Employer Portal - Employees

The Employee page displays the employees that are within your BrightPay employer file that you have linked to BrightPay Connect. Employees you add, update, or remove in BrightPay on your computer will be reflected here after your data synchronises to BrightPay Connect.

- Click on an employee to navigate to their employee dashboard.

Your view of an employee's dashboard largely mimics what that employee will see if they are using Employee Self Service. As an employer-level user, however, you have access to additional features as well as the ability to directly set annual leave or update employee details.

Please note: the 'Last Active' date that is shown for each employee indicates the most recent time he/she logged in to Self Service, if applicable.

Accessing an Employee's Documents

1) Click 'Browse All Documents' to access all documents that have been uploaded to BrightPay Connect for the employee you have selected. Alternatively, click 'Documents' on the top menu bar.

Documents which can be accessed here are:

- the employee's payslips

- the employee's P60s (if applicable)

- P45 (if applicable)

- P11D (if applicable)

2) If data from a previous tax year has been uploaded to BrightPay Connect, simply choose whether you wish to view 'Most Recent' or a previous tax year at the top right of the screen.

3) Select the document you wish to view. This will now be previewed on screen.

4) Click the 'download' button at the top right to save the document to PDF.

Updating Employee Details

1) Should you wish to view or update an employee's details, within 'Employee Details', simply click 'Update Details'. Alternatively, click 'Employee Details' on the top menu bar.

This page shows the personal details that are currently held for the employee in question.

2) To add or change details, click the 'Change' button next to each applicable field and enter or update the details as required. Click 'Save Changes', when completed.

Any changes made here will subsequently be synchronised back into the BrightPay employer file itself.

Please note: Some important details that must be reported to HMRC such as date of birth, National Insurance number (NINO) and tax code cannot be changed here. For security, sensitive details (e.g. payment bank account information) are not displayed here either. The payroll administrator should be contacted directly if any of these details needs to be updated.

Employee Calendar

The current month will be displayed on the employee's dashboard, showing any leave that the employee has taken/due to take.

1) To access the employee's full calendar, click 'Full Calendar'. Alternatively, click 'Calendar' on the top menu bar.

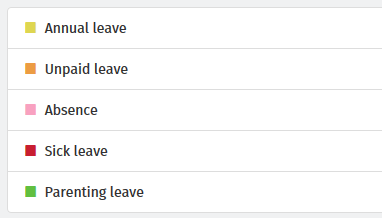

This will provide an overview of the employee's calendar events as follows:

2) Use the 'previous' and 'next' navigation buttons at the top right of the calendar to move forwards and backwards in the year. Hover your mouse over a day on the calendar to see details.

3) To add/cancel leave, select 'Add Leave', either on the employee's dashboard or when accessing the full calendar.

4) Select the Date, Type of Leave, and whether the leave is for a full day or half day. Enter any additional information regarding the leave, if required.

5) Click Submit or click Add Day to add further leave days.

The employee's calendar will be updated accordingly and any leave added will subsequently synchronise back into the BrightPay employer file itself.

Managing an Employee

1) Should you wish to prevent an employee from logging into their self service portal, this can be done via their dashboard by clicking 'Manage' on the menu bar. Simply tick the box 'Prevent this employee from logging into the Employee Portal'.

2) To reset an employee's password, click 'Reset employee password' to send a password reset to the employee. This will block any login attempt using the employee's credentials until the password has been updated.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.