Importing using a CSV File - Other software

BrightPay facilitates the importing of employee information in CSV format. Therefore if your current payroll software allows the export of employee information in CSV format (or to Excel, which can subsequently be converted to CSV format), BrightPay's import utility can be used.

A CSV import of both employee and their mid-year pay information can be performed in BrightPay at any point in the tax year (should your current software allow the export of such information).

Should your current payroll software not allow the export of employee information, then employee details will need to be set up manually within BrightPay.

To import employee data into BrightPay from a CSV file, go to File > Import/ Export Data > Import Employees from a CSV File.

1) Browse to the location of your Employee CSV File

2) Select the required file and click 'Open'

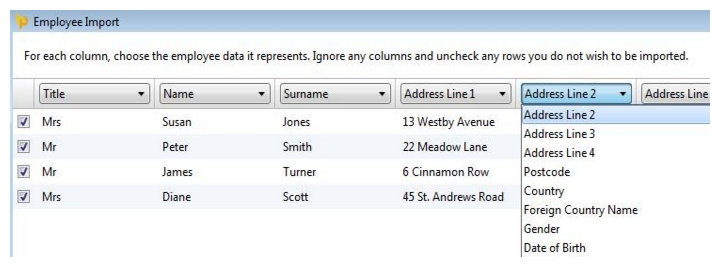

3) Your employee information will be displayed on screen. For each column, choose the employee data it represents. Ignore any columns and uncheck any rows you do not wish to be imported

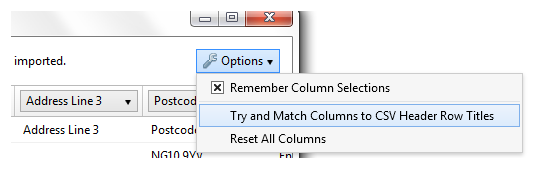

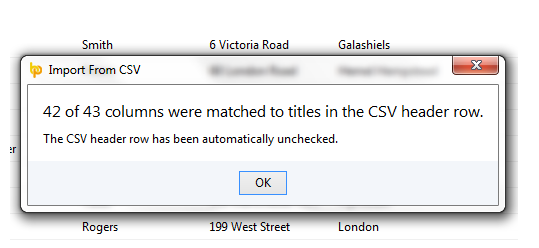

To assist with column selection, under 'Options', simply select 'Try and Match Columns to CSV Header Row Titles'. BrightPay will try and match as many columns as it can for you.

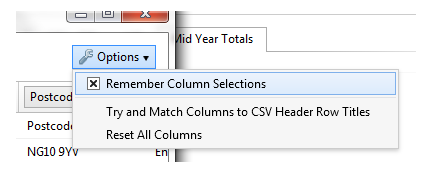

Please note: should you have employee CSV files to import for more than one company e.g. you are moving a number of companies across from a previous software, simply instruct BrightPay to 'Remember Column Selections' under the 'Options' menu. BrightPay will subsequently remember the column selection used in the previous import when next importing a new employee CSV file.

Alternatively, should you wish to reset your column selection, select 'Reset All Columns'.

4) Click Import to complete the import of your employee information.

Fields which can be imported into BrightPay using CSV file format are:

Title

Name

Middle Name

Surname

Address Line 1

Address Line 2

Address Line 3

Address Line 4

Postcode

Country

Foreign Country Name

Gender

Date of Birth

Marital Status

Nationality

Passport Number

Phone Number

Email Address

Works Number

Start Date

Starter Declaration

Seconded to Work in UK

Is EEA Citizen

Is EPM 6 Scheme

Taxable Pay in Previous Employment

Tax in Previous Employment

Leave Date

Is Deceased

Department

Leave Year Start Date

Is Annual Leave Carried Over from Previous Year

Number of Annual Leave Days Carried Over from Previous Year

Number of Annual Leave Hours Carried Over from Previous Year

Number of Days Holiday in Year

Typical Number of Hours in Working Day

Is Monday a Typical Working Day

Is Tuesday a Typical Working Day

Is Wednesday a Typical Working Day

Is Thursday a Typical Working Day

Is Friday a Typical Working Day

Is Saturday a Typical Working Day

Is Sunday a Typical Working Day

Tax Code

Week/Month 1 Basis

National Insurance Number

National Insurance Table

Is a Director

Director Start Date

Director End Date

Is Using Alternate Director NI Calculation

Is Exempt From Employer NICs

Student Loan Plan

Student Loan Start Date

Student Loan Stop Date

Payment Frequency

Payment Calculation Method

Annual Pay Rate

Period Pay Rate

Daily Pay Rate

Hourly Pay Rate

Payment Method

Payment Bank Name

Payment Bank Branch

Payment Bank Sort Code

Payment Bank Account Name

Payment Bank Account Number

Payment Bank Reference

Payroll ID (RTI)

Contracted Hours Worked

Is Irregular Payment Pattern

Is Flexibly Accessing Pension Rights

Job Title

Starting Salary

Employment Arrangements

Next Review Date

Document Password

Medical Information

Notes

Additional fields which can be imported if a MID-YEAR setup:

SSP to Date (Mid Year)

SMP to Date (Mid Year)

SPP to Date (Mid Year)

SAP to Date (Mid Year)

ShPP to Date (Mid Year)

Gross Pay to Date (Mid Year)

Taxable Pay (including Free Pay) to Date (Mid Year)

Free Pay to Date (Mid Year)

Tax to Date (Mid Year)

NIC-able Pay to Date (Mid Year) (Current NI Table)

Earnings to LEL to Date (Mid Year) (Current NI Table)

Earnings from LEL to PT to Date (Mid Year) (Current NI Table)

Earnings from PT to UEL to Date (Mid Year) (Current NI Table)

Employee NI Contributions to Date (Mid Year) (Current NI Table)

Employer NI Contributions to Date (Mid Year) (Current NI Table)

Total NI Contributions to Date (Mid Year) (Current NI Table)

National Insurance Table (Preceding)

NIC-able Pay to Date (Mid Year) (Preceding NI Table)

Earnings to LEL to Date (Mid Year) (Preceding NI Table)

Earnings from LEL to PT to Date (Mid Year) (Preceding NI Table)

Earnings from PT to UEL to Date (Mid Year) (Preceding NI Table)

Employee NI Contributions to Date (Mid Year) (Preceding NI Table)

Employer NI Contributions to Date (Mid Year) (Preceding NI Table)

Total NI Contributions to Date (Mid Year) (Preceding NI Table)

Student Loan Deductions to Date (Mid Year)

Employee Pensionable Pay to Date (Mid Year)

Employer Pensionable Pay to Date (Mid Year)

Employee Pension to Date (Mid Year)

Employee Additional Voluntary Pension to Date (Mid Year)

Employer Pension to Date (Mid Year)

Net Pay to Date (Mid Year)

Take Home Pay to Date (Mid Year)

Cost to Employer to Date (Mid Year)

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.