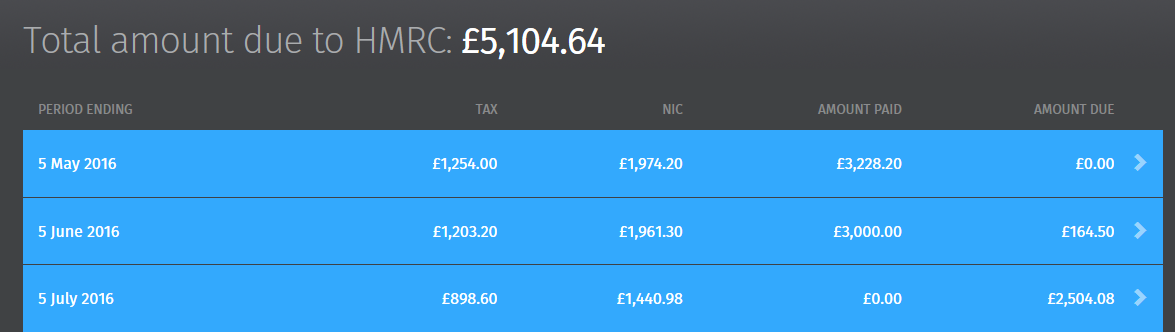

Employer Portal - HMRC Payments

The HMRC Payments page displays the payments due to HMRC for the tax year. These amounts will update as you finalise pay periods using BrightPay on your computer and synchronise your data to BrightPay Connect.

1) Click on a payment to view the full P30 (Employer's Payslip), which shows the full breakdown of how the amounts are calculated.

2) Click the 'download' button at the top right to save the P30 to PDF.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.