Entering your Staging Date in BrightPay

Your staging date is set in law as of 1 April 2012 and is the date your automatic enrolment duties come into effect for you. You'll need your PAYE reference to find out your staging date.

Your PAYE reference can be found on letters you have received from The Pensions Regulator about automatic enrolment. Alternatively, it can be found on the letter HMRC sent you when you first registered as an employer, or within the Employer utility in BrightPay.

If you don't pay your staff through a PAYE scheme, your staging date will be 1 April 2017.

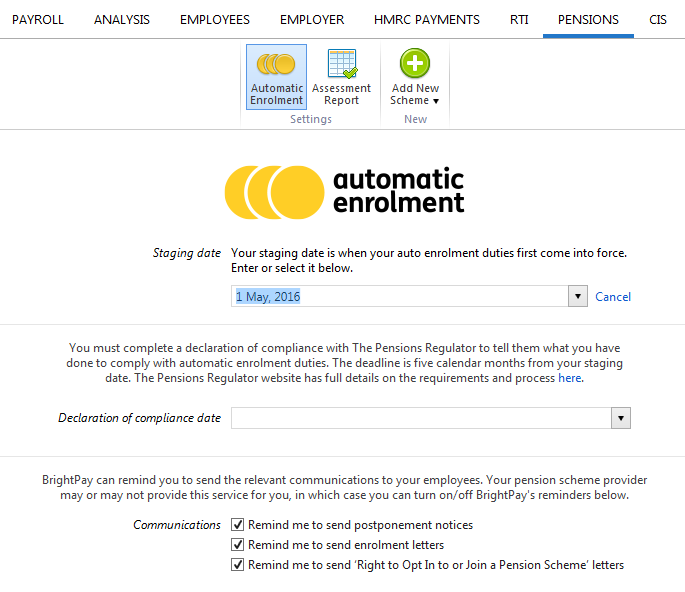

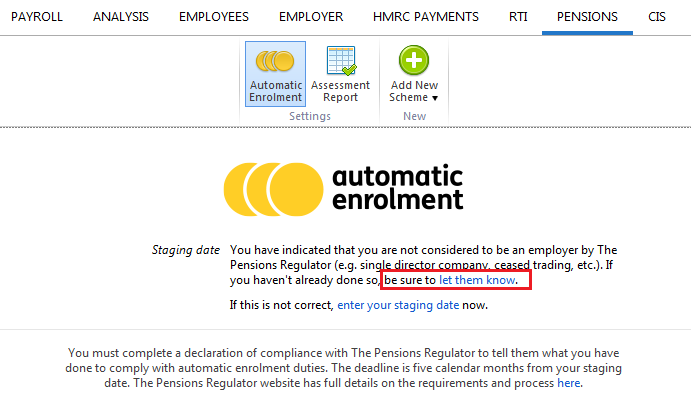

To enter your staging date in BrightPay, click Pensions > Automatic Enrolment

1) Enter your staging date in the field provided:

Entering your staging date here will ensure that your on screen automatic enrolment alerts will start at the correct time for you.

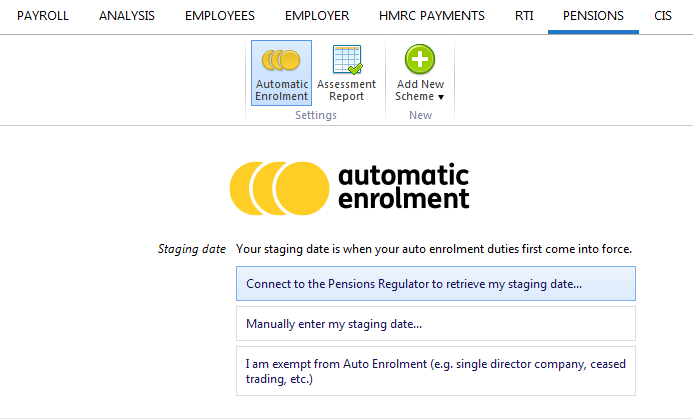

2) If you are unsure of your staging date, or wish to check it, click Change, followed by Connect to the Pensions Regulator to retrieve my staging date...:

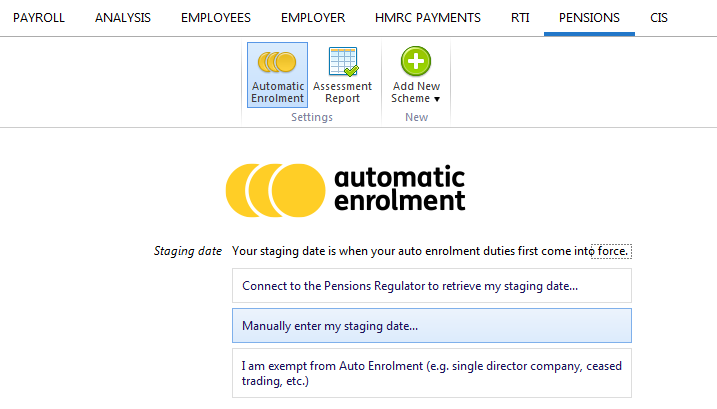

3) If you wish to change the staging date you have entered, click Change, followed by Manually enter my staging date...

Please note: the staging date cannot be changed once you have staged for automatic enrolment

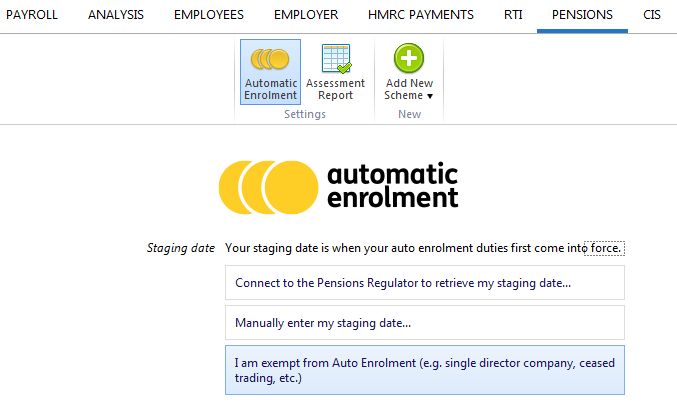

4) If you are exempt from automatic enrolment (e.g. you are a single director company, you have ceased trading, etc.) and you have not already informed the Pensions Regulator of this, click Change, followed by I am exempt from auto enrolment (e.g. single director company, ceased trading, etc.)

- Click the link 'let them know' to submit your notification on the Pensions Regulator website:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.