Processing Entitled Workers in BrightPay

As soon as you reach your staging date, BrightPay will automatically assess your employees for you and determine whether your employees are eligible jobholders, non eligible jobholders or entitled workers.

Entitled Workers

Workers who are not eligible for automatic enrolment but are "entitled" to join a pension scheme. These include workers who either:

- are aged between 16 and 74

- are working or ordinarily work in the UK under their contract

- do not have qualifying earnings payable by the employer in the relevant pay reference period

As soon as you reach your staging date in the Payroll utility, on-screen flags and alerts will appear to notify that you have automatic enrolment duties to perform.

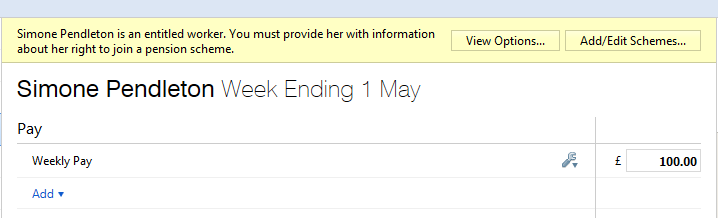

- BrightPay will indicate an employee's Entitled Worker status on the yellow bar in their payroll screen:

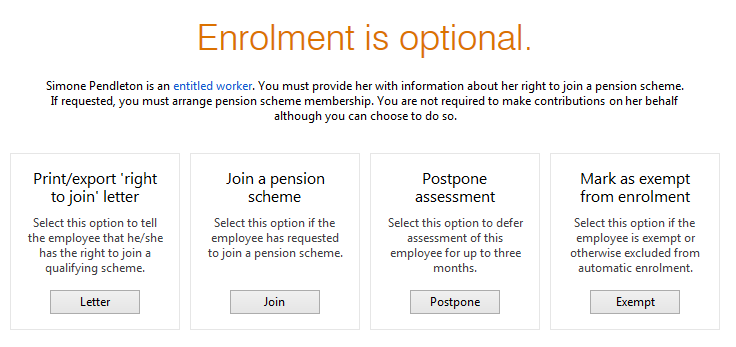

- Click View Options to bring you through to the various actions available based on this worker category:

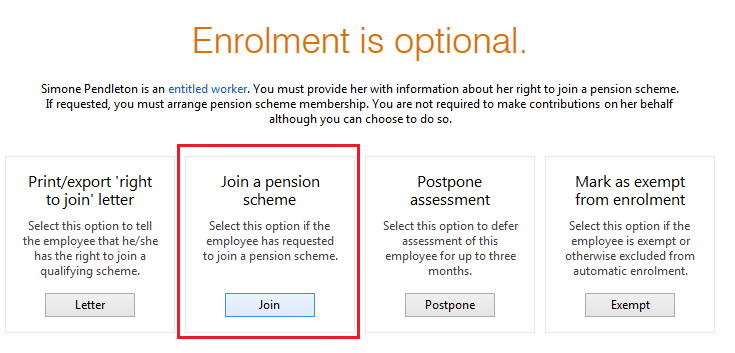

You must now choose the next appropriate action to take for this employee:

- Communicate with the worker - Notification letter to advise the worker that they can join a pension scheme.

- Join

- Postpone them

- Exempt them

Notifying the employee of their right to join

An employer must first provide an entitled worker with information about their right to join a qualifying AE scheme. BrightPay will automatically prepare this letter for you and will include the following information:

- Right to join the company/employer pension scheme

- How to notify the employer about joining

- Details of the available scheme (provider etc)

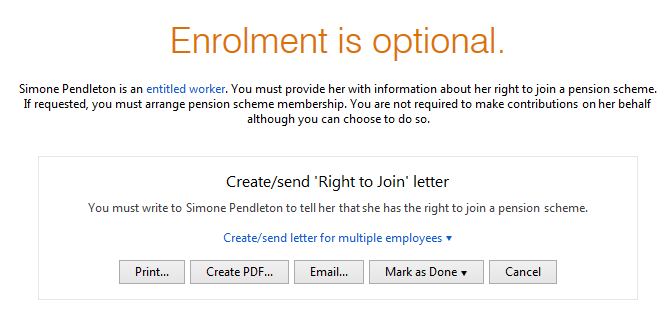

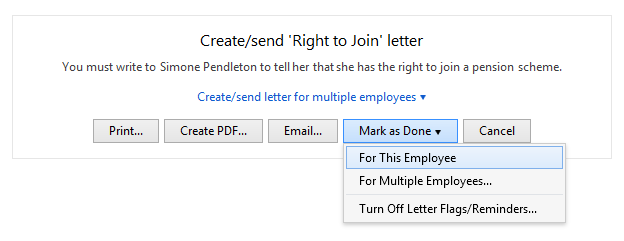

After clicking Letter, Select Print/ Create PDF/ Email as required:

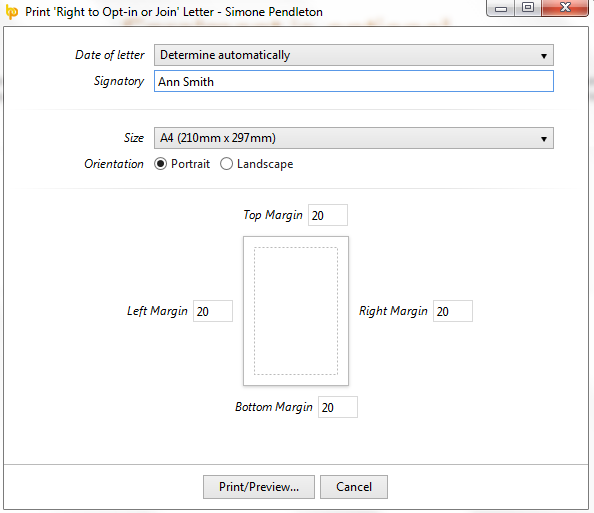

BrightPay will ask for a date and the signatory to be added to the letter.

Once this letter has been given or emailed to the employee, simply Mark as Done:

Joining the Pension Scheme

Entitled workers may choose to join the company pension scheme - to add an employee to the pension scheme select Join:

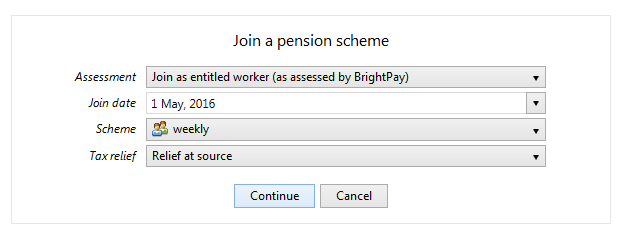

1) Select the correct Assessment for the employee

2) Enter the correct Join Date

3) Select the AE Scheme required from the drop down listing

4) Select the applicable Tax Relief from the drop down listing - If tax relief at source applies, the employee's contributions will be adjusted by 0.2%.

5) Press Continue

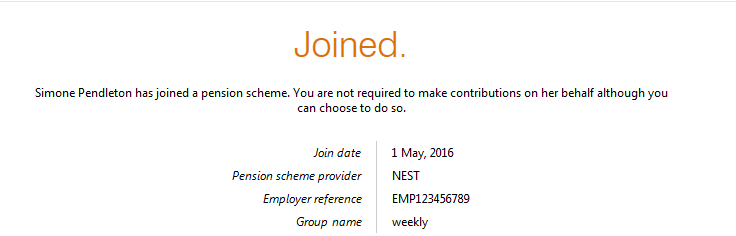

The employee has now been opted in to the selected group of your pension scheme

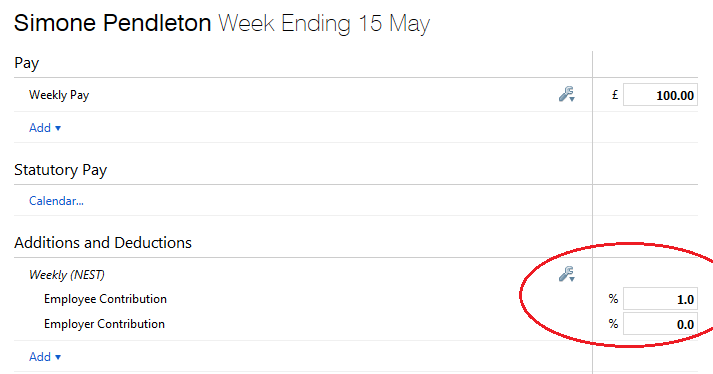

Pension Contributions

Once an employee has joined a pension scheme pension, contribution deductions start from the current open or subsequent pay period.

The deduction applied to the payslip is made in accordance with the contribution rates and earnings bands selected when setting up your pension scheme in BrightPay.

Please note: if tax relief is at source, then the employee contribution will be adjusted by 0.2%.

Please note: for Entitled Workers there is no obligation on the employer to make any contributions towards the employee's pension.

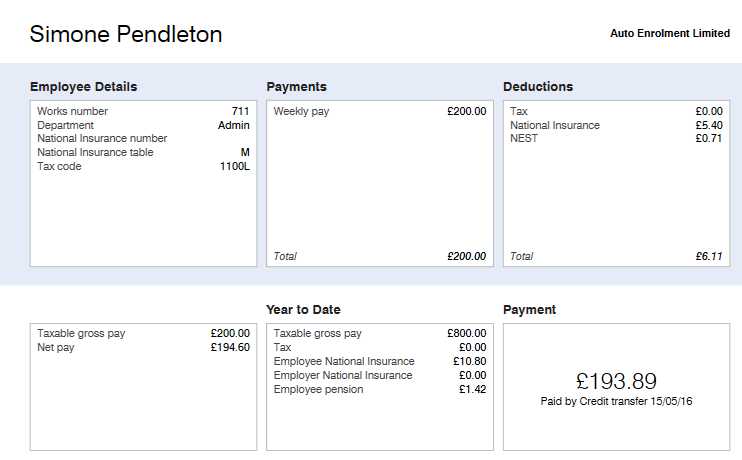

Payslip - Notification to employees of pension contribution deductions made

All pension contributions deducted from an employee's pay in each pay period will be itemised on their payslip. Employees should be issued with a payslip for each pay period.

BrightPay facilitates the printing, exporting and emailing of payslips.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.