Preparing Enrolment Files/ Contribution Files in BrightPay

Where we offer dedicated support for a pension provider, this means that Brightpay can produce the contributions files (and where applicable the enrolment files) in the correct format for the pension provider in question.

BrightPay offers dedicated support for the following pension providers:

- Aegon

- Aviva

- Creative Pension Trust

- Legal & General

- NEST

- NOW Pensions

- The People’s Pension

- Royal London

- Salvus

- Scottish Widows

- Simply Auto Enrolment Solutions

- Smart Pension

- Standard Life

- True Potential

- Trust Pensions

- Welplan

- Workers Pensions Trust

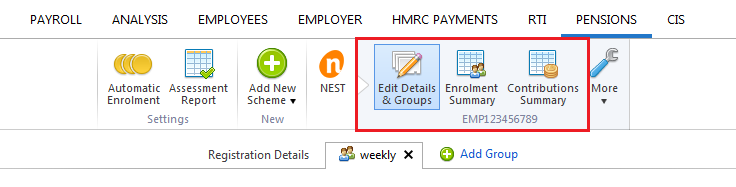

To produce enrolment files/ contributions files for upload into any of the above pension providers, click into the Pensions utility and select your pension scheme on the menu toolbar.

Please note: when preparing enrolment files/ contribution files in BrightPay, care should be taken that details entered at each step match exactly the details given to you by your chosen provider (including upper and lower casing). This is to ensure that enrolment files and contribution files will upload successfully for you.

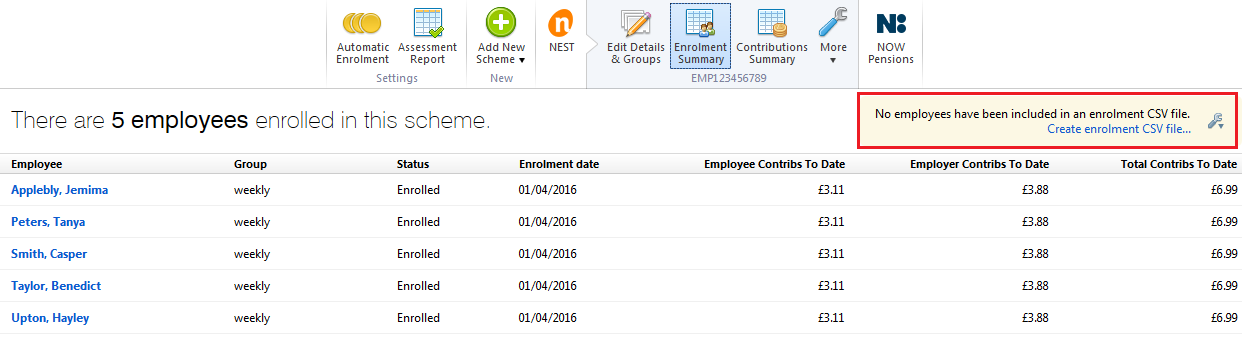

Creating an Enrolment File for upload

If your pension provider first requires an enrolment file to be uploaded into their portal, click Enrolment Summary

- Click Create Enrolment CSV File...

- Complete each step accordingly, as per the pension provider's requirements

- At the prompt, click Save File. Save the file to a location of your choice, ready for upload into your pension provider's portal.

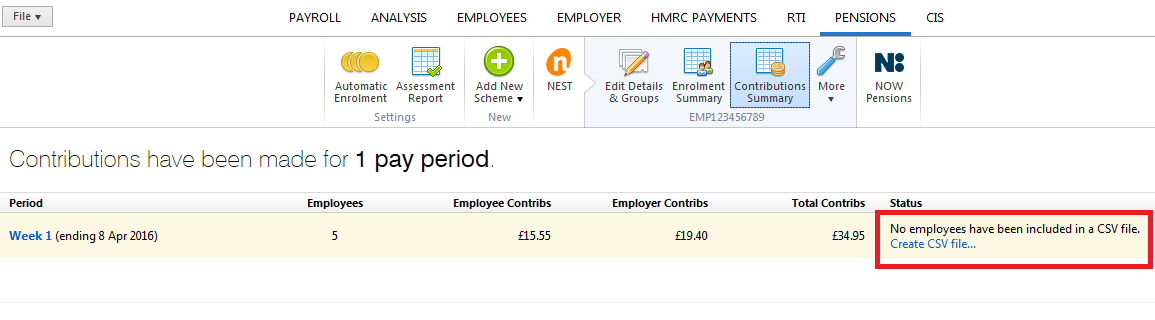

Creating a Contributions File for upload

To prepare a contributions file for upload into your pension provider's portal, click Contributions Summary

- Click Create CSV File...

- Complete each step accordingly, as per the pension provider's requirements

- At the prompt, click Save File. Save the file to a location of your choice, ready for upload into your pension providers portal.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.