Employee Portal - Dashboard

The Employee dashboard gives an employee access to information and resources applicable to their employment.

Here an employee can view recent notifications, browse their payslips and other payroll related documents and view their employment calendar. In addition, if the functionality has been activated by the employer, also make a request for leave , and view or update personal details.

Accessing Your Documents

1) Click 'Browse All Documents' to access all documents that have been uploaded to BrightPay Connect for you. Alternatively, click 'Documents' on the top menu bar.

Documents which can be accessed here include:

- your payslips

- your P60s (if applicable)

- your P45 (if applicable)

- your P11D (if applicable)

2) If data from a previous tax year has been uploaded to BrightPay Connect by your employer, simply choose whether you wish to view 'Most Recent' or documents from a previous tax year at the top right of the screen.

3) Select the document you wish to view. This will now be previewed on screen.

4) Click the 'download' button at the top right to save the document to PDF.

Updating Your Personal Details*

*Please note: this particular functionality must be activated by the employer to be available to the employee

1) Should you wish to update your personal details, within 'Employee Details', simply click 'Update my details'. Alternatively, click 'My Details' on the top menu bar.

This page shows the personal details that your employer currently holds for you, and allows you to request any updates.

2) To add or change details, click the 'Change' button next to each applicable field and enter or update the details as required. Click 'Submit Request', when completed.

Your employer will receive a notification with the details of your request for approval.

Please note: Some important details that your employer must report to HMRC such as date of birth, National Insurance number (NINO) and tax code cannot be changed here. For security, sensitive details (e.g. payment bank account information) are not displayed here either. Please contact your employer directly if any of these details needs to be updated.

Your Calendar

The current month will be displayed on your dashboard, showing any leave that you have taken/due to take during this month.

1) To access your full calendar, click 'Full Calendar'. Alternatively, click 'Calendar' on the top menu bar.

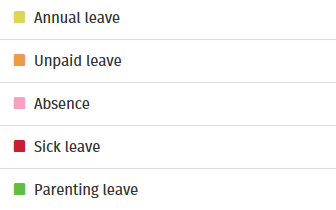

This will provide an overview of the your calendar events as follows:

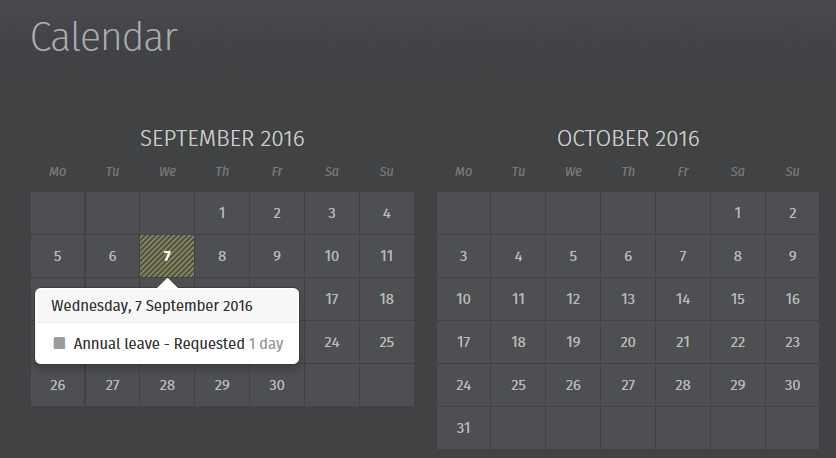

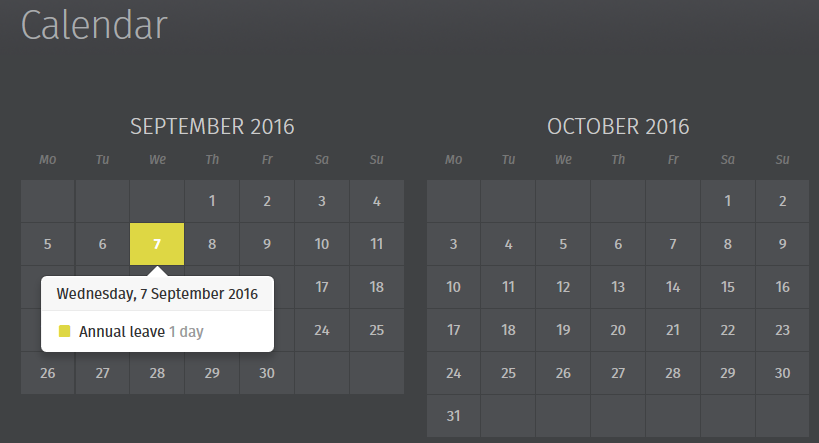

2) Use the 'previous' and 'next' navigation buttons at the top right of the calendar to move forwards and backwards in the year. Hover your mouse over a day on the calendar to see details.

3) If your employer has enabled functionality allowing you to request leave through your self service portal, select 'Request Leave', either on your dashboard or when accessing the full calendar.

4) Select the Date, Type of Leave, and whether the leave is for a full day or half day. Enter any additional information regarding the leave, if required.

5) Click 'Submit Request' or click 'Add Day' to add further leave days.

Your requested days will now be marked on your calendar, and your employer will receive a notification with the details of your request for approval.

If your leave request is approved by your employer, you will receive email notification confirming this. Your calendar will be updated accordingly to show the approval.

Should your leave be rejected, you will receive email notification confirming this. You should contact your employer directly if you need further details.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.