Printing a P45

Since 6th April 2013 and in line with the introduction of RTI, employers are no longer required to submit a P45 to HMRC when an employee leaves their employment. Instead, HMRC will be notified of an employee leaving in the last Full Payment Submission you send for that employee.

However as soon as an employee leaves your employment and their leave date has been processed through BrightPay (for assistance with this click here), a P45 should still be printed and given to them for their own records.

Printing The Employee's P45

1) Within Employees, select the employee from the listing.

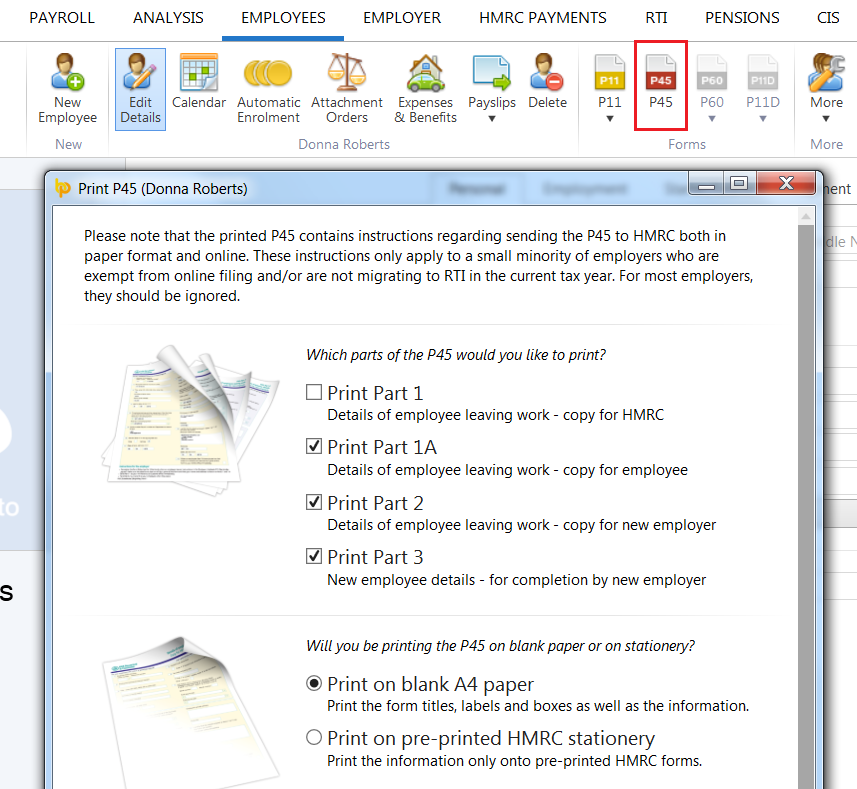

2) Select P45 on their menu toolbar.

3) Select which parts of the P45 you wish to print and click Print Preview, followed by Print. Parts 1A, 2 and 3 can be printed for the employee as well as a copy of Part 1 for the employer to keep on file.

P45 option greyed out?

If the P45 option is greyed out in the employee record after entering the employee's leave date, this usually means that the pay period in which the leave date is falling is still 'open' and has yet to be finalised within the Payroll utility.

Simply check the leave date, and then within the Payroll utility, establish the pay period in which this leave date falls.

Is the payslip in which the leave date falls still open for the employee? If so, simply finalise this payslip accordingly and the P45 button should then be visible for you within the employee's record.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.