Entering your Duties Start Date in BrightPay

Your duties start date is the date your automatic enrolment duties come into effect for you.

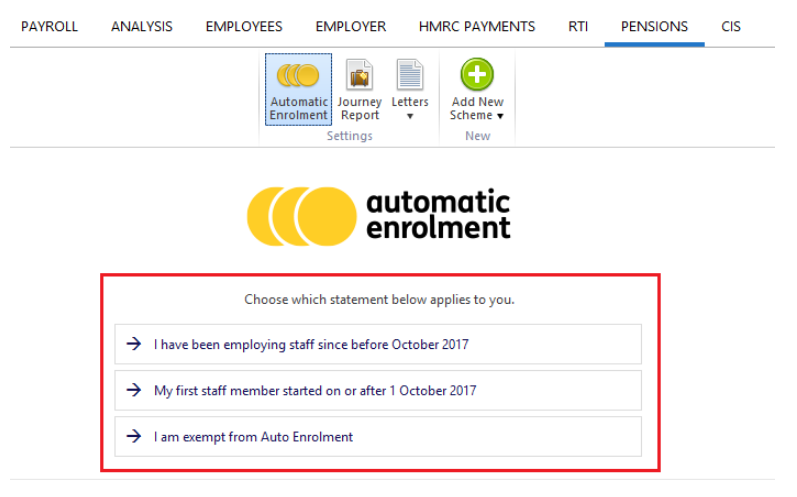

To determine/enter your duties start date in BrightPay, click Pensions > Automatic Enrolment

- Choose the statement that applies to you and complete accordingly:

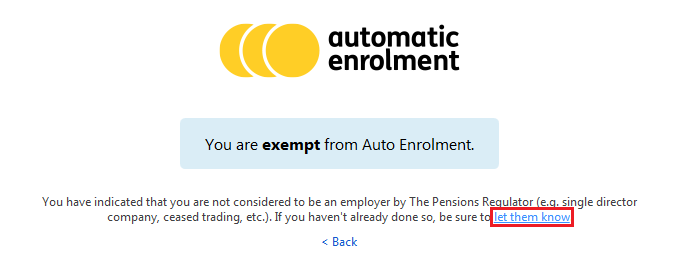

- If you are exempt from automatic enrolment (e.g. you are a single director company, you have ceased trading, etc.), select the option 'I am exempt from Auto Enrolment'. This will prevent any automatic enrolment alerts appearing in the software going forward.

If you have not yet informed The Pensions Regulator of your exemption, a link is provided to let them know:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.