Tax Codes - The Basics

A tax code is used by an employer or pension provider to calculate the amount of tax to deduct from an employee's pay or pension. If an employee has the wrong tax code this could result in them paying too much or too little tax.

A tax code is worked out by HM Revenue and Customs (HMRC), who sends it to the relevant employer or pension provider.

What is a tax code

A tax code is usually made up of several numbers and a letter, for example: 1150L or K497.

If your tax code is a number followed by a letter

If you multiply the number in your tax code by £10 plus £9, you'll get the approximate total amount of income you can earn in a year before paying tax.

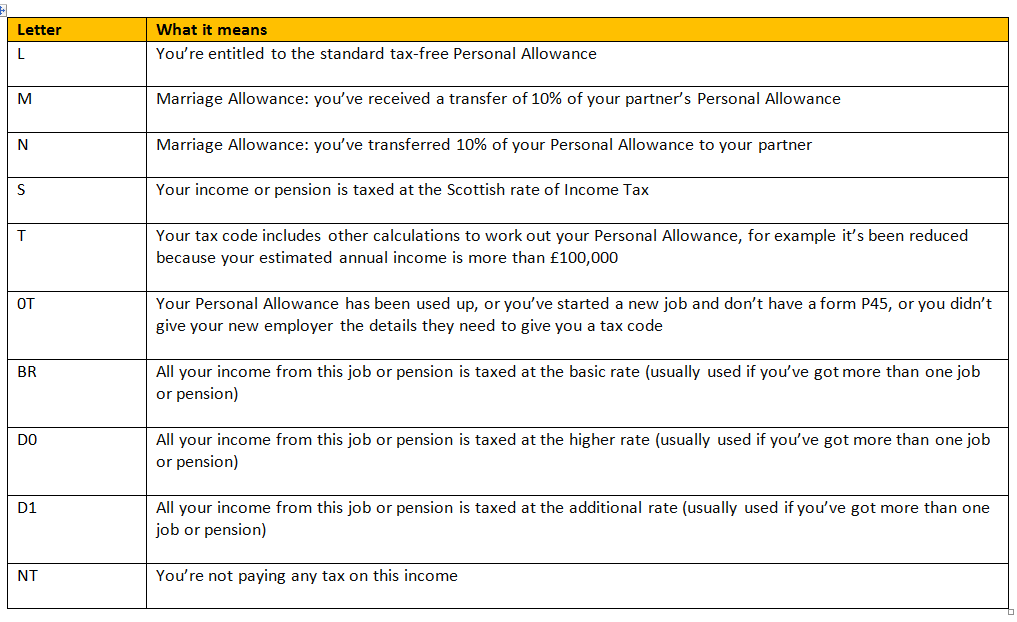

The letter shows how the number should be adjusted following any changes to allowances announced by the Chancellor - common tax code letters are explained below.

Common tax code letters and what they mean

How tax codes are worked out

Step one

Your tax allowances are added up. (In most cases this will just be your Personal Allowance and any Blind Person's Allowance. However, in some cases it may include certain job expenses.)

Step two

Income you've not paid tax on (for example untaxed interest or part-time earnings) and any taxable employment benefits are added up.

Step three

The total amount of income you've not paid any tax on (called 'deductions') is taken away from the total amount of tax allowances. The amount you are left with is the total of tax-free income you are allowed in a tax year.

Step four

Broadly speaking, to arrive at your tax code the amount of tax-free income you are left with is divided by 10 and added to the letter which fits your circumstances.

For example, the tax code 117L means:

You are entitled to the basic Personal Allowance

£1,170 must be taken away from your total taxable income and you pay tax on what's left

The tax code spreads your tax-free amount equally over the year so that you get about the same take-home pay or pension each week or month.

How the 'K code' works

If your deductions (untaxed income on which tax is still due) are more than your allowances you'll be given a K code, to ensure you pay tax on the excess. Whereas with other tax codes the number indicates the amount of income you can have tax-free, the number in a K code multiplied by ten broadly indicates how much must be added to your taxable income to take account of the excess untaxed income you received.

K code example

K497 means:

Your untaxed income was approximately £4,970 greater than your taxable income

As a result, approximately £4,970 must be added to your total taxable income to ensure the right amount of tax is collected

(The actual calculation is more complex and of course precise - and ensures that the exactly right amount is added to your taxable income.)

If your tax code has ‘W1’ or ‘M1’ at the end

W1 (week 1) and M1 (month 1) means your tax is based only on what you are paid in the current pay period, and not the whole year. These codes are sometimes known as ‘non-cumulative’ and are mainly used as emergency tax codes.

Where to find your tax code

A tax code can be found on:

- Payslips from your employer or pension provider

- Your personal tax account

- P45 from an employer if you leave a job

- P60 from your employer at the end of each tax year

- A PAYE Coding Notice - you may get one by post or you can check using HMRC’s Self Assessment online service if you’re registered

If you get income from more than one employer or pension provider, each will usually use a different tax code.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.