Full Payment Submission (FPS)

Each time you pay your employees, you will submit a Full Payment Submission (FPS) to HMRC. An FPS is to be sent on or before each payday, and informs HMRC about the payments and deductions for each employee. BrightPay will automatically create an FPS each time you finalise one or more payslips.

An FPS contains:

- employer registration details (PAYE Reference, Accounts Office Reference, etc.)

- personal identifiable details for each employee (name, address, NINO, date of birth, gender, etc.)

- employment details for each employee (directorship, starter information, leaver information, etc.)

- year to date figures for each employee (tax, NICs, etc.)

- figures for the relevant period for each employee (payment date, gross pay, deductions, etc.)

Submitting an FPS to HMRC

To submit an FPS to HMRC, first finalise your payslips within ‘Payroll’ for the pay period in question. An FPS will be automatically created within the RTI utility, ready for submission to HMRC.

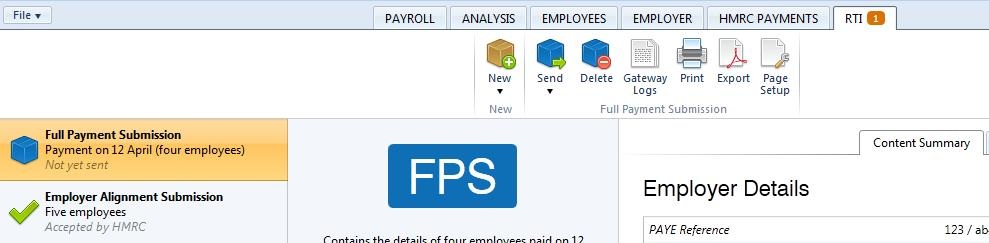

1) Click the RTI tab heading and select the FPS from the listing:

2) The contents of the FPS will be displayed on screen. The FPS can be printed or exported at any time before or after its submission to HMRC by clicking 'Print' or 'Export'.

3) When ready to submit the FPS to HMRC, click Send Now.

4) Confirmation details will subsequently appear on screen to indicate that your submission has been accepted by HMRC.

5) Should your submission fail, simply click on 'Details' for more information on why your submission has been rejected by HMRC and amend your payroll where required.

What If The Information You Send In An FPS Is Incorrect?

Having submitted an FPS, should you subsequently need to amend pay details etc. for one or more employees, simply 'Re-open Payslips' within 'Payroll' for the employee(s) in question and amend their payslip(s) as required. Finalise your payslips again.

Points to note:

-

After re-finalising the payslips, if the employee's pay date matches the pay date that was included in the original FPS, an amended FPS will not be created. Instead, the amendments made to the employee's payslip will be included in the next FPS created when the payroll is next updated, where the employee's year to date figures will be reconciled.

-

Alternatively, an Additional FPS can be submitted to HMRC to inform them of the updated year to date figures for the employee. An Additional FPS can be prepared and submitted to HMRC within the RTI menu.

-

If a different pay date is used on the employee's payslip, a new FPS will be created - please note submitting a new FPS using a different pay date may cause reconciliation issues with HMRC.

Zero Pay Periods

If no employees are paid in a particular pay period, a nil FPS will be created when the zero payslips are finalised. The nil FPS can then be submitted to HMRC in the normal manner.

Where salaries are taken sporadically, for example a one-person company with a sole director, a number of nil Full Payment Submissions may arise. For example, a director receives a salary in April and is only paid again in September. This will result in four nil Full Payment Submissions being created when the payroll is finalised for May, June, July & August. If these payroll periods are only finalised in September when the next salary payment is made, these can simply be marked as 'sent' in BrightPay, thus avoiding a late submission trigger.

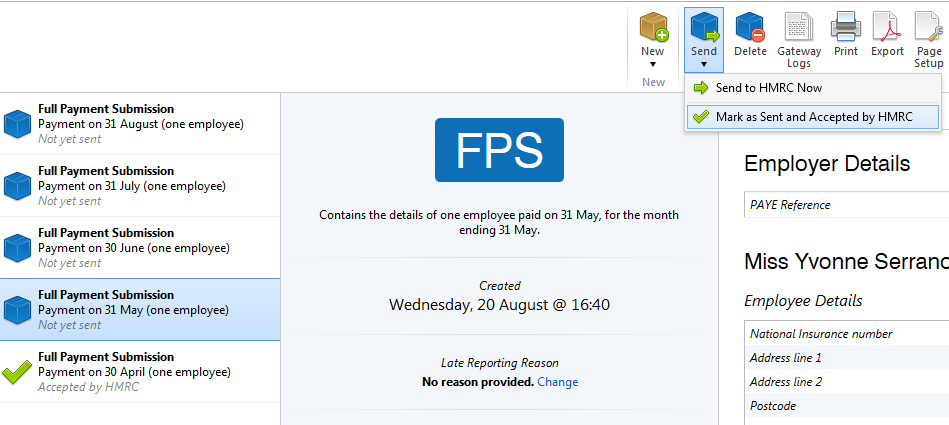

To mark an FPS as sent in BrightPay:

1) Click the RTI tab heading and select the FPS from the listing.

2) Click the 'Send' button on the menu toolbar and select 'Mark as Sent and Accepted by HMRC'.

This will flag the FPS as sent on BrightPay but the FPS file will not be submitted to HMRC.

IMPORTANT: If there are no payments in the current or earlier/historical tax periods for which there will be no FPS(s) submitted, then this must be communicated to HMRC via the Employer Payment Summary (EPS). This is indicated using the 'No Payment For Period' indicator on the EPS.

Alternatively, zero pay tax periods can be communicated in advance to HMRC by using the 'Period of Inactivity' indicator on the Employer Payment Summary (EPS).

For assistance with preparing and submitting an EPS, please see here

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.