Rates & Thresholds 2015-16

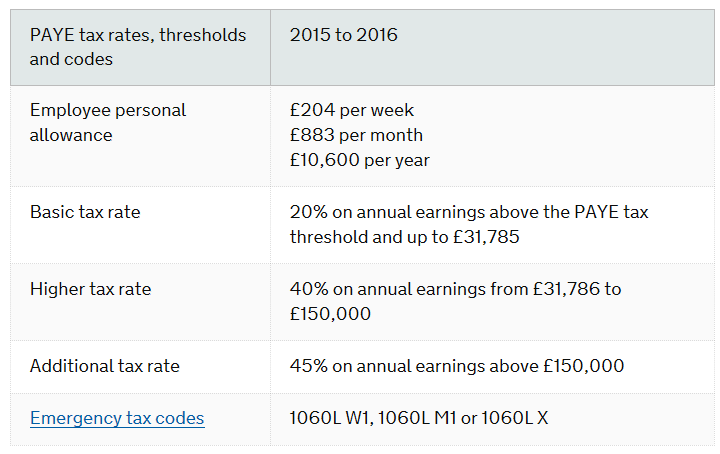

Tax thresholds, rates and codes

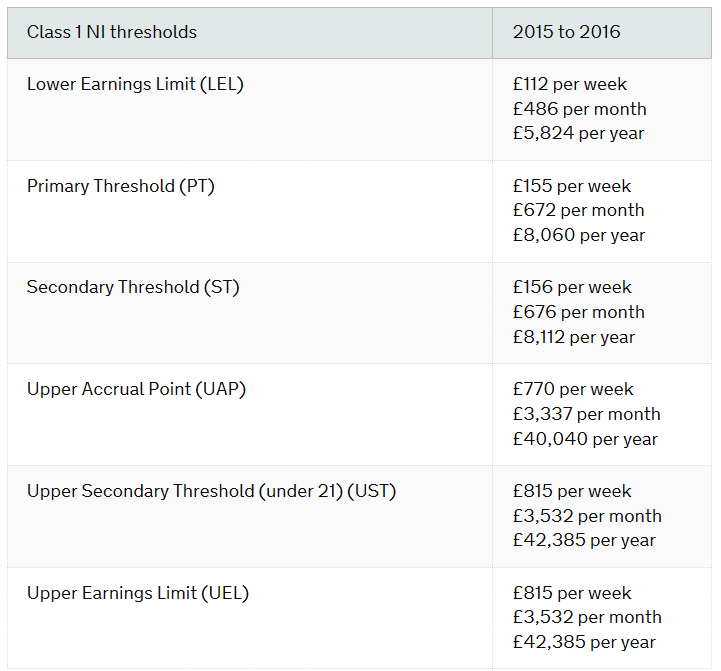

Class 1 National Insurance thresholds

]

]

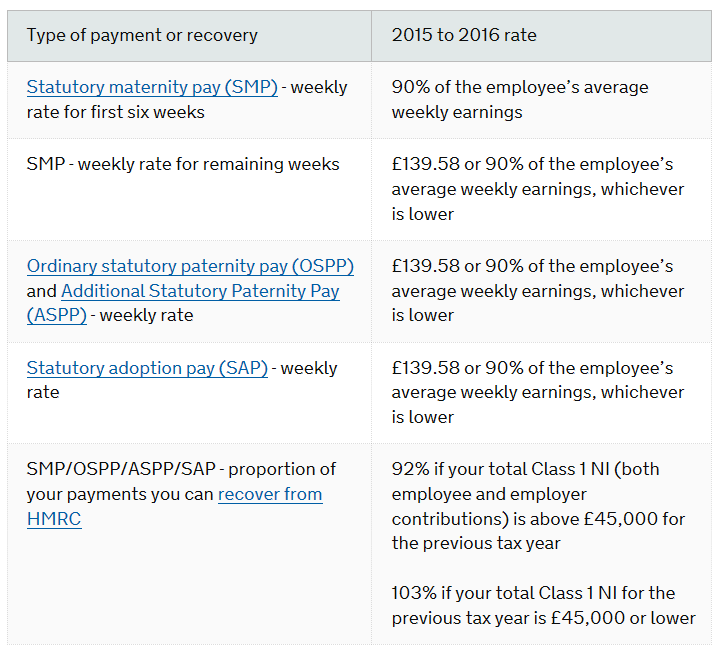

Statutory maternity, paternity and adoption pay

Statutory Sick Pay (SSP)

The same weekly SSP rate applies to all employees. However, the amount you actually pay an employee for each day they’re off work due to illness (the daily rate) depends on the number of ‘qualifying days’ (QDs) they work each week.

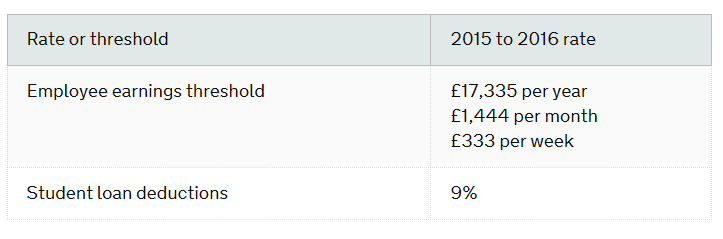

Student loan recovery

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.