Backing Up/Restoring Your Payroll

In order to protect your payroll data, it is always recommended to take a backup of your payroll to a safe location, for example to an external device, server or cloud environment. This ensures that your payroll data is saved elsewhere and can be re-instated in the event that you suffer a PC breakdown or crash.

Backing Up Your Payroll Data

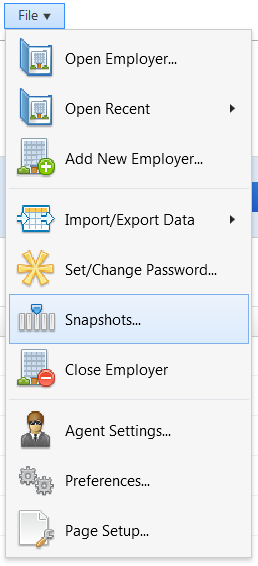

To back up your employer data file, simply click on ‘File', followed by 'Snapshots’.

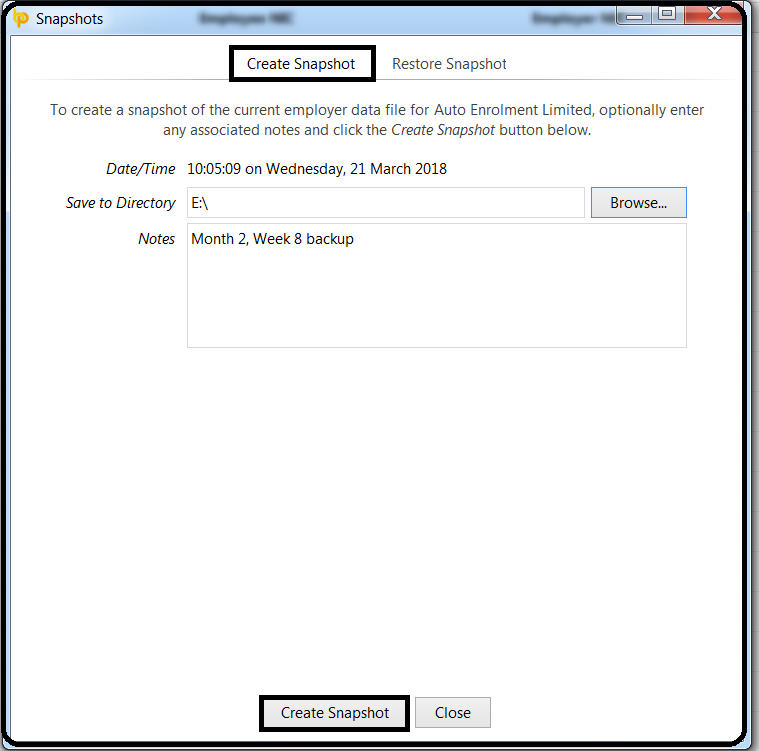

1) Within Create Snapshot, browse to the location where you would like the backup file to be saved.

2) If you would like to enter an associated note that could later assist in identifying a particular backup file, simply type your note in the 'Notes' section

3) Click ‘Create Snapshot’ to complete the backup process.

Please note that a backup can be performed at any time, for example after updating a payroll period or just before exiting the payroll.

Restoring Your Payroll Data

Should you need to restore your payroll data at any time from a backup that has previously been taken, simply click on ‘File’, followed by 'Snapshots'.

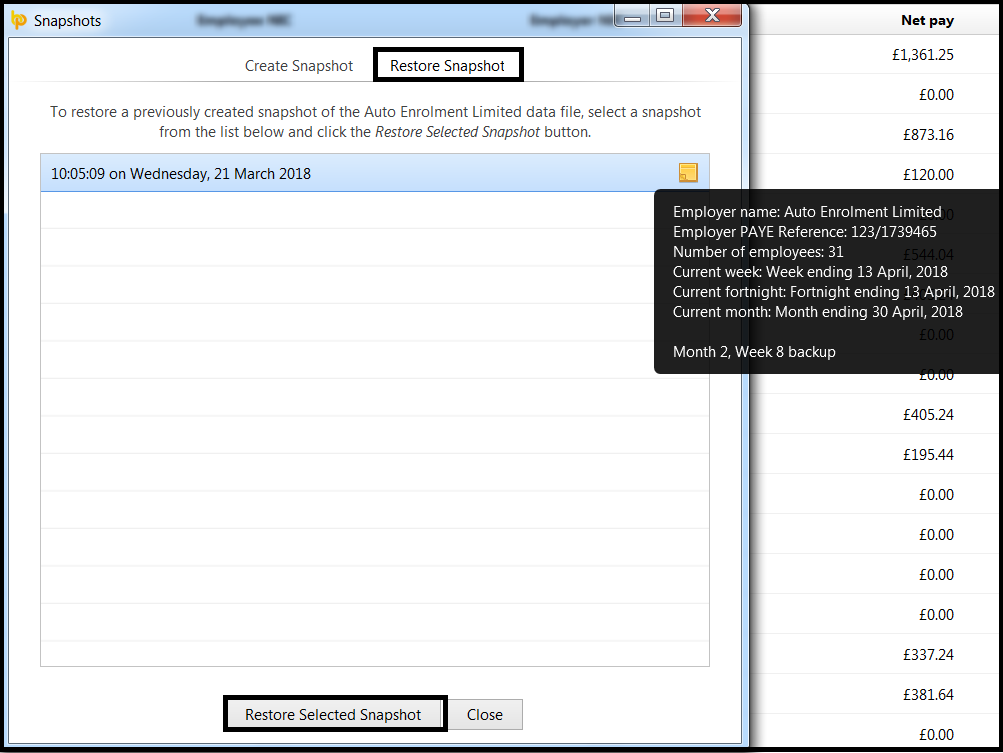

1) Click Restore Snapshot

2) A list of available backups that the software has detected and the date and time these were taken will be displayed on screen. To the right of each backup you will also find additional information regarding the backup, including any notes that were entered at the time of backing up the payroll data.

3) To restore a backup, select the appropriate dataset from the list and click ‘Restore Selected Snapshot’.

4) Click ‘Yes’ to restore the backup.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.