Expenses & Benefits

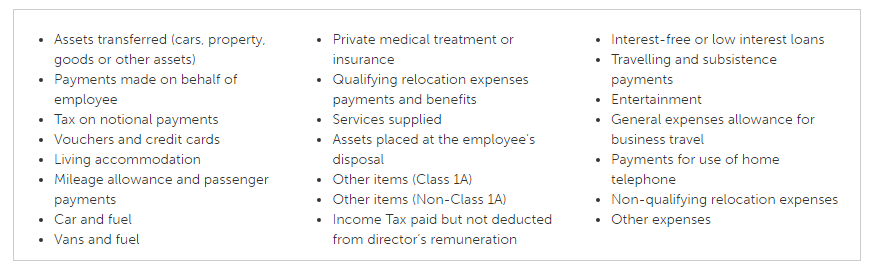

BrightPay for Windows 2016/17 allows you to record all types of reportable expenses and benefits that you provide to your employees, it is available for Standard & Bureau users.

BrightPay can produce a P11D for sending to HMRC after year end which includes your Class 1A NICs declaration and details of the expenses and benefits provided including cash equivalents.

If you have registered for payrolling of benefits by 5 April 2016, BrightPay 2016/17 also supports calculating the PAYE on expenses and benefits in each pay period.

Benefits that cannot be payrolled are:

- vouchers and credit cards

- living accommodation

- interest free and low interest (beneficial) loans

Payrolling Benefits:

Tax due on benefits and expenses is collected by adding a notional value to an employee’s taxable pay in payroll, rather than reporting them separately on a P11D. Tax is deducted or repaid as usual by reference to the employee’s tax code.

All payrolled benefits and expenses are included in a Full Payment Submission (FPS) as per HMRC's requirement.

Note: Expenses/benefits and P11D are not available for Free Licence customers.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.