Saved Reports

To access the Reporting function, click 'Analysis'.

A number of pre-set reports have already been set up for your use and can be found within the Saved Reports section in the menu toolbar.

Some of the saved reports display in the toolbar while others can be found by selecting "More".

These saved reports represent the most common payroll reports generally used. The default reports that appear in the toolbar consist of:

- Daily Pay

- Employee Details

- Hourly Pay

- Payroll Summary

- Pensions

- Statutory Pay

- Year to Date

The saved reports available under "More" consist of:

- Additions

- CIS Summary

- CIS Summary (Year to Date)

- Deductions

- Employee Contact Details

- Employee Payment Details

- National Insurance

- Notes

- P32

- Pensions (Year to Date)

- Statutory Pay (Year to Date)

Manage Reports

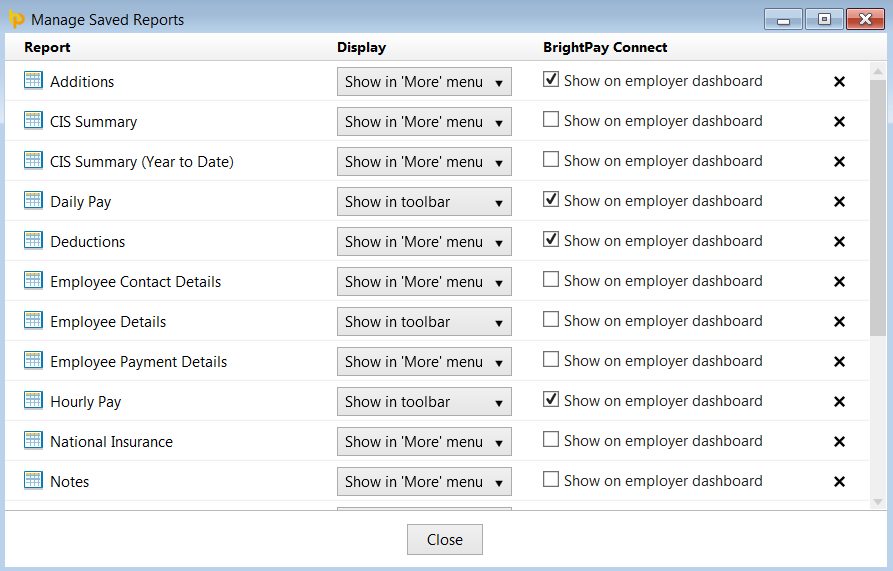

This utility allows you to manage saved reports. Here you can indicate whether a report is to show in the menu toolbar or within the 'More' menu, and you can also delete reports.

Also, if using BrightPay Connect, this screen allows you to indicate which reports you wish to show on your BrightPay Connect employer dashboard.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.