Recording Annual Leave on the Calendar

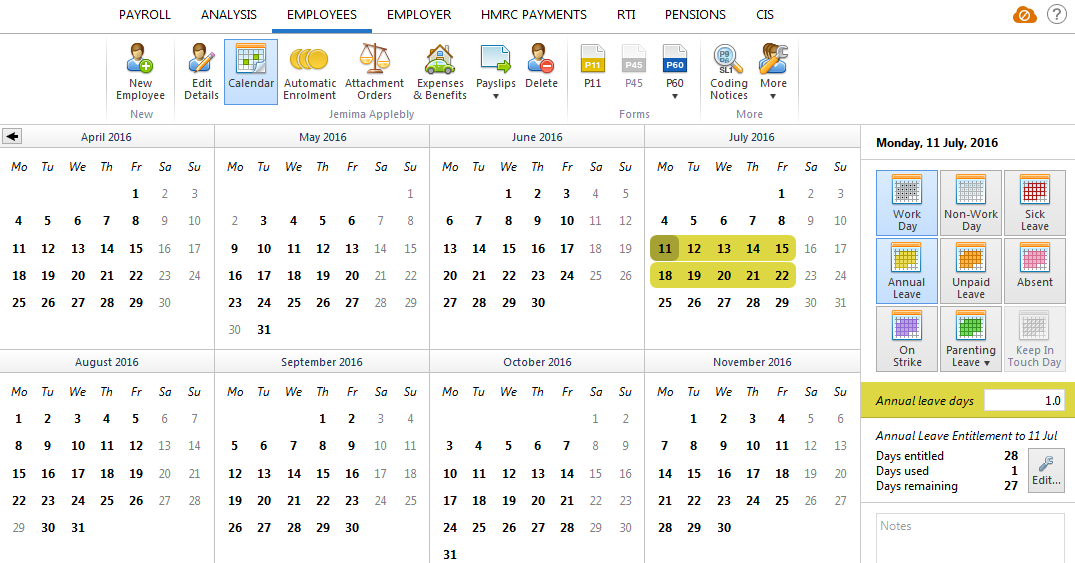

To record an employee’s annual leave, simply click Employees:

- Select the employee from the listing and click Calendar on their menu toolbar

- Select the required date or range of days on the calendar

- Select Annual Leave from the listing of leave types offered on the right side of the calendar

- The selected day/ date range will be flagged in yellow which is associated with this leave type

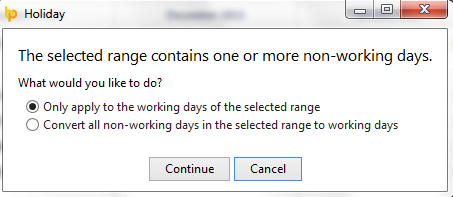

If a selected date range includes typical non-working days, BrightPay will prompt whether or not the typical non-working days should be included and flagged as the same leave type:

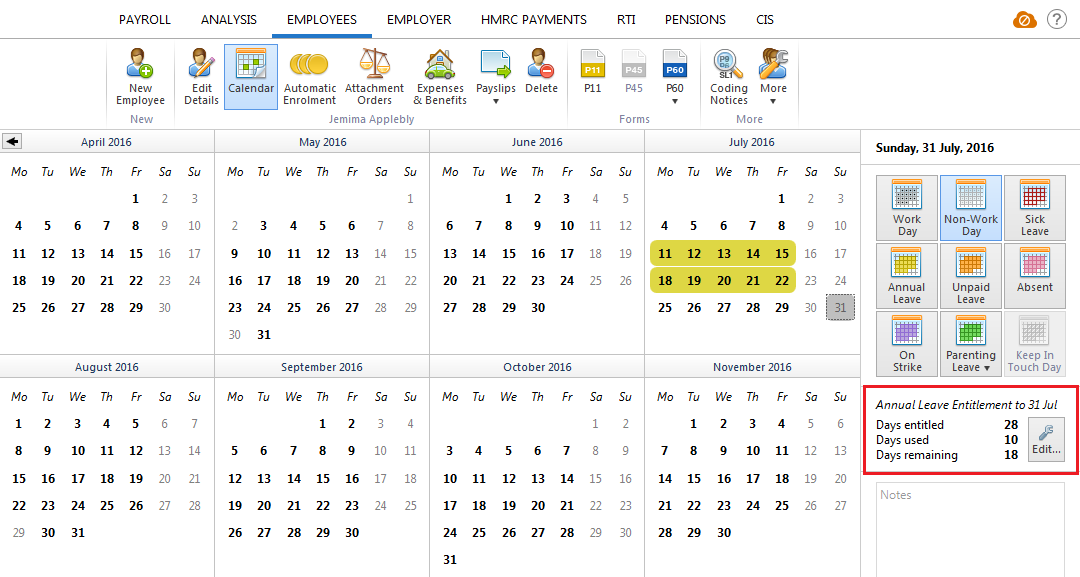

BrightPay will keep a track of an employee's annual leave entitlement based on the annual leave entitlement method chosen for them:

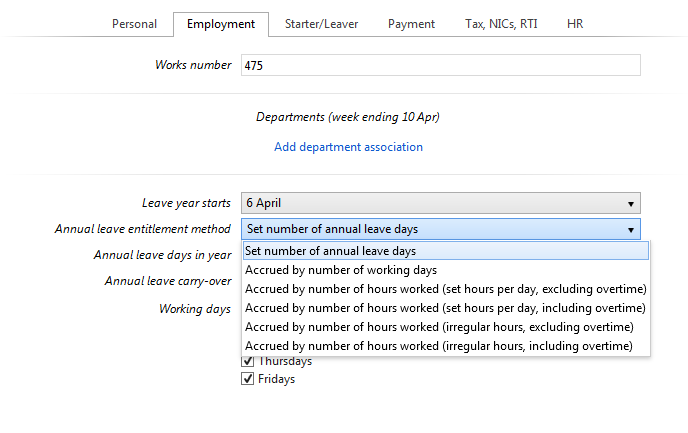

An employee's annual leave entitlement method can be set within the Employment section of their employee record:

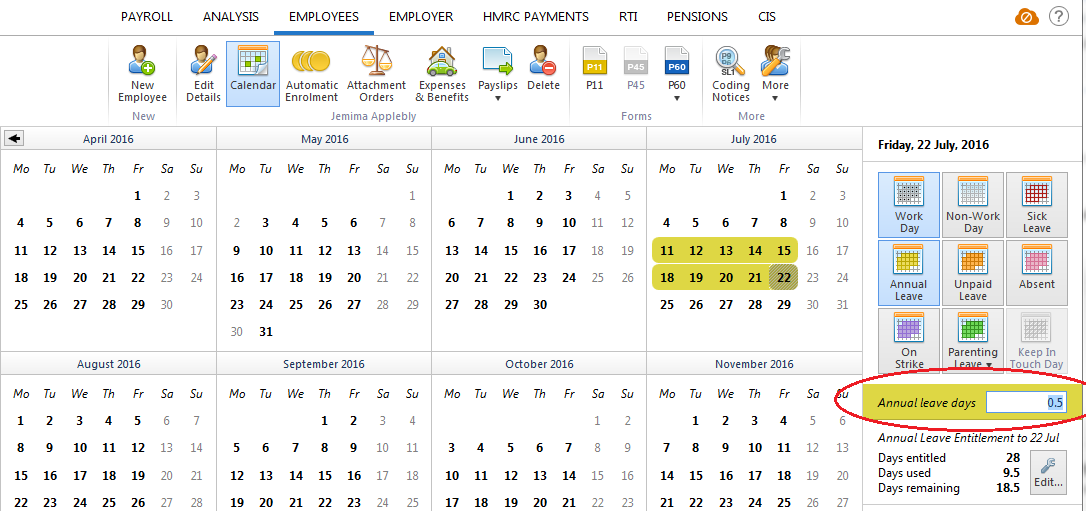

For employees whose annual leave entitlement method is one of the following:

- set number of annual leave days

- accrued by number of working days

- accrued by number of hours worked (set hours per day, excluding overtime)

- accrued by number of hours worked (set hours per day, including overtime)

part days can be allocated by selecting the applicable date on the calendar and using the dedicated option to the right of the calendar to adjust accordingly.

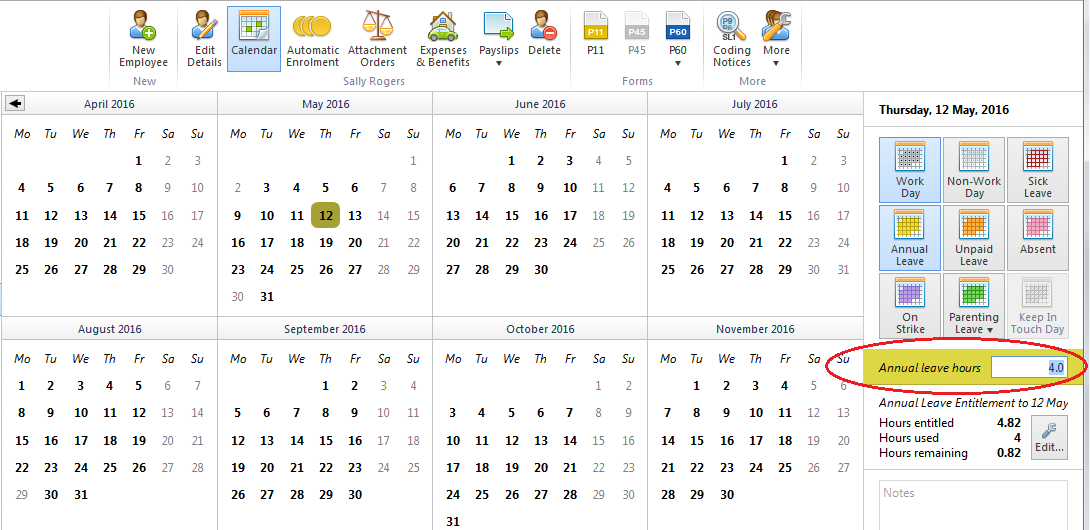

For employees whose annual leave entitlement method is one of the following:

- accrued by number of hours worked (irregular hours, excluding overtime)

- accrued by number of hours worked (irregular hours, including overtime)

part hours can be allocated by selecting the applicable date on the calendar and using the dedicated option to the right of the calendar to adjust accordingly.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.