Net to Gross Payments

To perform a Net to Gross calculation within the payroll, simply select 'Payroll' on the menu bar and select the relevant employee’s name from the listing.

1) Within the employee's 'Pay' section, click the 'Edit' button next to the employee's periodical pay.

2) Click Net to Gross...

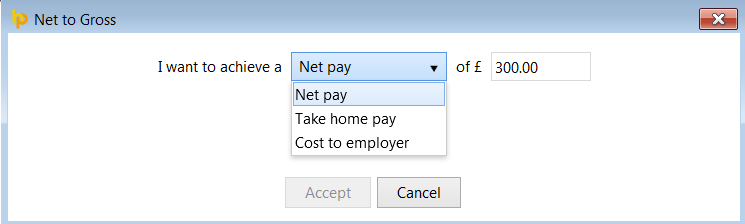

3) Enter the desired Net Pay/Take Home Pay/Cost to Employer amount, as required.

4) Click Calculate.

5) Click 'Accept' to accept the gross amount.

Please note: any entries within 'Statutory Payments' and 'Additions/ Deductions' are taken into account for the basis of the calculation.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.