Moving to BrightPay mid-year - Recoverable Amounts to Date

If you are migrating to BrightPay mid tax year, and have previously recovered statutory payments in the same tax year within your previous software, these amounts must be recorded in BrightPay to ensure correct year-to-date figures are reported to HMRC when you next submit an Employer Payment Summary.

To record statutory amounts already recovered in your previous software:

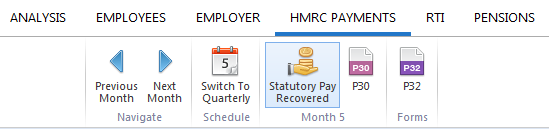

- Select HMRC Payments on the menu bar

- Click the Statutory Pay Recovered tab on the tool bar:

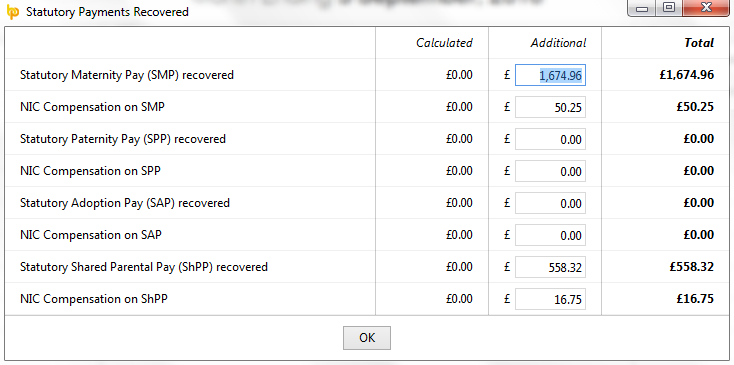

- Enter all applicable recoverable amounts claimed to date through your previous software:

- Click OK to save changes

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.