Coronavirus Job Retention Scheme - Claim Report in BrightPay

A Claim Report is available in BrightPay to assist users in ascertaining the amounts needed for input into HMRC's Coronavirus Job Retention Scheme online service.

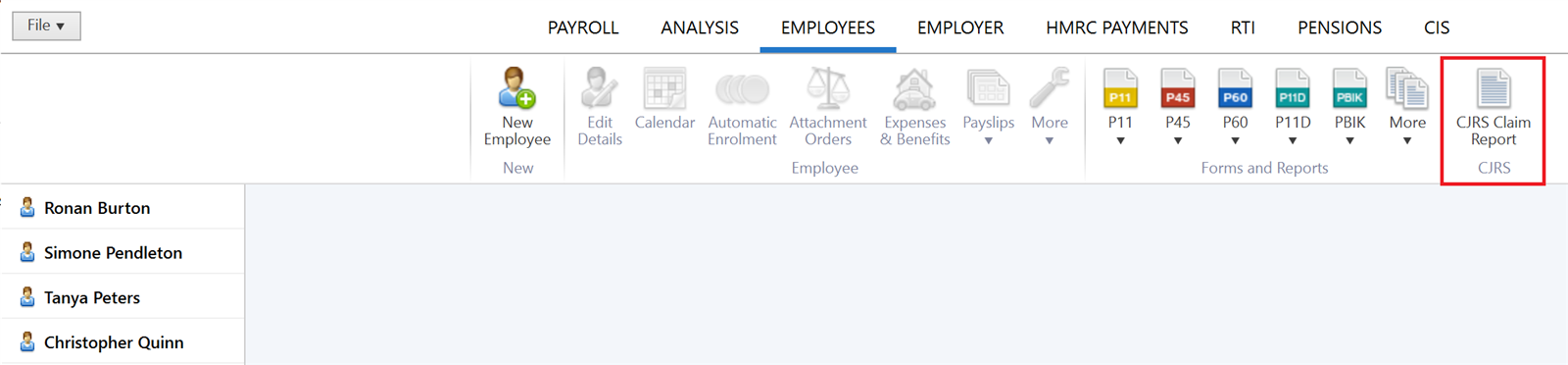

1) To access this report, go to Employees > CJRS Claim Report:

2) Complete the first screen accordingly:

a) enter at least a Company Registration Number, a Self Assessment UTR or Corporation Tax Reference

b) enter the start and end date of the Claim Period you are claiming for

c) enter the amount of your Employment Allowance that you have claimed or expect to claim in this period

d) enter a default furlough start date - should furlough start dates differ for employees you are claiming for, this date can be changed in a later step

e) enter a default furlough end date, if known - this is an optional field and can be left blank if not known.

f) Select a default option for determining the furlough pay for each employee. Should a different method have been used for different employees, this can be changed at a later step

g) Click Continue

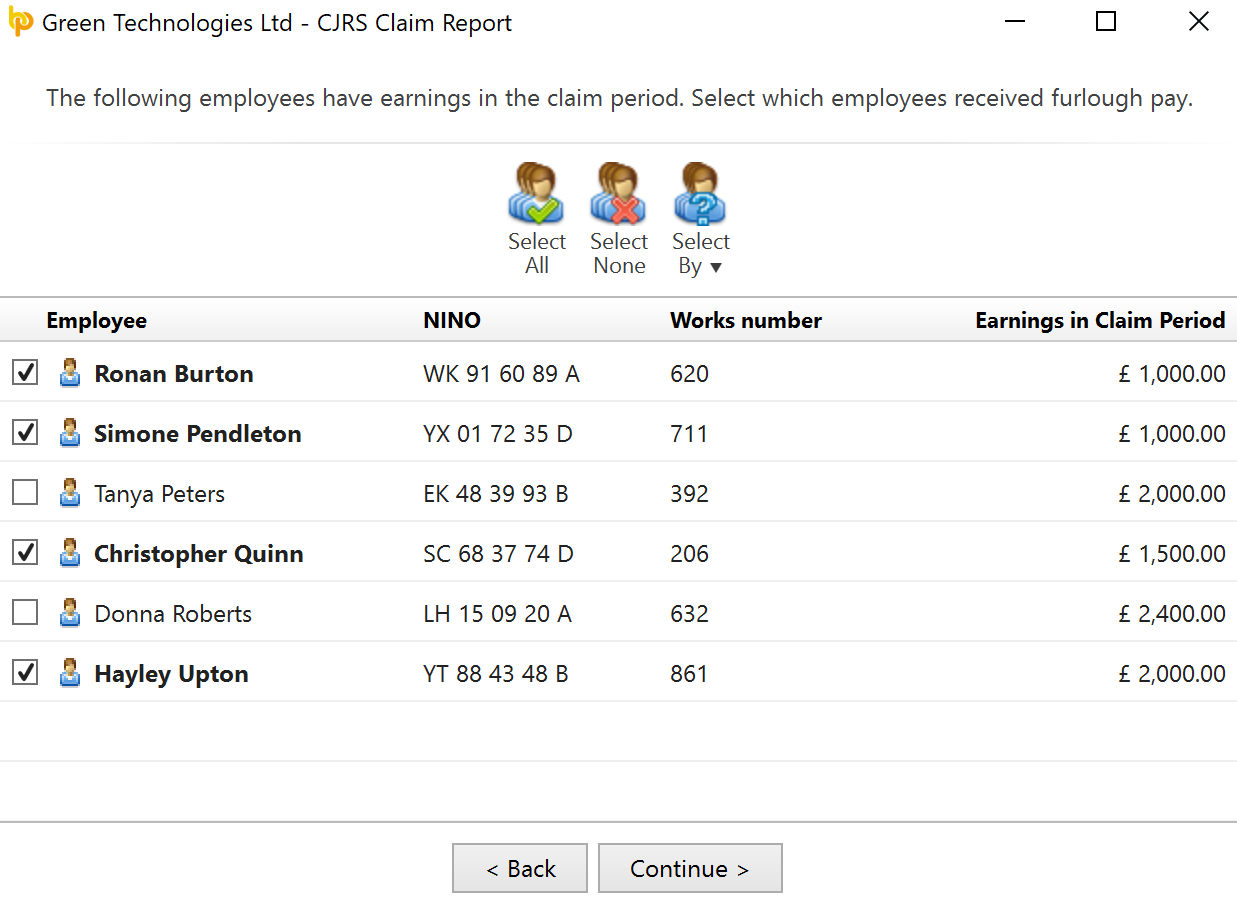

3) On the next screen, select the employees who have received furlough pay and for whom you wish to claim for, followed by Continue:

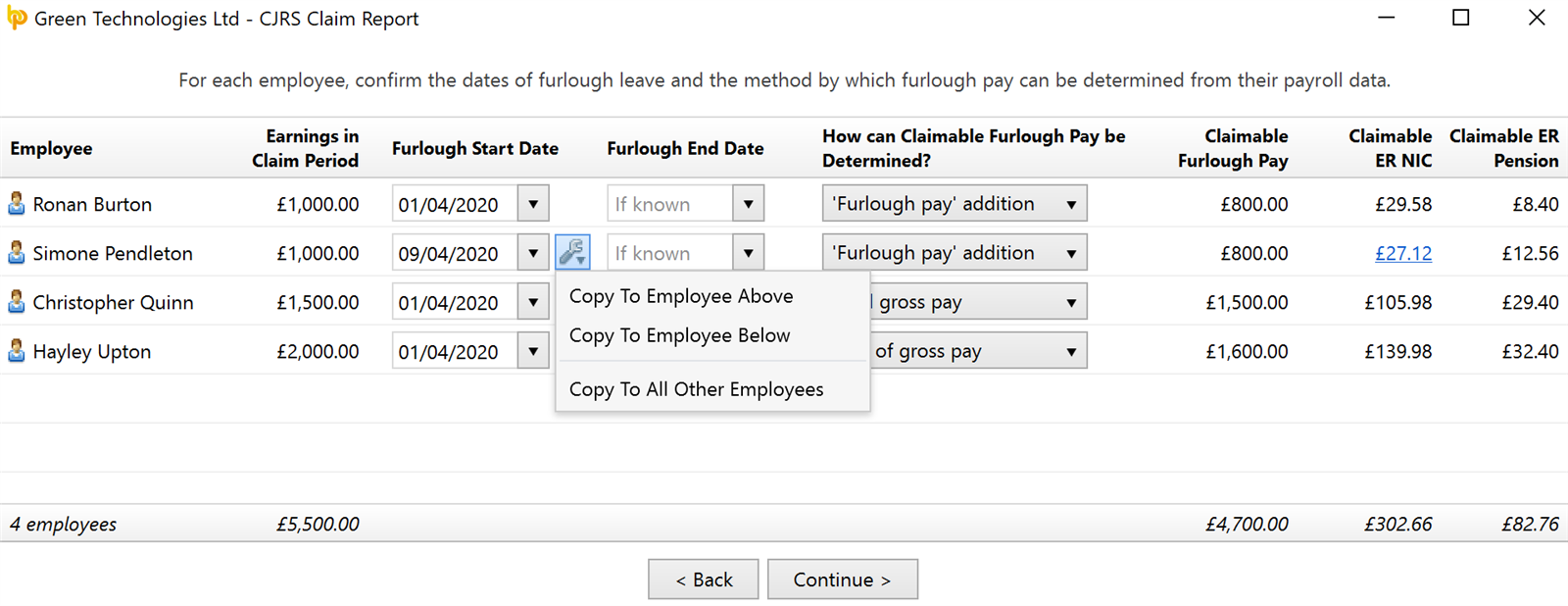

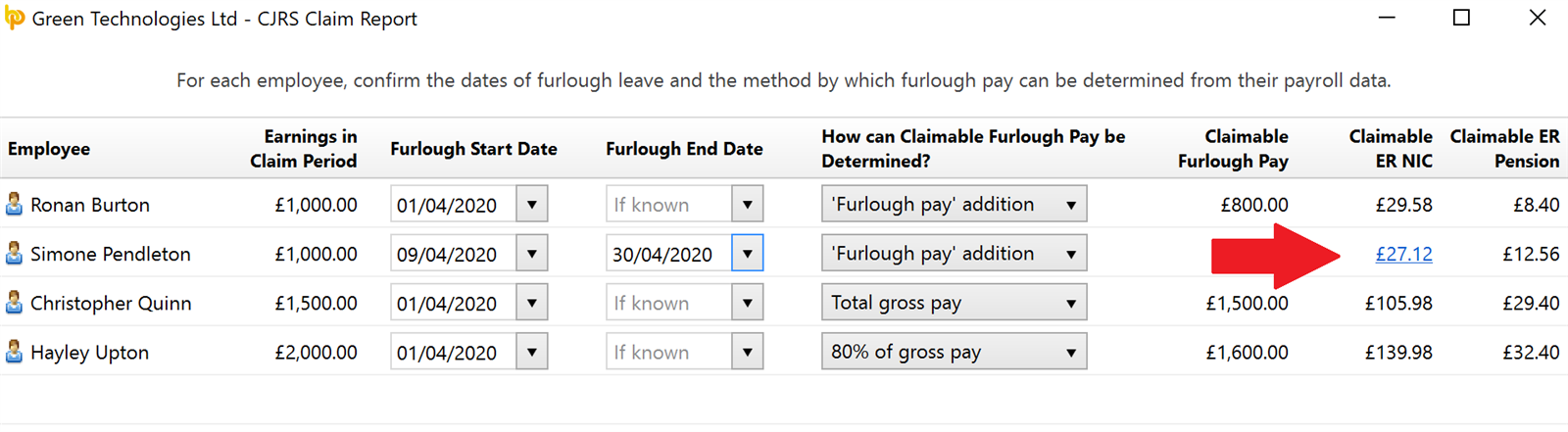

4a) For each employee, now confirm their dates of furlough leave. For any employee for whom the default dates don't apply, amend their dates accordingly using the drop down. Use the Edit button to copy furlough date settings to other employees.

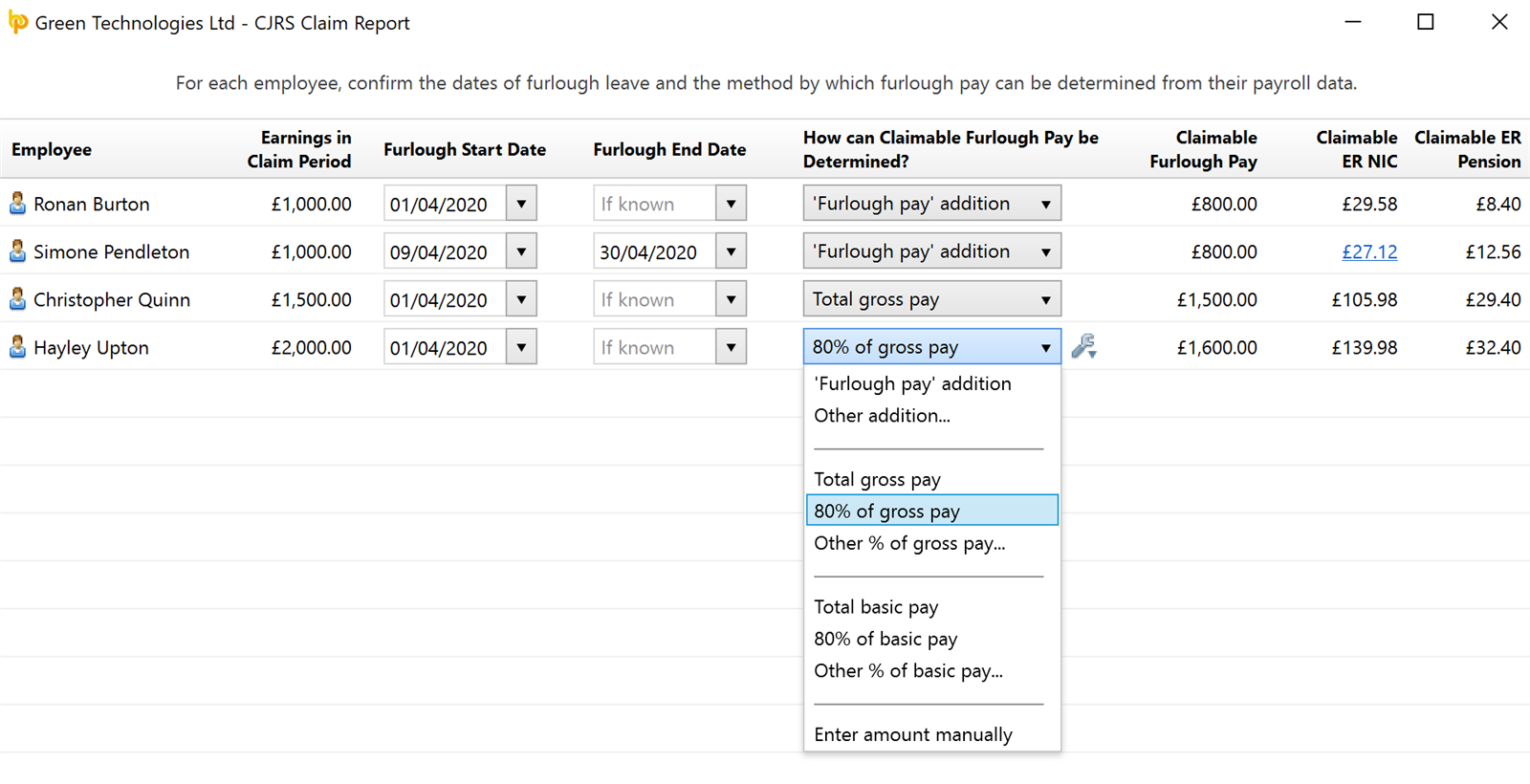

b) For each employee, also confirm the method by which their furlough pay is to be determined. Should the default setting you have chosen in Step 2 not apply to a particular employee, click the drop down menu and choose the applicable method from the listing. Use the Edit button to apply a setting to other employees.

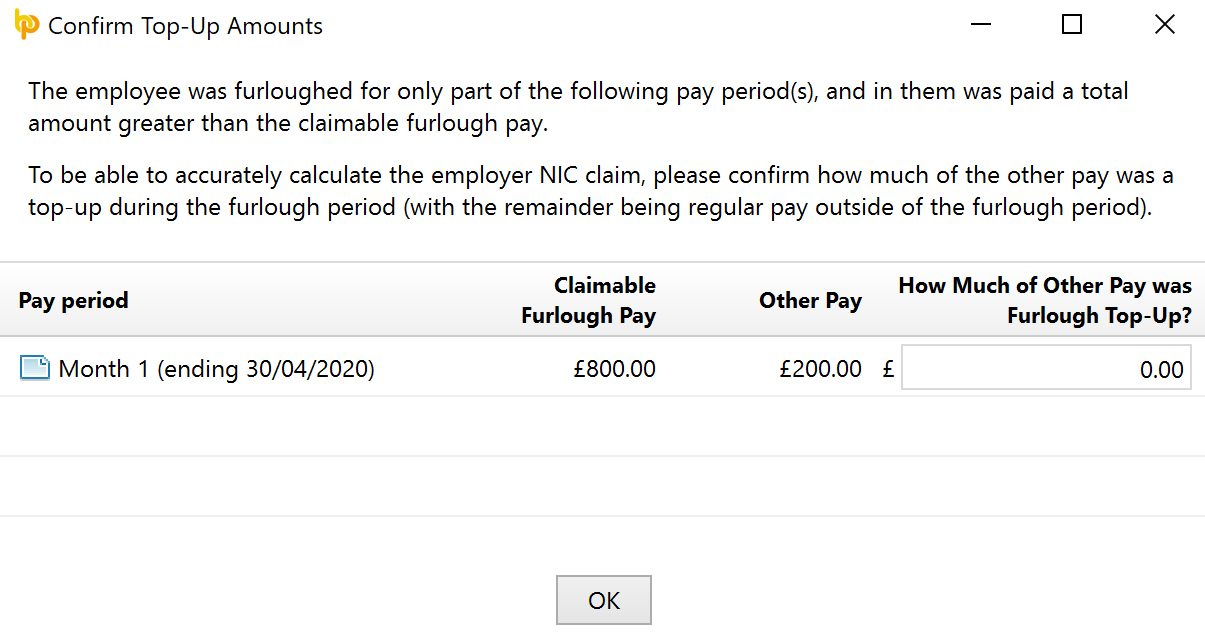

c) Where an employer NIC amount is highlighted in blue, this means that the software needs more information relating to top-up amounts in order to ascertain the correct employer NIC reclaimable.

- Click on the highlighted amount and read the information carefully.

- Confirm the amount of any top-up in the field provided and click OK

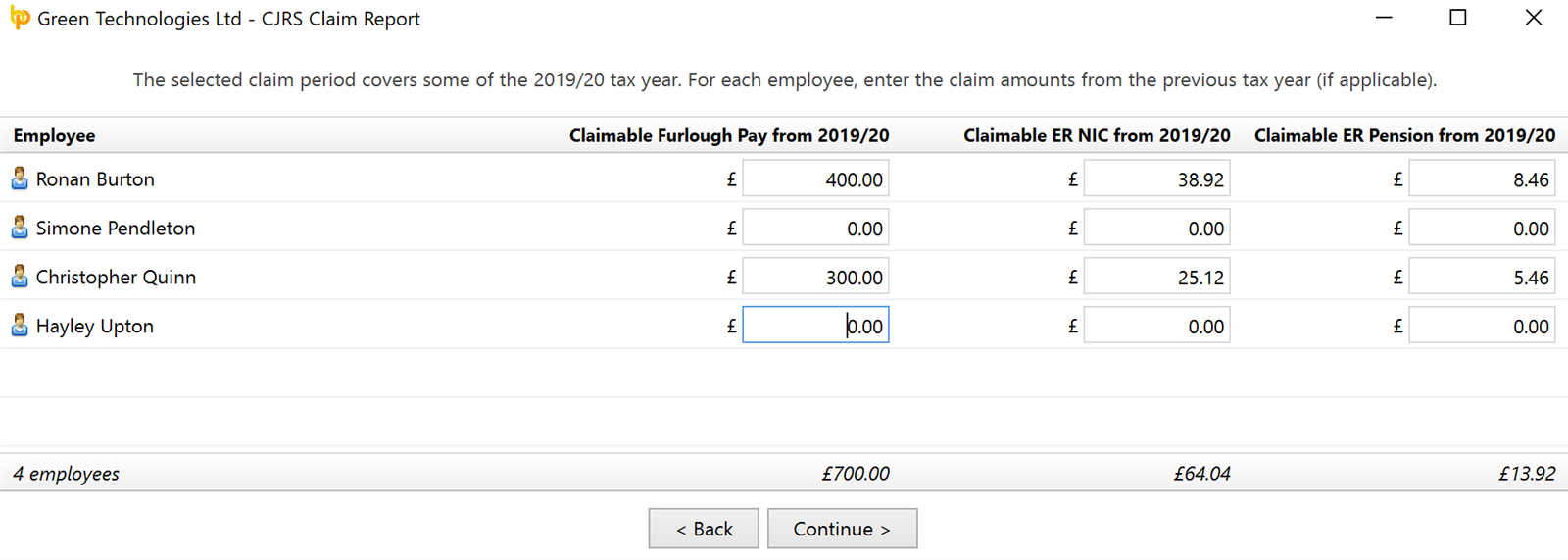

5) If your chosen claim period covers some of the 19-20 tax year and you wish to claim amounts for the previous tax year, you will be prompted to enter these amounts manually on the next screen:

- Click Continue

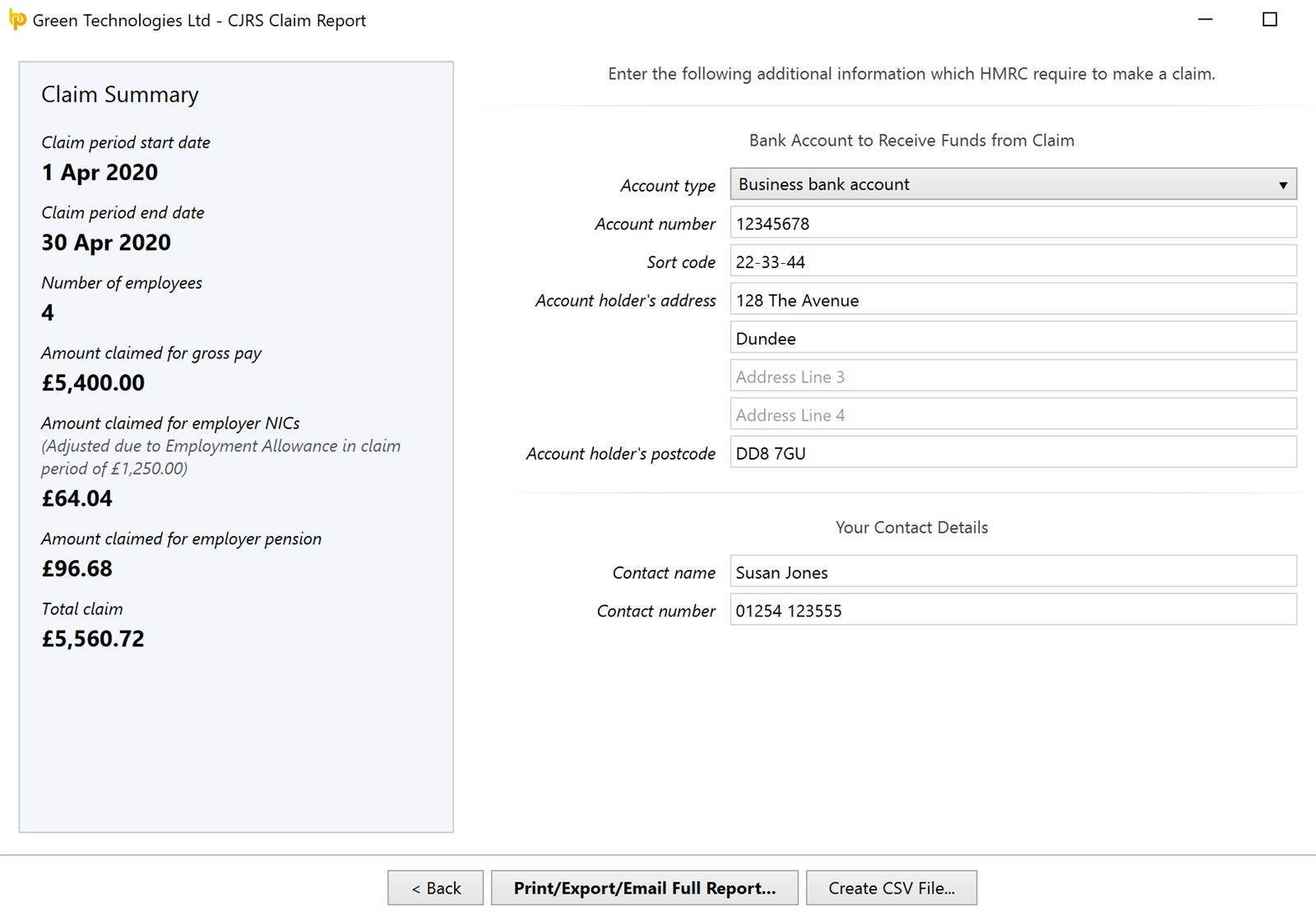

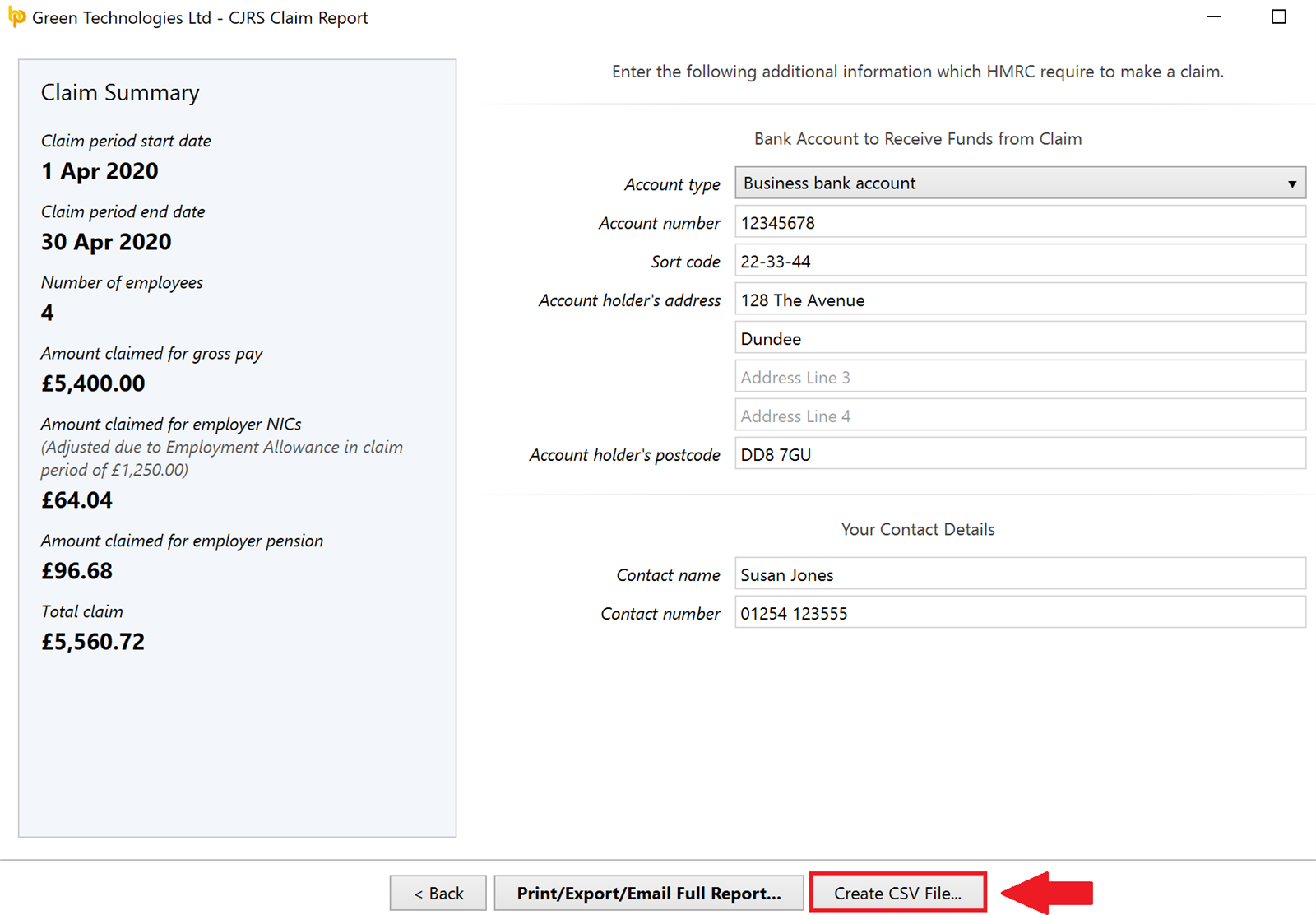

6) On the final screen, enter any additional information that HMRC require when making a claim.

- A summary of your claim will be displayed on the left-hand side:

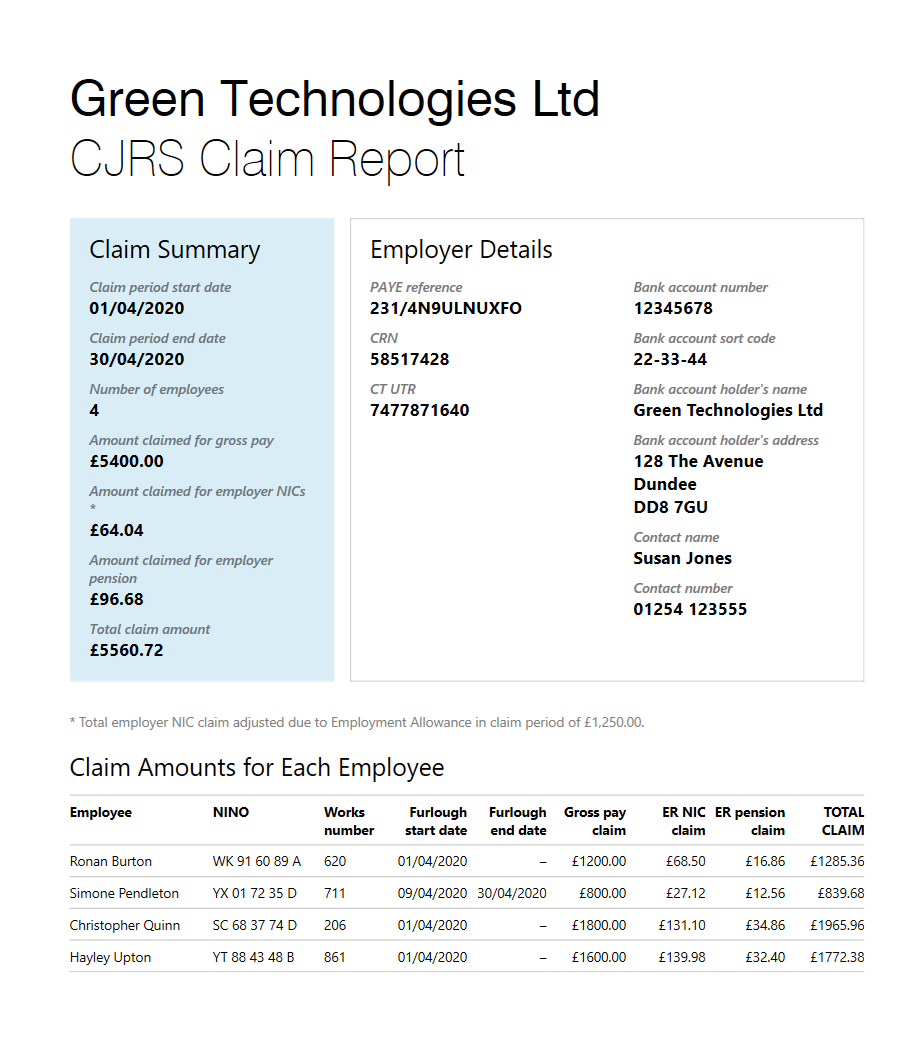

- Should you wish to view the full report, click Print/Export/Email Full Report...

- The Full Report should subsequently be printed, exported or emailed for your records

7) If you have more than 100 employees, a CSV file can be uploaded into HMRC's online service containing the details of your claim.

- Should this be applicable to you, simply click Create CSV File...

- At the prompt, save your CSV file to a location of your choice and upload to HMRC when ready to do so.

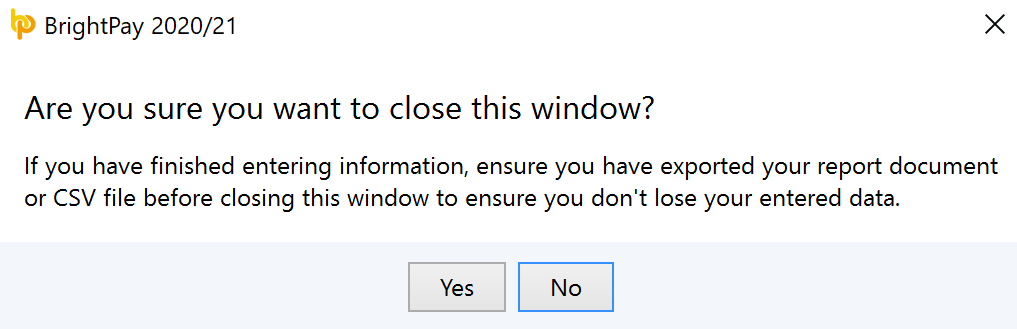

8) Once your Claim Report is completed, simply close out of the utility.

- Before doing so, however, please ensure you have exported your report document or CSV file, so not to lose your entered data.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.