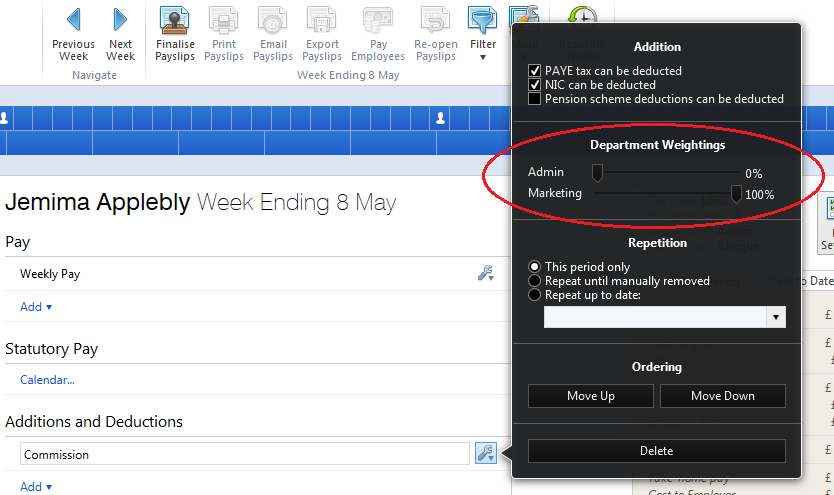

Departmental weightings can also be assigned to all addition and deduction types if required:

Need help? Support is available at 0345 9390019 or [email protected].