Reporting Contracted Hours - Hourly Bands for FPS

For the Full Payment Submission (FPS) employers must indicate, at each employee level, into which HMRC predetermined list of hourly bands the employees normal working week falls.

This reports the number of weekly contracted hours the employee is contracted to work as opposed to the actual hours worked per week, therefore this field should not require amendment unless there is an amendment to the employees contract.

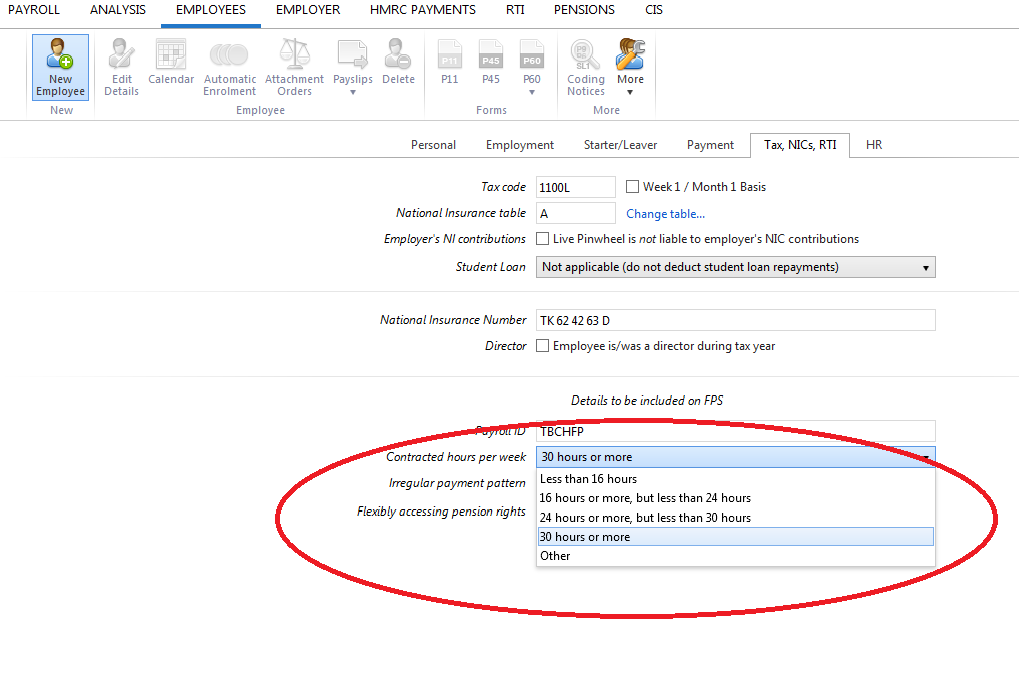

The current hourly bands to use are:

A Less than 16 hours

B 16 hours or more but less than 24 hours

C 24 hours or more, nut less than 30 hours

D 30 hours or more

E Other

'E Other' should only be used, for example, for workers on zero hour contracts, no set hours or pensioners being paid a company retirement pension or annuity.

It is important to record the correct number of hours your employee has worked to help ensure they receive the right amount of benefits and tax credits they are entitled to.

To assign the correct hourly band:

-

Choose the Employee menu

-

Select the employee from the employee listing on the left menu.

-

Once the employee is selected, choose the Tax, NICs, RTI option within the employee record.

-

There is a dedicated field called Contracted Hours per week, this displays the HMRC hourly bands. Choose the appropriate band for the employee in order for this to flow through to the FPS submission for RTI purposes.

-

Whichever hourly band is selected within this field has no bearing on the actual payroll hours paid to the employee.

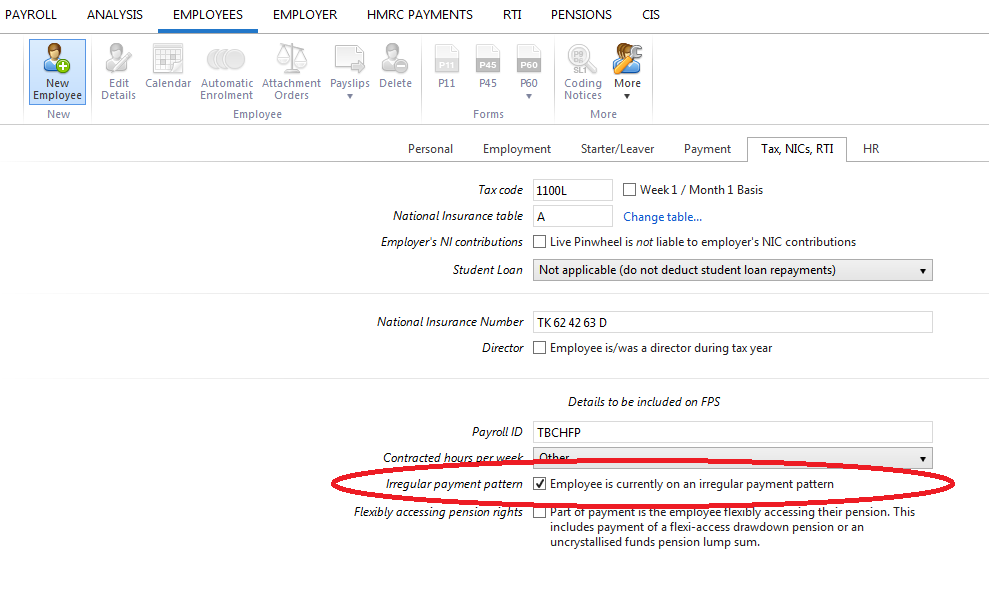

Irregular payment patterns

From the HMRC listing of hourly bands, band E Other applies to employees who are not paid on a regular basis for example:

-

casual or seasonal employees

-

employees on maternity leave

-

employees on long term sick leave

-

any employee who for any reason will not be paid for a period of three months or more

HMRC will check if an employee has not been paid for a certain period of time and will treat them as having left that employment. Setting this indicator on every FPS submitted for that employee avoids that happening.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.