Employment Allowance

With effect from 6th April 2014, an NIC Employment Allowance is available to claim by eligible employers.

The employment allowance for tax year 2016-17 is £3,000 - an increase from £2,000 in tax year 2015-16.

Please note, single-director companies will not be eligible to claim the National Insurance Contributions Employment Allowance for the tax year 2016-17. The main reason for this change is to make the Employment Allowance more focused on businesses that are creating and sustaining employment and as a result where a director is the sole employee of a limited company this company is excluded from availing of the Employment Allowance. These regulations apply in England, Wales, Scotland and Northern Ireland.

Further guidance on single director companies is available here.

**** Employers that were eligible in 2015/16 but cease to be eligible in 2016/17 will have to notify HMRC of this ineligibility via the Employment Payment Summary (EPS). The ‘Employment Allowance indicator’ field needs to be amended to ‘Employer is not eligible for Employment Allowance, this should be on the first EPS that is submitted in the new tax year.

Eligibility

You can claim the Employment Allowance if:

- you are a business or charity (including community amateur sports clubs) paying employers’ Class 1 National Insurance

- you employ a care or support worker

The Employment Allowance is to be set against an employer’s liability for secondary Class 1 National Insurance Contributions (NICs) only, not against other NICs such as primary (employee’s) Class 1, Class 1A or Class 1B contributions.

You cannot claim the Employment Allowance, however, if you:

-

you employ someone for personal, household or domestic work (eg a nanny or gardener) - unless they’re a care or support worker

- already claim the allowance through a connected company or charity

- are a public authority, this includes; local, district, town and parish councils

- carry out functions either wholly or mainly of a public nature (unless you have charitable status), for example:

- NHS services

- General Practitioner services

- the managing of housing stock owned by or for a local council

- providing a meals on wheels service for a local council

- refuse collection for a local council

- prison services

- collecting debt for a government department

You do not carry out a function of a public nature, if you are:

- providing security and cleaning services for a public building, such as government or local council offices

- supplying IT services for a government department or local council

To check your eligibility and for further information about the Employment Allowance go to Employment Allowance Eligibility.

Claiming the Employment Allowance in BrightPay

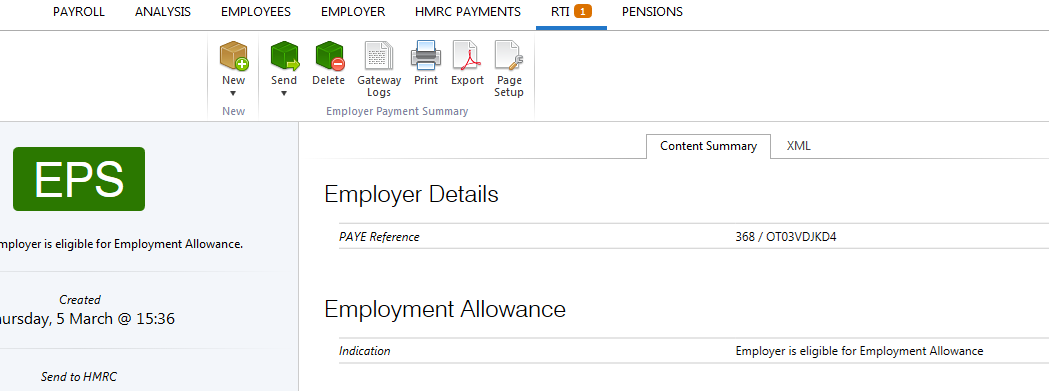

The claim process for eligible employers is very straightforward and is administered via BrightPay, and is merely a flag on the Employer Payment Summary (EPS) submission via RTI, notifying HMRC that they are claiming the employment allowance. There is no requirement to enter a claim value within the actual EPS submission.

To prepare an EPS for submission you must first set up your HMRC Payments schedule.

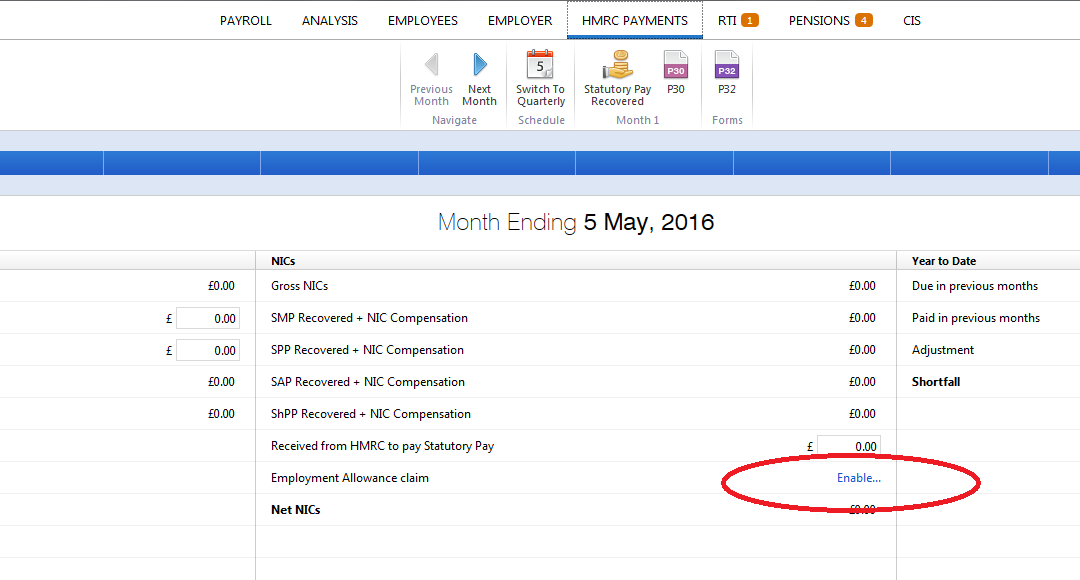

- Choose HMRC Payments menu item.

- Choose the agreed payment frequency between you and HMRC, monthly or quarterly

- Under NIC you will see the option for Employment Allowance Claim

- To claim the Employment Allowance, select Enable

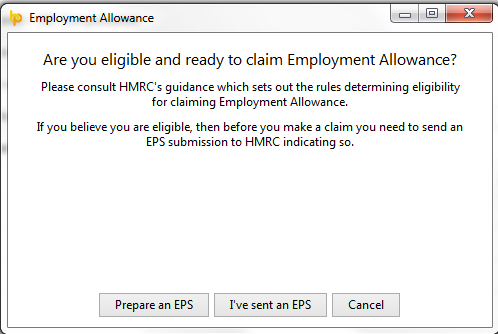

- The claim for the Employment Allowance is made via an EPS. Simply click Prepare an EPS and submit to HMRC:

- Once the EPS has been submitted and accepted by HMRC, click back into HMRC Payments and click the Enable button again.

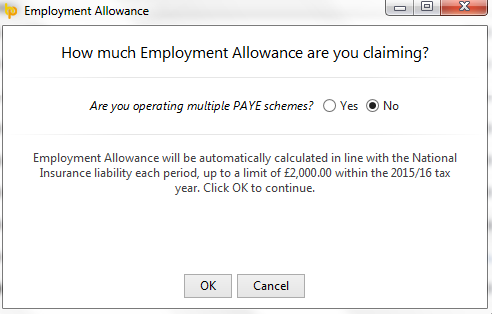

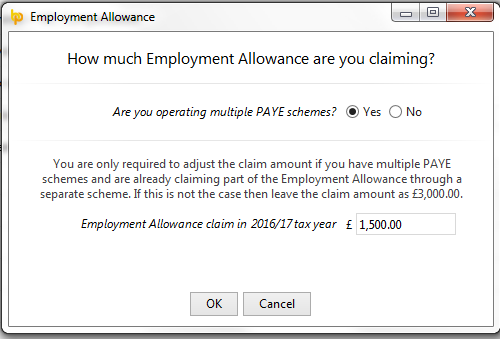

- Select whether you are operating multiple PAYE Schemes - if the answer is no, you will be allocated the full £3,000 allowance:

- if the answer is yes, simply enter the amount of the allowance that is applicable to the PAYE scheme you are processing:

- Click "OK" to save your selection.

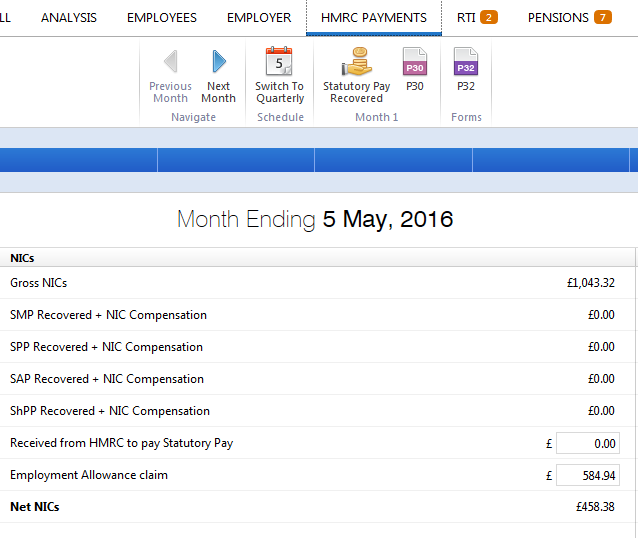

- BrightPay will now automatically calculate the amount of Employer NIC that can be set against the £3,000 allowance (or if part of a multiple PAYE scheme, the amount of allowance entered as per example above) and will reduce your NIC liability for the tax month/ quarter accordingly:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.