Re-opening Payslips

This utility allows you to re-open the last pay period finalised or re-open previously updated pay periods in order to amend pay details for one or more employees. On re-opening a pay period, original pay details for each employee will be retained by the software allowing the user to amend accordingly.

To Re-open The Last Pay Period Finalised

To access this utility, click Payroll:

1) On the payment schedule bar, select the pay period you wish to re-open.

2) Click Re-Open Payslips on the menu toolbar.

3) Select the employee(s) you wish to re-open payslips for.

4) Click Ok.

The selected employee(s) payslips will now be available for editing and finalising again.

To Re-open More Than One Pay Period

To access this utility, click Payroll:

1) On the payment schedule bar, select the pay period from where you wish to re-open payslips. Pay periods falling after the pay period selected will subsequently be re-opened.

2) Click Re-Open Payslips on the menu toolbar.

3) Select the employee(s) you wish to re-open payslips for.

4) Click Ok.

The selected employee(s) payslips will now be re-opened from the pay period selected and will be available for editing and finalising again.

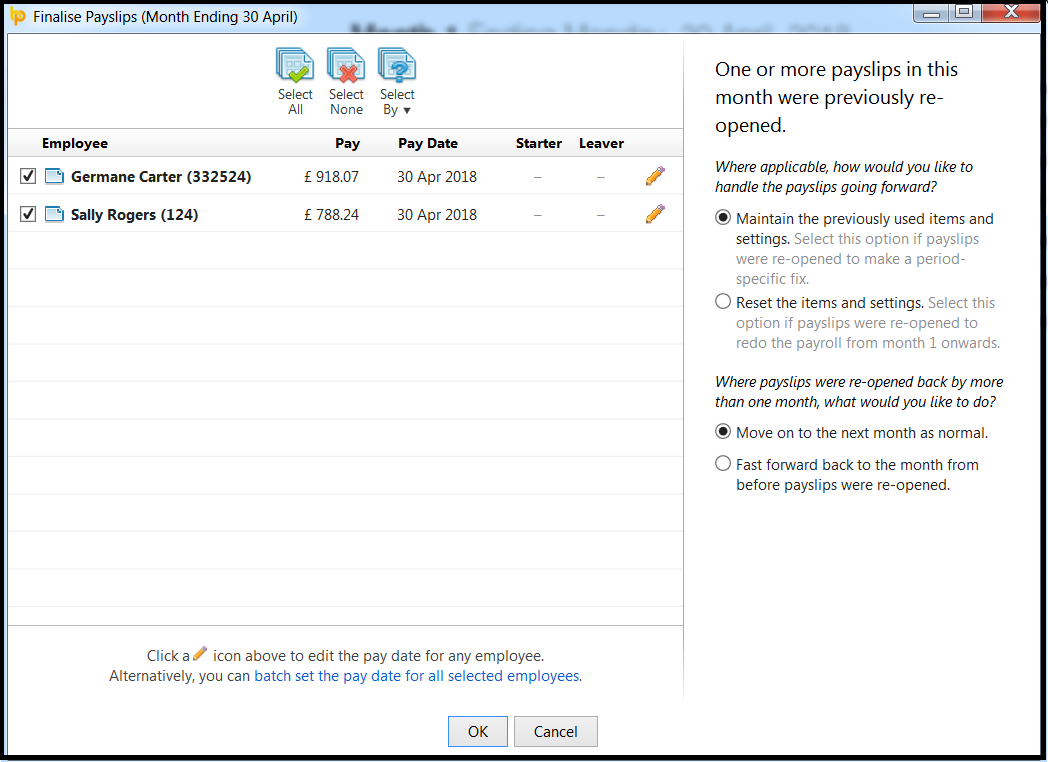

For payslips going forward, you will have the following options:

- Maintain the previously used items and settings (e.g. if payslips were re-opened to make a period-specific fix)

- Reset the items and settings (e.g. if payslips were re-opened to completely redo the payroll from that period onwards)

If more than one period back was re-opened, BrightPay displays additional options to:

- Move on to the next period as normal

- Fast forward back to the period from before payslips were re-opened.

Please note: if “Reset the items and settings” is selected for the first choice above, then the second choice is hidden (there can be no fast-forward if everything is reset)

Re-opening Payslips And Impact On Your RTI Full Payment Submissions

If you have already submitted one or more Full Payment Submissions (FPS) to HMRC for the payslips you have re-opened, the following should be noted:

- After re-finalising the payslips, if the employee's pay date matches the pay date that was included in the original FPS, an amended FPS will not be created. Instead, the amendments made to the employee's payslip will be included in the next FPS created when the payroll is next updated, where the employee's year to date figures will be reconciled.

- Alternatively, an Additional FPS can be submitted to HMRC to inform them of the updated year to date figures for the employee. An Additional FPS can be prepared and submitted to HMRC within the RTI menu.

-

If a different pay date is used on the employee's payslip, a new FPS will be created - please note submitting a new FPS using a different pay date may cause reconciliation issues with HMRC.

- If, however, an FPS has been created but not yet submitted to HMRC, any amendments made to an employee's payslip will be automatically updated within the unsent FPS when the payslip is finalised again. If all employees' payslips are re-opened, the unsent FPS will be deleted altogether.

Making Corrections after the end of the Tax Year

If an error is discovered in any FPS for 2018/19 after your final submission has been made, then an Additional Full Payment Submission (FPS) can be submitted to HMRC.

An Additional FPS can now be submitted at any time during or after the tax year.

Discontinuation of the Earlier Year Update (EYU):

In prior tax years, where amendments to payroll data have been identified after the 19th April following the end of the tax year, HMRC have required an Earlier Year Update to be submitted to them to correct an employer’s account.

HMRC have now simplified this process and, from 20th April 2019, will instead accept an Additional Full Payment Submission in place of an Earlier Year Update where payroll amendments for tax year ending 5th April 2019 are needed.

In line with HMRC’s simplified process, the option to create and submit an Earlier Year Update has thus been discontinued in 2018-19 BrightPay and going forward.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.