Adding/ Amending Addition Types

This utility allows users to set up default Addition Types that will be available for selection when processing each employee’s payslip.

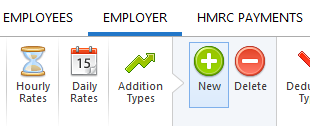

1) To add a new Addition Type – select Addition Types on the menu toolbar, followed by New.

- Enter a name for your addition and select which deductions are to be applied, according to HMRC ruling.

- If desired, enter a default amount for the addition and its default repetition.

- If the addition is to be used by employees, tick the box provided.

- If the addition is to be used by CIS subcontractors, tick the box provided.

Click Save.

2) To view or edit an Addition Type – select Addition Types on the menu toolbar. Select the addition from the listing and view/ amend accordingly. Click Save Changes.

3) To delete an Addition Type – first select Addition Types on the menu toolbar. Select the addition from the listing and click Delete on the menu toolbar. Click Yes to confirm you wish to delete the addition.

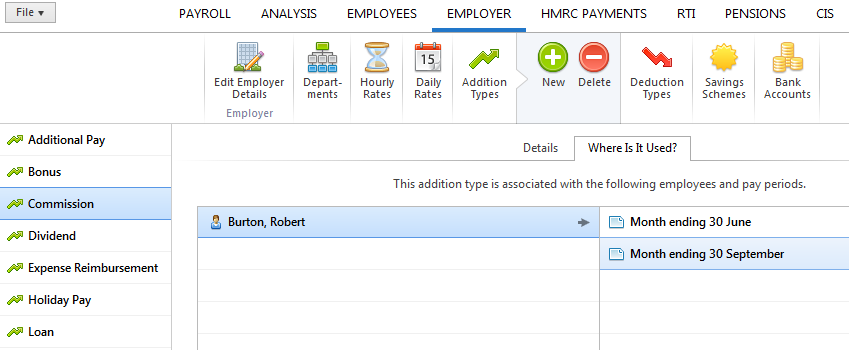

4) To view which employees have been assigned to a particular Addition - select Addition Types on the menu toolbar, followed by Where Is It Used?. Select the addition from the listing. Employees who have been assigned to the addition chosen will be displayed on screen.

To view the pay periods in which an employee has been assigned to this addition, click on the employee's name to display the periods on screen. The payslip for any of the pay periods displayed on screen can be individually viewed by clicking on the pay period you wish to view.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.