Apprenticeship Levy

The Apprenticeship Levy is a new measure; it will affect employers in all sectors.

The levy is payable by employers with an annual pay bill in excess of £3,000,000. It is estimated that less than 2% of employers will pay it. The Apprenticeship Levy is to fund new apprenticeships.

Key Points

• Payable from 6th April 2017

• 0.5% of annual pay bill

• Apprenticeship levy allowance - £15,000 per annum

• Allowance reduces the levy due, only those with annual pay bill > £3,000,000 will pay

• Unused allowance cannot be carried forward to the next tax year

• Connected companies/charities – one allowance to share

• Paid in the same manner as PAYE & NICs

• Starting/stopping being an employer during tax year > use full annual allowance against amount owed

• Start paying must continue reporting it even if annual pay bill < £3,000,000

• Keep records for any information used to calculate levy for at least 3 years after tax year it relates to

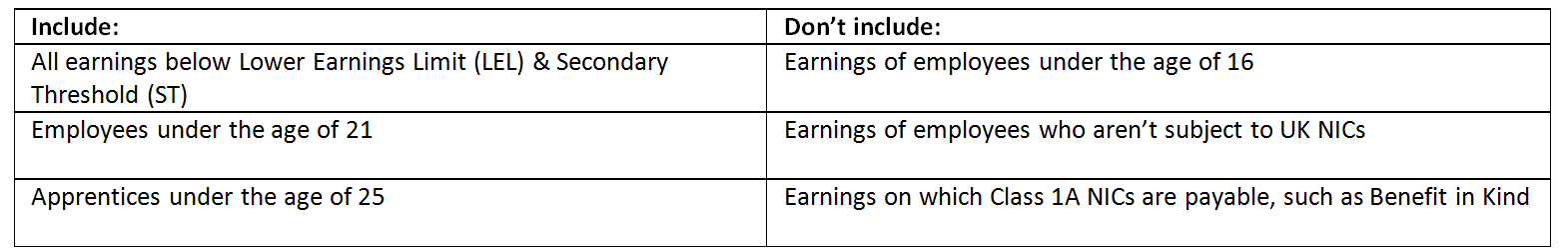

Annual pay bill includes all payments to employees that are subject to employer Class 1 secondary NICs, such as wages, bonuses and commissions

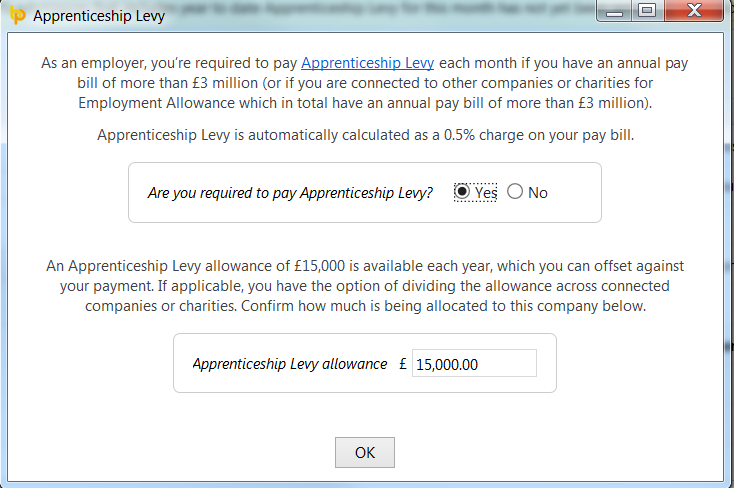

Enabling the Apprenticeship Levy in BrightPay

- Choose HMRC Payments

- Choose the agreed payment frequency between you and HMRC, monthly or quarterly, if not already done

- Under NIC, you will see the option for Apprenticeship Levy

- To enable the levy, select Enable

- Confirm you are required to pay the Apprenticeship Levy and the value of the Apprenticeship Levy allowance allocated to this company

- Click OK

Reporting your Apprenticeship Levy to HMRC

You must report the following each month to HMRC via an Employer Payment Summary (EPS):

- The amount of the annual Apprenticeship Levy allowance you’ve allocated to that PAYE scheme

- The amount of Apprenticeship Levy you owe to date in the current tax year

BrightPay will automatically calculate the amount of Apprenticeship Levy due each tax period by calculating 0.5% of the pay bill less the year to date Apprenticeship Levy Allowance. This amount will be reflected in the HMRC Payments utility and will be reported on the Employer Payment Summary (EPS).

Please note: you don’t need to report Apprenticeship Levy on your EPS if you haven’t had to pay it in the current tax year.

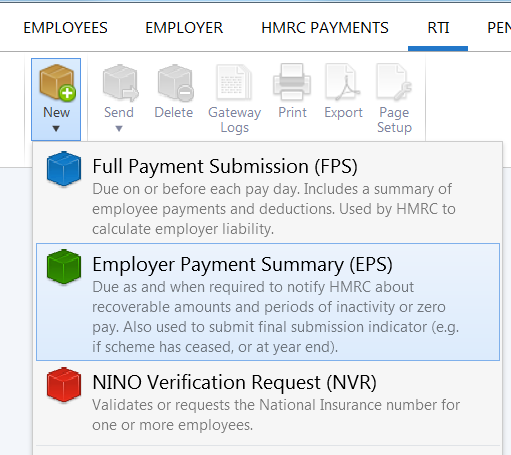

1) Select 'RTI' on the menu bar

2) Click New on the menu toolbar and select Employer Payment Summary (EPS):

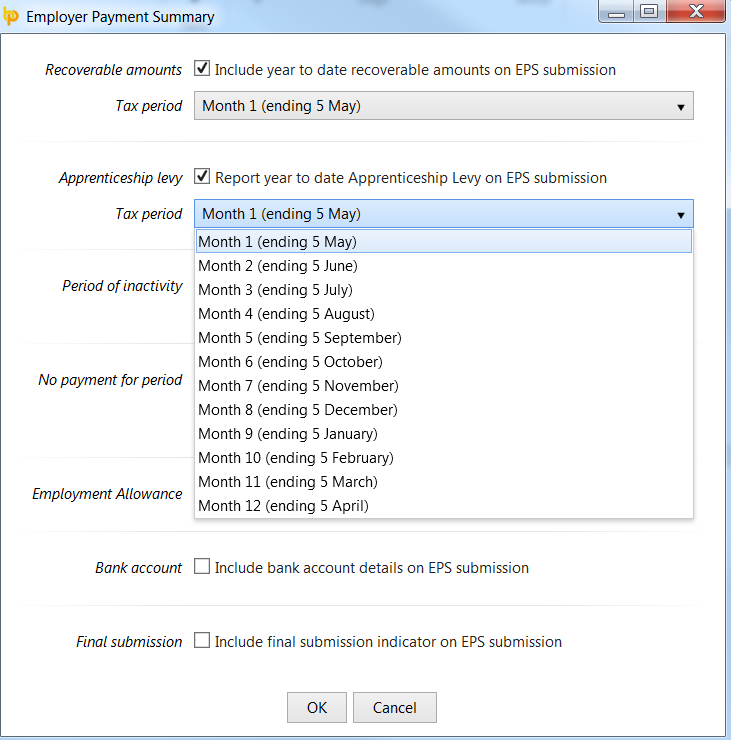

3) Ensure the 'Apprenticeship Levy' marker is ticked

4) Select the applicable Tax period from the drop down menu

5) Click 'OK' and submit to HMRC, when ready.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.