Direct Earnings Attachment

From 8 April 2013 the Department for Work and Pensions (DWP) introduced Direct Earnings Attachments as a method to recover money owed to DWP.

A DEA has its own regulations and operates differently from other orders such as Deduction from Earnings Order (DEO), Attachment of Earnings Order (AEO) and Council Tax Attachment of Earnings Order (CTAEO). A DEA does not replace any of these other orders and in some circumstances employers may receive requests to implement deductions for multiple orders for the same employee.

DWP are responsible for recovering monies as a result of debt arising under the Social Security Administration Act 1992.

Where the Secretary of State has been unable to recover monies owed to the DWP from customers, those monies may be recovered by deduction from the customer's earnings.

Where a DEA is to be implemented, the DWP will send an employer a letter (notice) to inform them of this.

Where a DEA notice is received, an employer has the legal obligation to:

- calculate a deduction based on the net earnings for each pay date (see tables below)

or

- apply a fixed amount calculated by the DWP if they ask you to do so (usually only in exceptional circumstances)

The employer must also:

- remit the amounts deducted (other than the administrative charge) by the 19th day of the month following the month in which the deduction is made.

- keep a record of each employee from whom a DEA deduction has been made, together with the amount of each deduction

Protected Earnings

Where the DWP ask an employer to operate a DEA, the employer must consider what is known as the Protected Earnings amount which is an amount equal to 60% of an employee's net earnings.

This means that for each pay period where a DEA calculation is applicable and after adding the amount of the DEA to the total amount of other orders that may be already in place, the employee must be left with at least 60% of their net wage.

Administrative costs

For each pay period where a calculation results in a DEA deduction, an employer may take up to £1.00 from their employee’s earnings towards their administrative costs. This can be taken even if it reduces the employee's income below the 60% protected earnings amount.

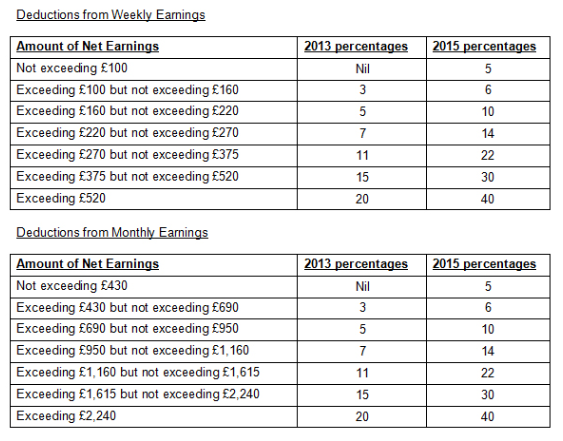

Deduction Tables

BrightPay will automatically calculate the employee's periodic deduction based on the tables below (unless the DWP requests a fixed amount to be deducted):

Please note, although BrightPay caters for 2015 rates, you should ensure before using them that they have been implemented. Employers will not be expected to make any different calculations until the DWP issue ‘stop’ notices for one DEA and ‘start’ another DEA under the revised tables.

Attaching an Order to an Employee within BrightPay

1) Go to Payroll, and select the employee from the listing

2) Under Additions & Deductions, click the Add button

3) Select Attachment Orders…

4) Click ‘Add Attachment Order’ and select the appropriate Attachment Order from the listing.

Setting up the Order

TYPES AND DATES

1) Enter a description for the Attachment Order.

2) Enter the reference number of the Attachment Order, which can be found on the documentation received.

3) Enter the date the Order was made.

4) Enter the date to apply the Order from.

5) Enter the date to stop – the Order should only be stopped once the full amount of the Order has been paid or you have received notification from the Courts to stop it.

AMOUNTS AND STATUS

1) Priority – tick the box provided if the Order is a priority order.

2) Fixed amount - tick this box if the DWP requests that a fixed amount is to be deducted from the employee and enter the periodic amount to be deducted, as stated on the Order.

3) Admin Charge – tick the box provided if you, the employer, wish to deduct £1 as an administration charge for operating the Order.

4) Enter the total amount to be paid.

5) Cumulative amount paid at start - if the employee has already paid some of the attachment (for example in a previous employment) enter the amount here.

6) Enter any Year to Date deductions, if applicable

7) Click Save.

BrightPay will now apply the Attachment Order on the employee’s payslip from the relevant period.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.