Moving to BrightPay mid-year - Employment Allowance

If you are migrating to BrightPay mid tax year, and still have some Employment Allowance left to claim, BrightPay must be instructed of this and also of the amount you still have left to claim. This will ensure that BrightPay doesn't allocate the full annual limit again to you going forward.

- Select HMRC Payments on the menu bar

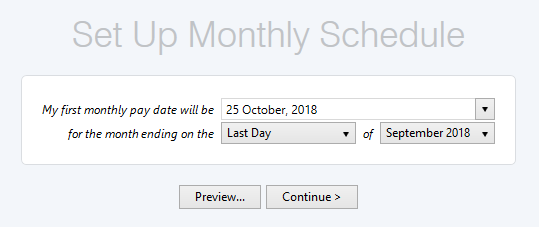

- When the 'HMRC Payments' tab is selected for the very first time, you will be asked to set your HMRC Payment Schedule. Choose Monthly or Quarterly, as per your requirements.

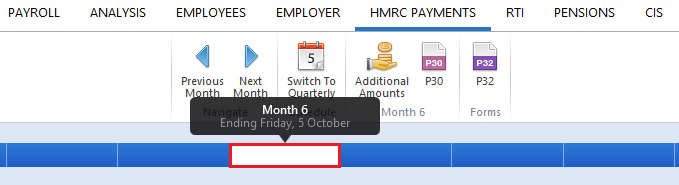

- Select the Tax Month/Quarter in which you will first be processing payroll in BrightPay

e.g. if your first pay period in BrightPay will be September, to be paid 25th September:

select Tax Month 6 on your blue schedule bar:

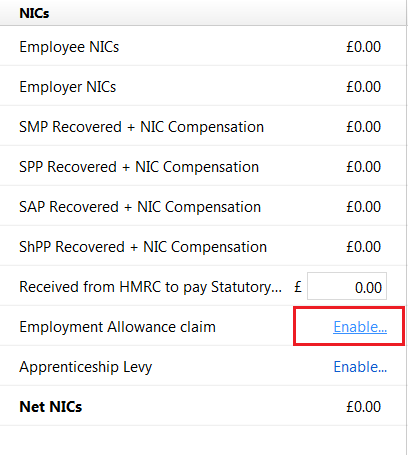

- Under 'NICs' you will see the option for Employment Allowance Claim - click Enable

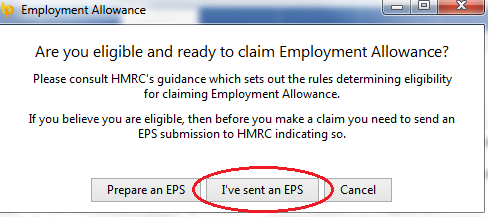

- At the prompt, instruct BrightPay that 'I've sent an EPS' (if you have already claimed some Employment Allowance in this tax year, this EPS will have been done in your previous software) :

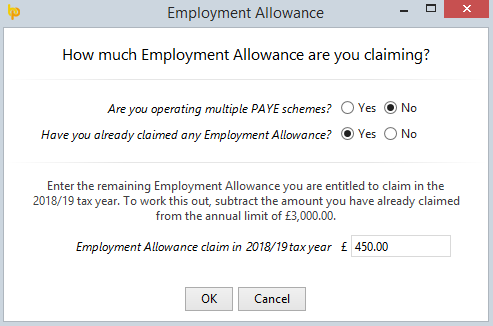

- Select whether you are operating multiple PAYE Schemes

- Select 'Yes' to the question 'Have you already claimed any Employment Allowance?'

- Enter the remaining Employment Allowance you are entitled to claim in the tax year. To determine this amount, subtract the amount you have already claimed from the annual limit of £3,000

Please note: if you have already claimed your full annual limit for the tax year in your previous software, no action is required in BrightPay. It is thus important not to enable the employment allowance in BrightPay, to ensure that you are not given the full annual limit again.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.