Recovering Statutory Payments

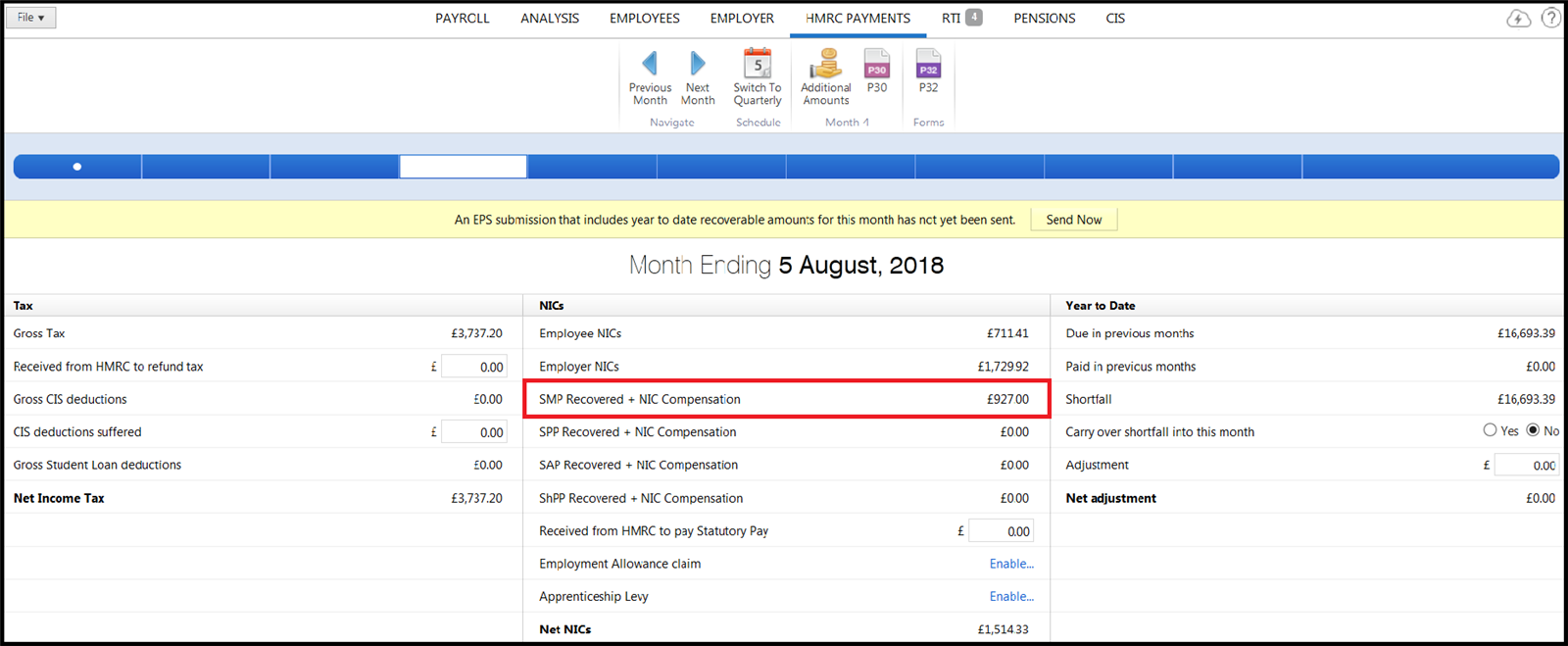

If you wish to claim recoverable amounts for statutory payments made to employees, these can first be viewed within your HMRC Payments utility.

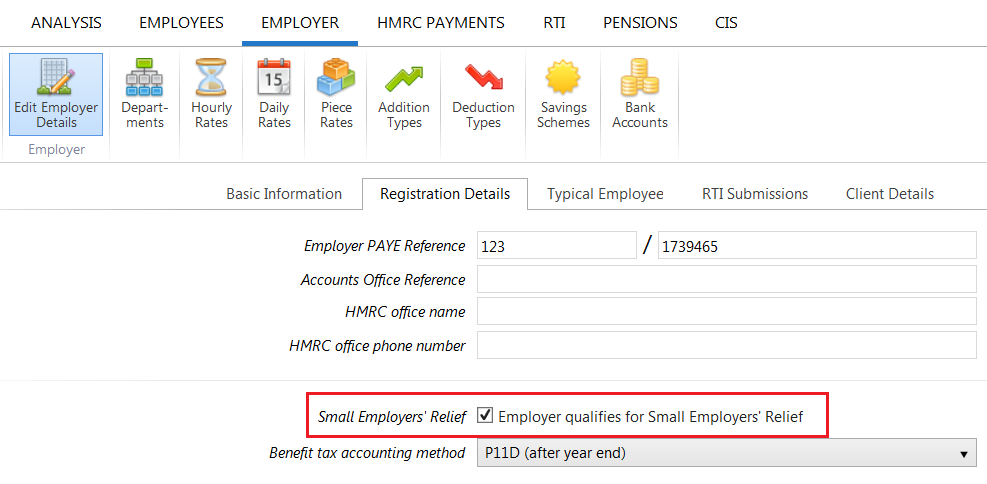

Please note: if you qualify for Small Employers' Relief, please ensure that this is enabled within Employer > Registration Details before submitting your EPS:

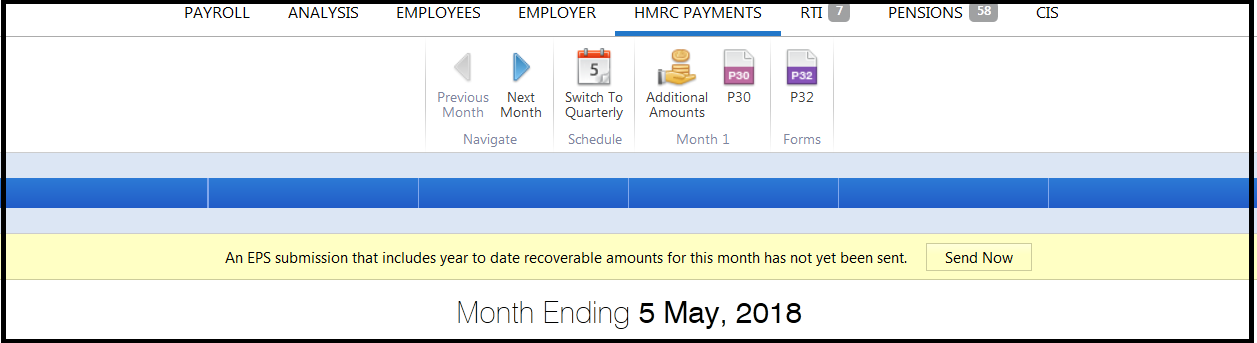

While in HMRC Payments, if recoverable amounts are detected in a tax period, BrightPay will prompt you that an EPS is due:

If you have no further items you wish to report via the EPS, simply click 'Send Now' and submit your EPS to HMRC.

Creating an EPS within the RTI utility

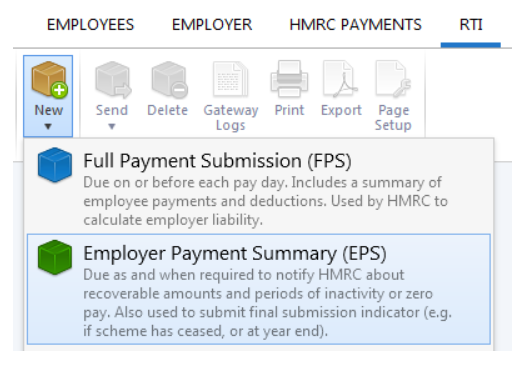

Alternatively, an EPS can be created and submitted to HMRC via the RTI utility. This process will facilitate reporting more than one item on the same EPS, if required e.g including bank details, final submission indicator for the tax year etc.

1) Simply select 'RTI' on the menu bar

2) Click 'New' on the menu toolbar and select 'Employer Payment Summary (EPS)'

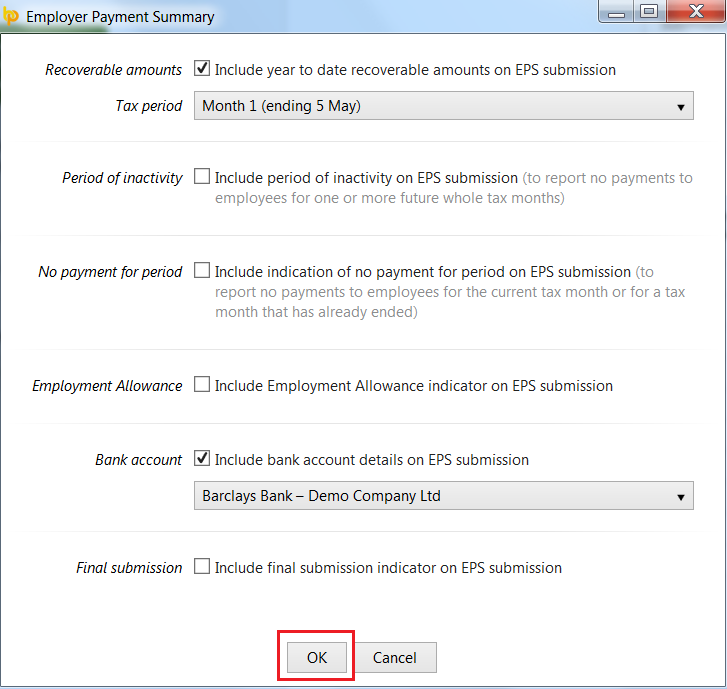

3) Complete the EPS accordingly and click 'OK' to save

4) Submit to HMRC when ready

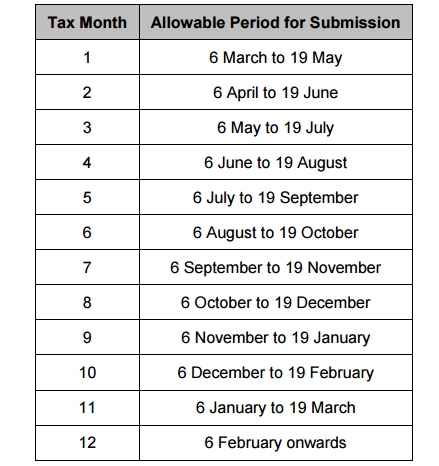

Allowable Period for Submission of an EPS with an Entry in Tax Month:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.