National Minimum Wage and National Living Wage

National Minimum Wage

The National Minimum Wage (NMW) is the minimum pay per hour most workers are entitled to by law. The rate will depend on a worker's age and if they are an apprentice.

National Living Wage

The Government's National Living Wage was introduced on 1 April 2016 for all working people aged 25 and over, and is set at £7.20 per hour. The current National Minimum Wage for those under the age of 25 still applies.

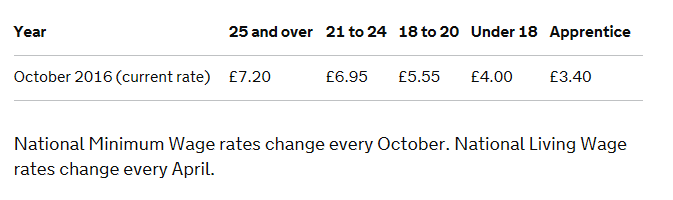

The rates effective from 1st October 2016 are:

Amending a Global Hourly Rate in BrightPay when the Minimum Wage changes

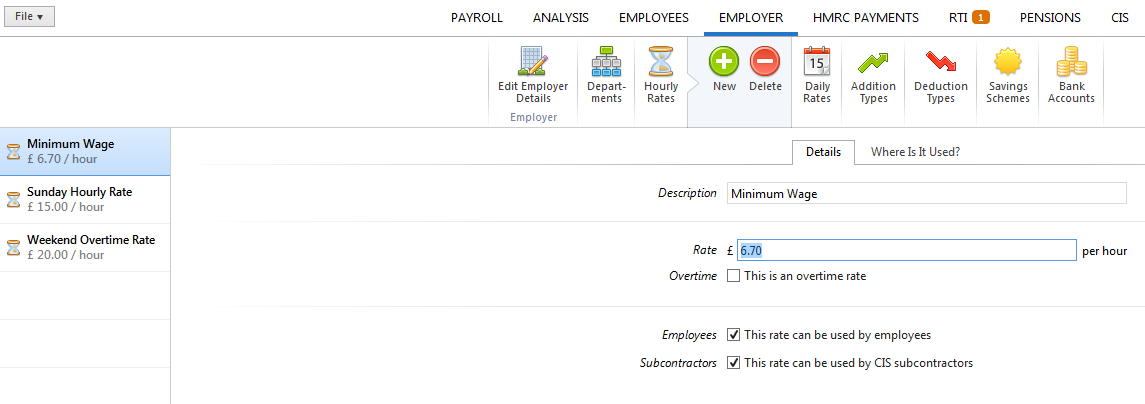

For hourly rates that have been set up at employer level in BrightPay, simply amend the rate in the Employer utility > Hourly Rates.

Any amendment made here, will automatically update all employees currently assigned to that hourly rate.

For assistance with setting up global hourly rates, click here .

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.