Notifying HMRC of your final submission of year

At the end of the tax year, a final Employer Payment Summary submission will be required in addition to your final FPS for the year, to inform HMRC that you have completed your final submission for the year.

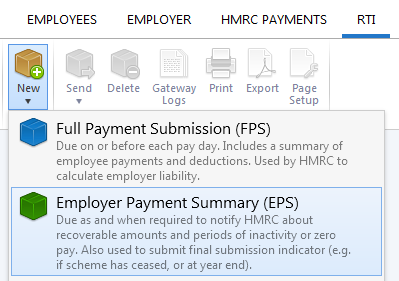

1) Select 'RTI' on the menu bar

2) Click New on the menu toolbar and select Employer Payment Summary (EPS):

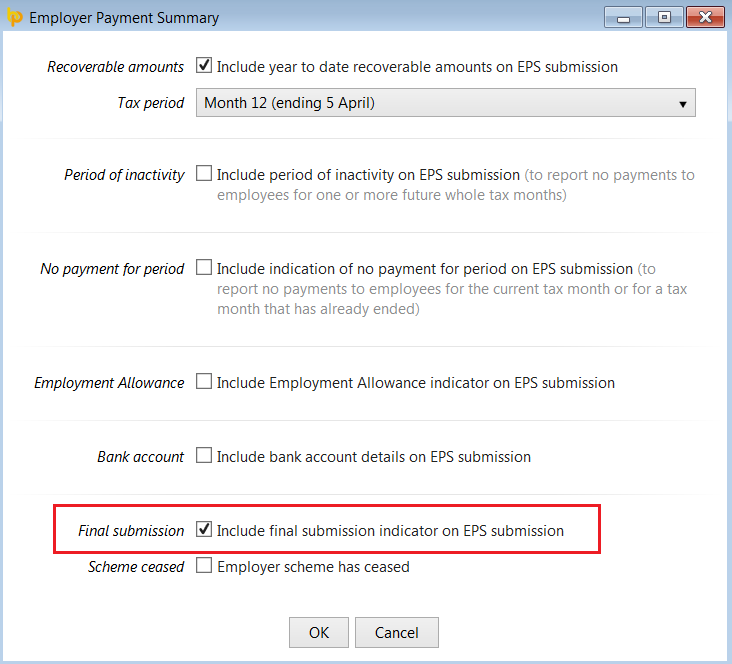

3) Tick the 'Final Submission' marker

4) Click 'OK' and submit to HMRC when ready.

Please note: since 6th March 2015, employers are no longer required to answer additional end- of-year questions on their EPS submission.

For guidance on if your PAYE scheme has also ceased, click here.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.