The People's Pension

The following guidance is specifically designed for users who have registered with The People's Pension for their AE qualifying pension scheme.

Please note: this guide should only be used after setting up your pension scheme with The People's Pension

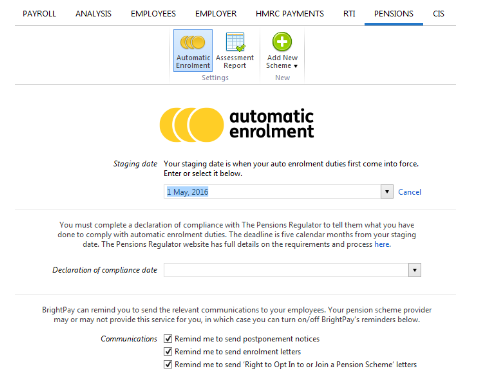

1. Entering your Staging Date in BrightPay

a) To enter your staging date in BrightPay, click Pensions > Automatic Enrolment

b) Enter your staging date in the field provided:

c) Click Save

Entering your staging date here will ensure that your on screen automatic enrolment alerts will start at the correct time for you.

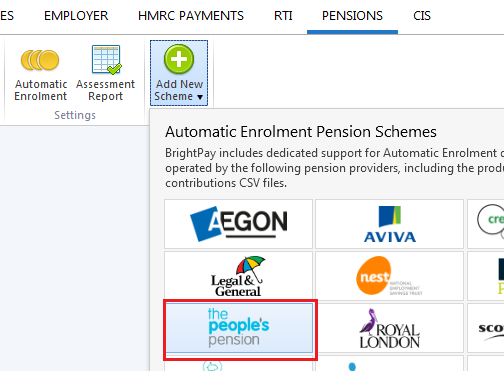

2. Entering your People's Pension Scheme in BrightPay

a) Click Pensions > Add New Scheme > followed by The People's Pension

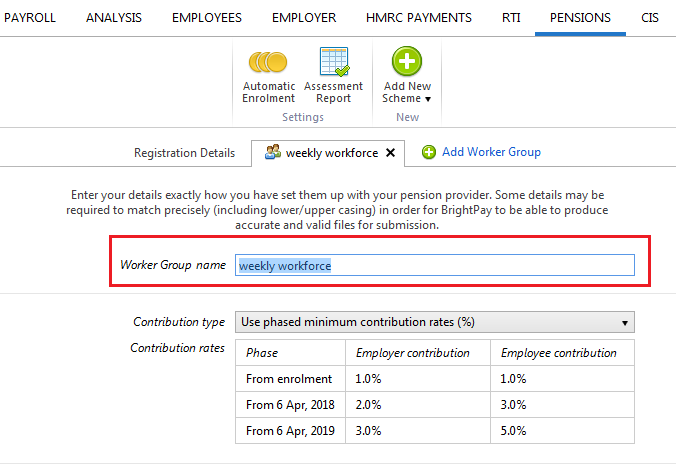

Please note: when entering your pension scheme details in BrightPay, care should be taken that details entered in BrightPay match exactly to how they are set up with The People's Pension (taking into account upper and lower casing). This will ensure that BrightPay can produce accurate and valid files for submission

b) Within Registration Details enter your Account Number in the field provided. This will have been given to you by The People's Pension when you completed their set up process.

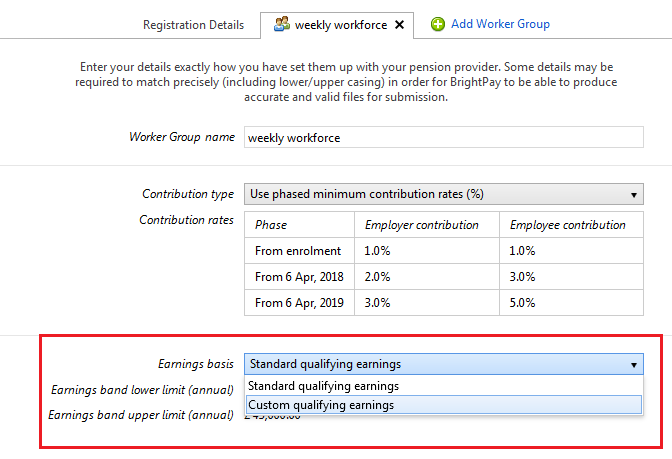

c) On the next tab, enter the Name of your first worker group which you have set up with The People's Pension.

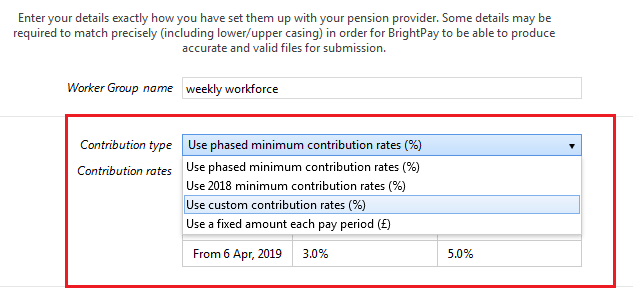

d) Select the Contribution Type that is to apply to this group by clicking on the drop-down menu:

e) Next select the Earnings Basis that is also to apply:

- 'Standard Qualifying Earnings' will apply the earnings band lower limit and upper limit as set by the DWP for the tax year in question.

- 'Custom Qualifying Earnings' will allow you to remove these limits and set those that you require, if applicable.

f) If you have more than one worker group set up with The People's Pension (e.g. to cater for employees on a different pay frequency or employees with different contribution rates), click 'Add Worker Group' and repeat steps c) to e).

g) Click Save to save your details

Please note: contribution rates and earnings bands are set as a default, meeting the minimum requirements for automatic enrolment. However each one of these is flexible to allow the employer to amend to suit their particular pension arrangements.

3. Assessing your Employees using BrightPay

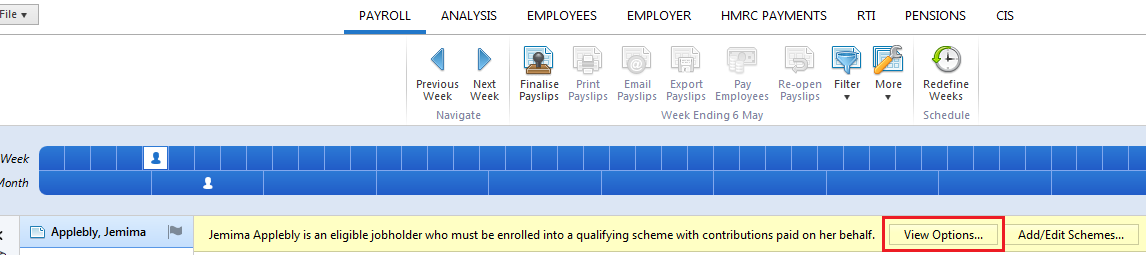

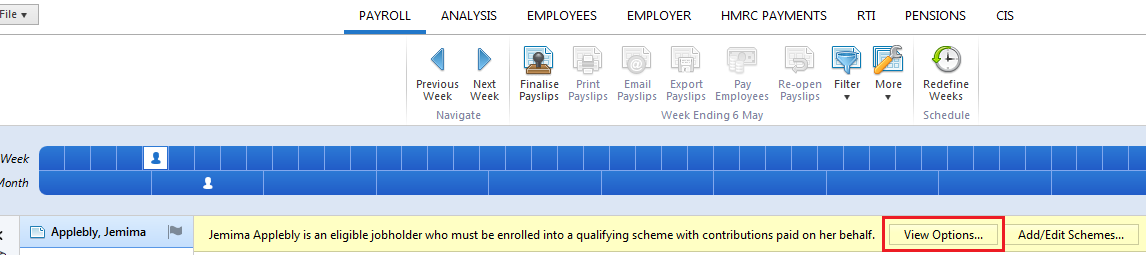

As soon as you reach your staging date in your Payroll utility, BrightPay will automatically assess your employees for you and determine whether your employees are eligible jobholders, non eligible jobholders or entitled workers.

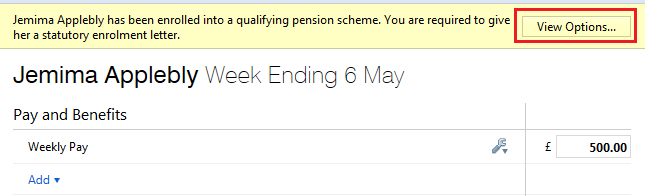

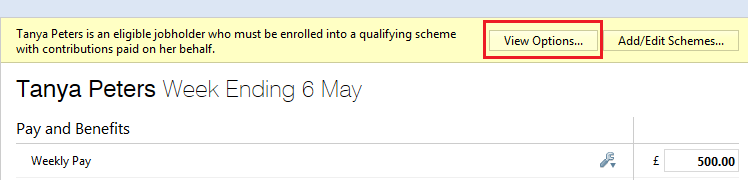

On-screen flags and yellow alerts will appear to notify you that you now have automatic enrolment duties to perform.

These alerts will bring you through to the various actions available based on the selected employee’s work category by clicking on 'View Options':

4. Enrolling your Employees in BrightPay

BrightPay will indicate an employee's Eligible Jobholder status on the yellow bar in their payroll screen.

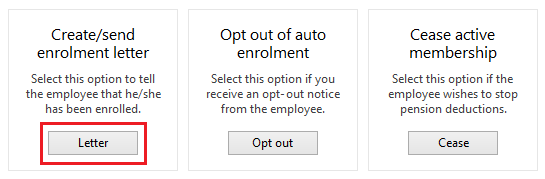

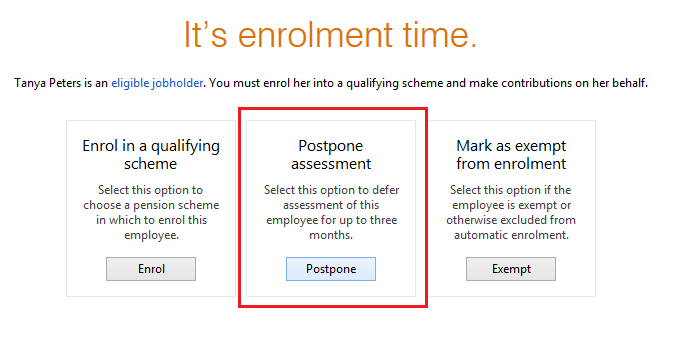

a) Click 'View Options' to bring you through to the various actions based on this worker category:

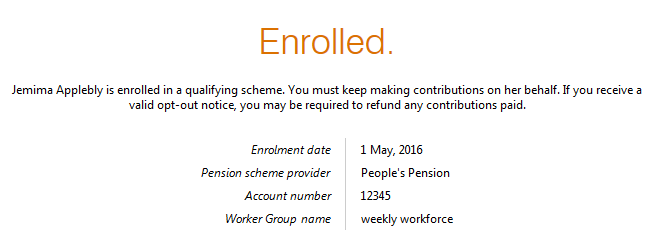

b) To enrol an eligible employee, simply select Enrol and choose your People's Pension worker group from the drop down menu.

c) Tax Relief - select the applicable tax relief option for your scheme from the drop down menu. The People's Pension can offer both Relief at Source and Net Pay Arrangement, so please contact The People's Pension if you are unsure of which tax relief method applies.

d) Click Continue to enrol the employee selected. Alternatively, click 'Enrol multiple employees with these settings..' to batch enrol employees who are to be be enrolled into the same group. The status of each employee selected will be updated to 'Enrolled':

5. Communicating with your Employees

i) Eligible Jobholders

Once an employee has been enrolled, you must provide them with a statutory enrolment letter. An employee's enrolment letter will include information about:

- their enrolment status

- their date of enrolment

- the Scheme into which the employee is enrolled

- contributions which are now attached to their earnings

- how to opt out should they choose to do so

- general information on how automatic enrolment will benefit the employee

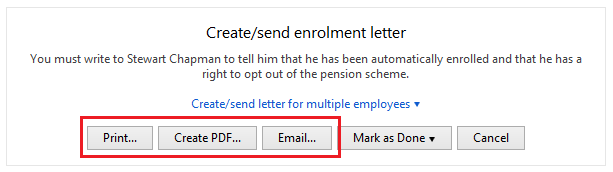

BrightPay will automatically prepare an employee's enrolment letter for you. Once an employee has been enrolled, BrightPay will prompt you to print/ export/ email their enrolment letter:

a) Click View Options followed by Letter:

b) Select Print/ Create PDF/ Email as required. Alternatively, should you wish to batch process your enrolment letters, simply select 'Create/send letter for multiple employees' and your chosen method of communication.

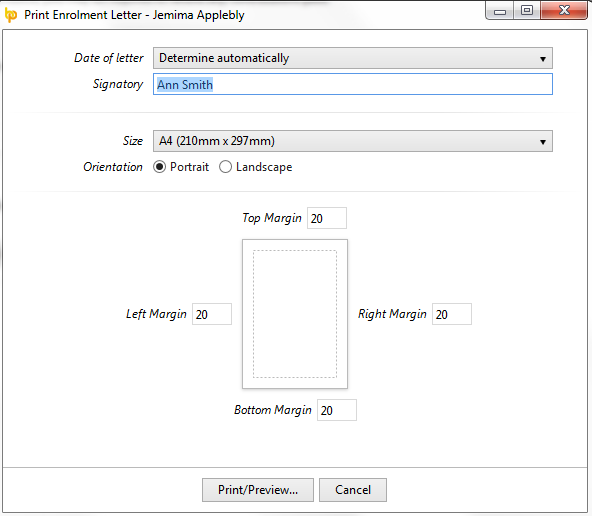

c) Enter a date (if applicable) and the signatory to be added to the letter:

d) Select Print/ Preview/ Create PDF/ Send Email accordingly.

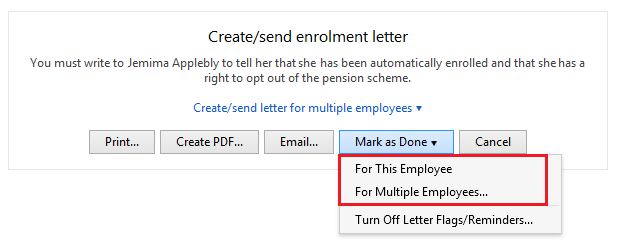

e) Once the employee is in receipt of the enrolment letter, simply 'Mark As Done - For This Employee'. Alternatively, if enrolment letters have been batch processed, select 'Mark As Done - For Multiple Employees':

ii) Notifying Non-Eligible Jobholders & Entitled Workers of their right to opt in/ join

Non-eligible jobholders are workers who are not eligible for automatic enrolment but can "choose to opt in" to a pension scheme. Entitled Workers are workers who are not eligible for automatic enrolment but are "entitled to join" a pension scheme.

An employer must provide such employees with information about their right to opt in/join a qualifying AE scheme. BrightPay will automatically prepare these letters for you.

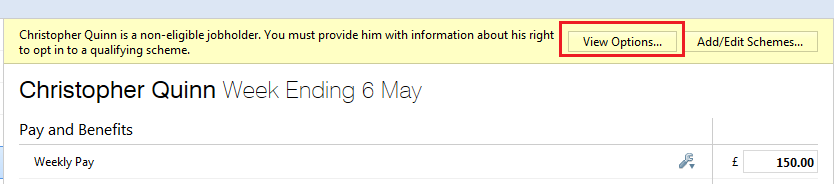

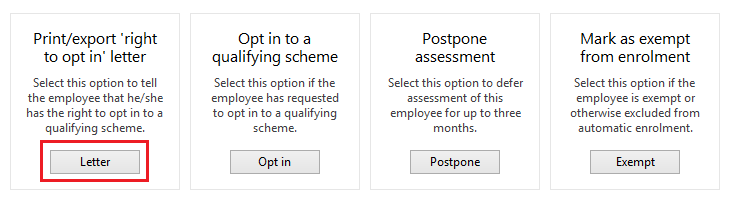

a) BrightPay will indicate an employee's status on the yellow bar in their payroll screen. Where an employee is being assessed as a non-eligible jobholder or an entitled worker, simply click View Options followed by Letter:

b) Select Print/ Create PDF/ Email as required. Alternatively, should you wish to batch process these letters, simply select 'Create/send letter for multiple employees' and your chosen method of communication.

c) Enter a date (if applicable) and the signatory to be added to the letter.

d) Select Print/ Preview/ Create PDF/ Send Email accordingly.

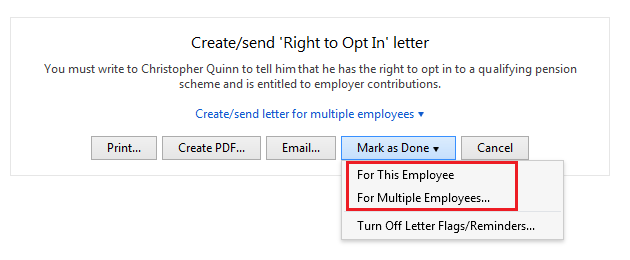

e) Once the employee is in receipt of the right to opt in/ right to join letter, simply 'Mark As Done - For This Employee'. Alternatively, if enrolment letters have been batch processed, select 'Mark As Done - For Multiple Employees':

6. Postponing Employees in BrightPay

You can use postponement to delay automatic enrolment for some or all employees for up to three months.

a) To postpone an employee, click 'View Options', followed by Postpone:

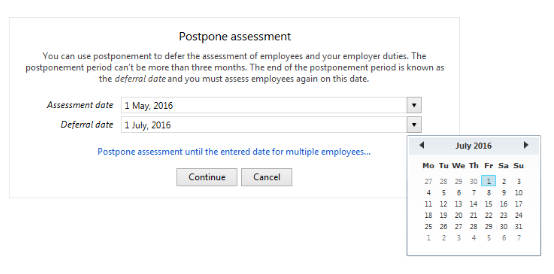

b) Enter the assessment date and deferral date applicable to the employee. Click Continue to postpone the employee selected. Alternatively, click 'Postpone assessment until the date entered for multiple employees...' to batch postpone employees who are to be postponed to the same date:

BrightPay will validate the date entered to ensure that it is no more than 3 months from the staging date.

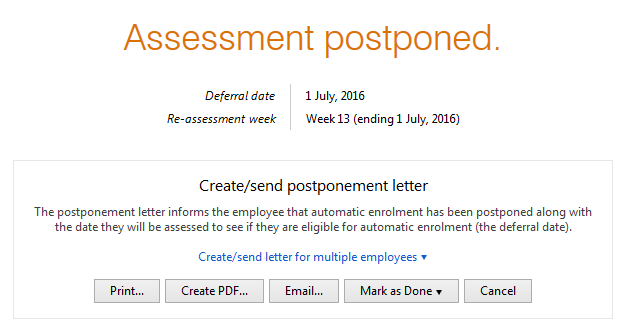

c) If postponement is used, you must provide the employee with a statutory postponement letter which BrightPay will automatically generate for you to give or email to the employee. Simply click Print/ Create PDF/ Email as required. Alternatively, should you wish to batch process your postponement letters, simply select 'Create/send letter for multiple employees' and your chosen method of communication.

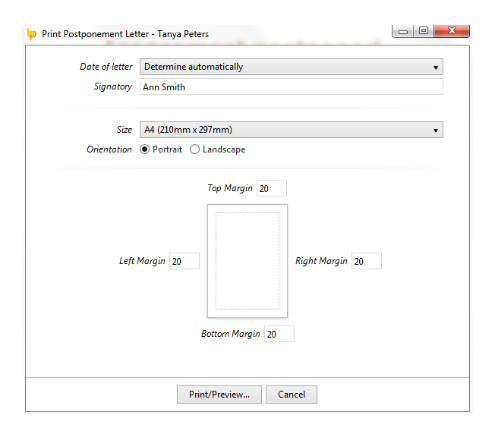

d) Enter the date (if applicable) and signatory to be added to the letter:

e) Select Print/ Preview/ Create PDF/ Send Email accordingly.

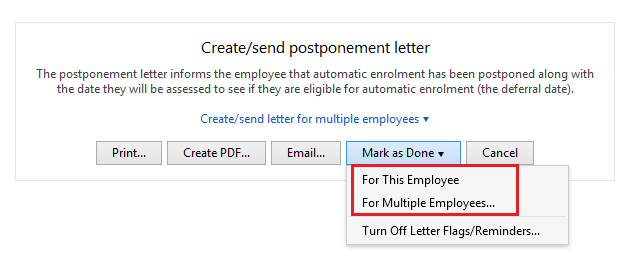

f) Once the postponement letter has been given or emailed to the employee, simply 'Mark As Done - For This Employee'. Alternatively, if postponement letters have been batch processed, select 'Mark As Done - For Multiple Employees':

7.Processing Pension Contributions

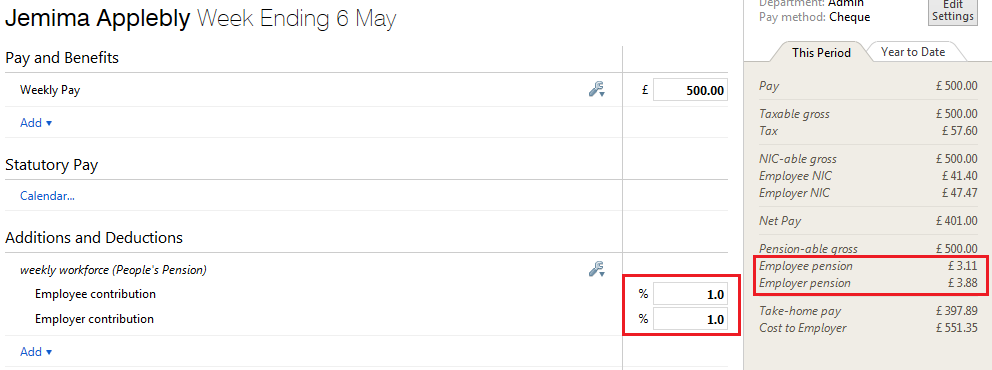

Once employees have been enrolled, have joined or opted-in, their pension deductions will automatically be applied to their payslips going forward. The deduction applied to the payslip will be made in accordance with the contribution rates and earnings bands selected when setting up the pension scheme in BrightPay.

Please note: if tax relief is at source, then the employee contribution will be adjusted by 0.2%.

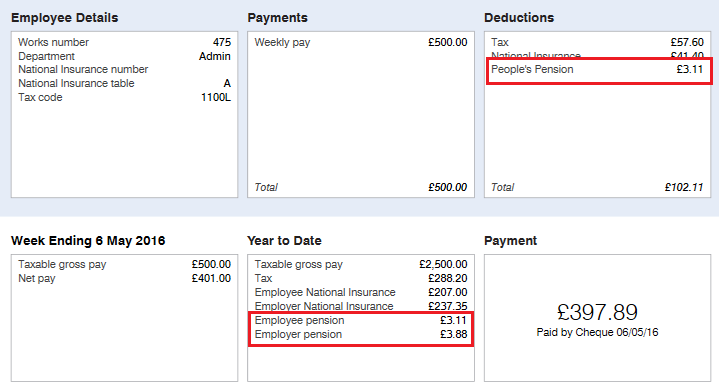

On finalising payslips, their pension deductions will also be reflected on their payslip:

8. Submitting your Contributions File to The People's Pension

BrightPay facilitates the creation of a Contributions File for upload to The People's Pension, in order to notify them of employees' details and their applicable pension contributions.

a) Within the Pensions utility, select Contributions Summary on the menu bar and click ‘Create CSV File’.

b) Choose the period which you would like to create the CSV file for. Click Next.

c) At step 2, select the employees who you wish to include in the CSV file. Click Next.

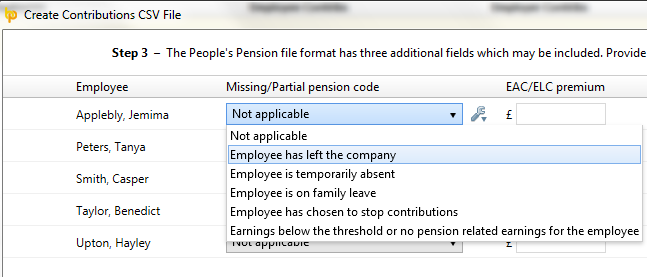

d) At step 3, complete the additional fields for relevant employees. For example, if an employee has left your employment, select 'Employee has left the company' to inform The People's Pension to no longer expect contributions for this employee. Click Next.

e) At step 4, simply click ‘Save File’ to save your CSV file to a location of your choice.

Your CSV File is now ready for upload to The People's Pension.

9. Ongoing Assessment of Employees

After staging, BrightPay will continue to monitor your employees for you and will alert you when you have further AE duties to perform.

Examples of when you may have further duties to perform are:

- a new starter commencing employment with you

- an existing employee now with earnings above the earnings trigger for automatic enrolment

- an employee turning 22 (with qualifying earnings)

- when a postponement period ends and an employee is re-assessed

Need help? Support is available at 0345 9390019 or [email protected].