Coronavirus Job Retention Scheme - Making a Claim through HMRC

Employers will need to make a claim for their grant for their furloughed workers through HMRC's Coronavirus Job Retention Scheme online service.

This online service is now available to use and can be accessed here.

Before making your claim

- HMRC strongly advise that you read all the available guidance on GOV.UK before you apply

- Ensure you gather all the information and the calculations you need before you start your application

- For additional help, HMRC have published a simple step by step guide to assist employers in making a claim.

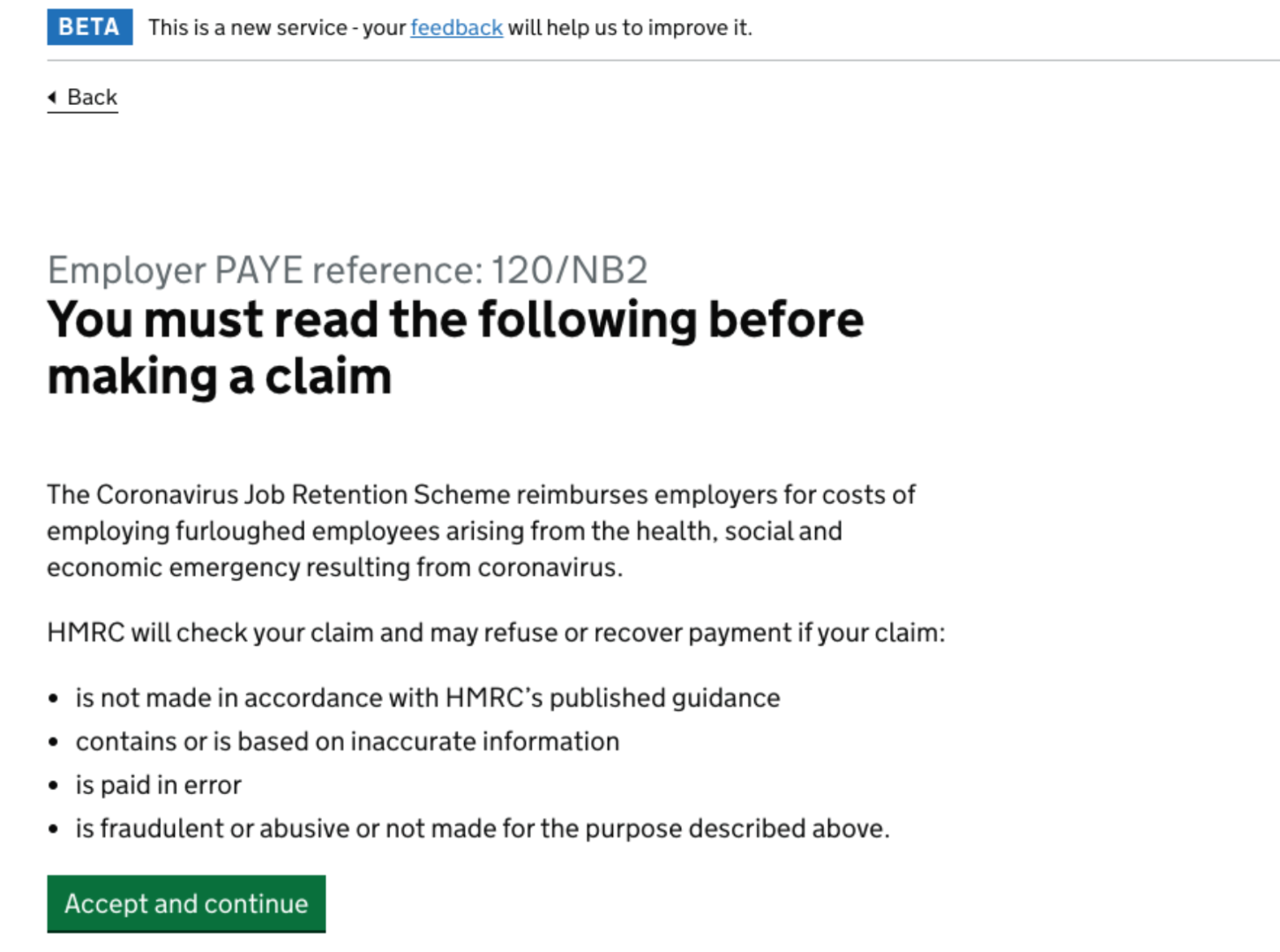

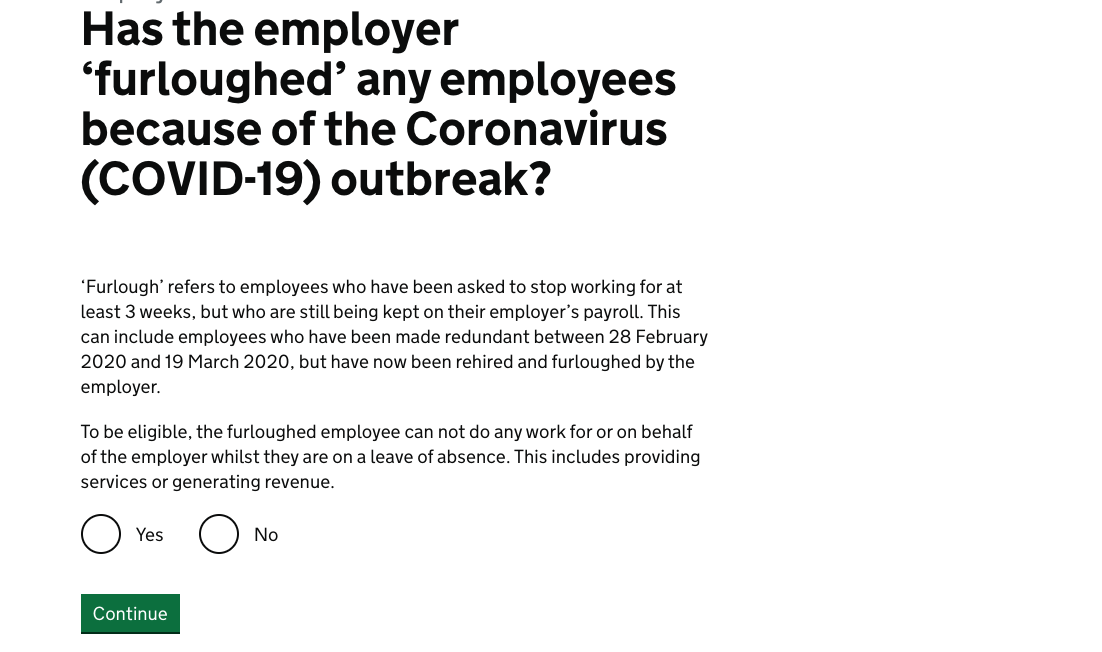

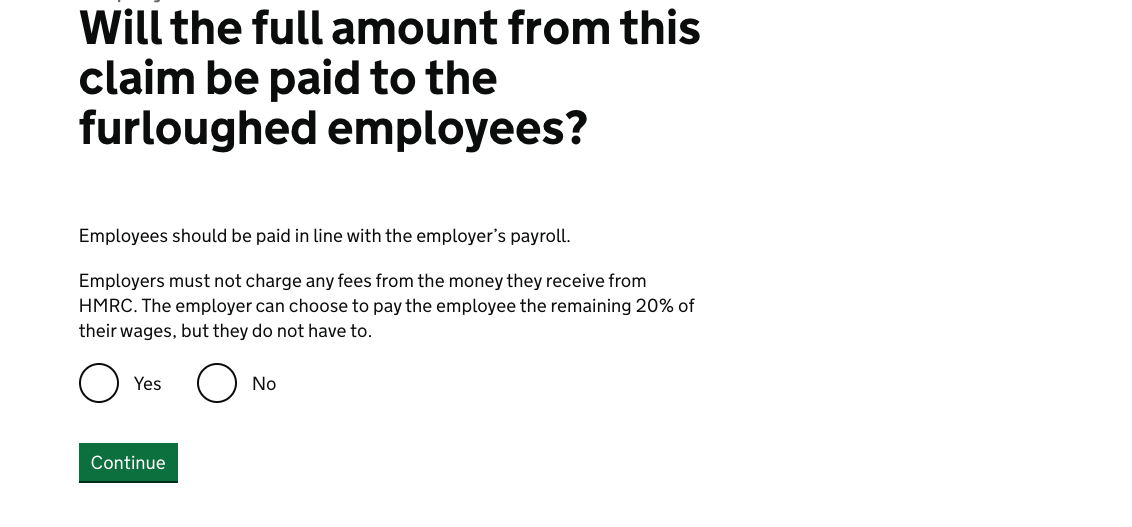

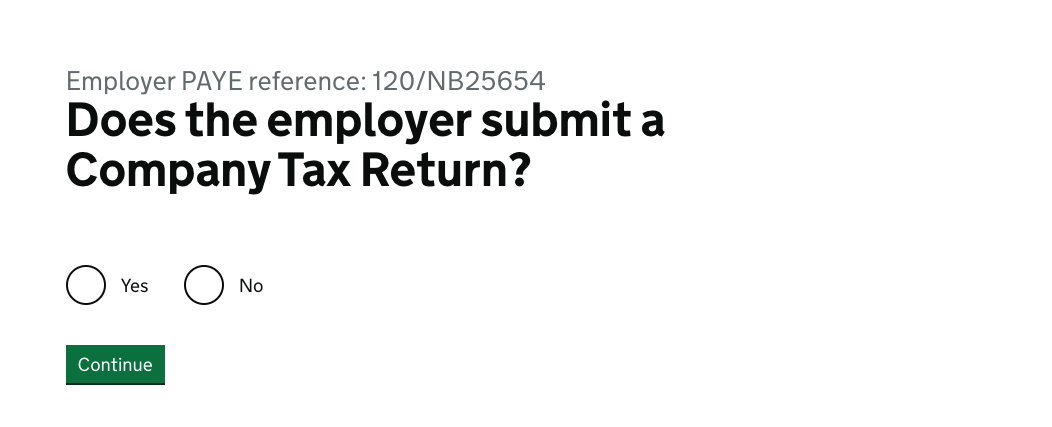

The Claim Process

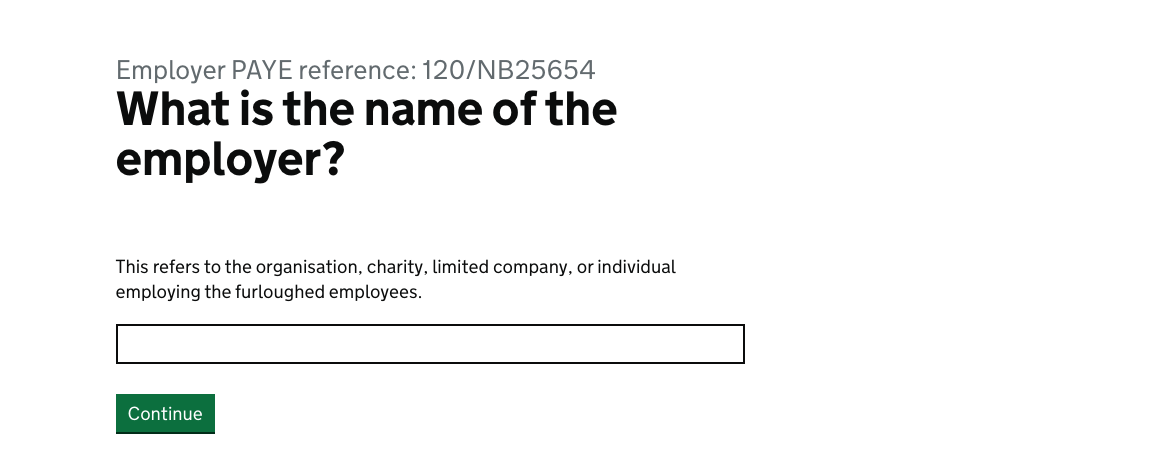

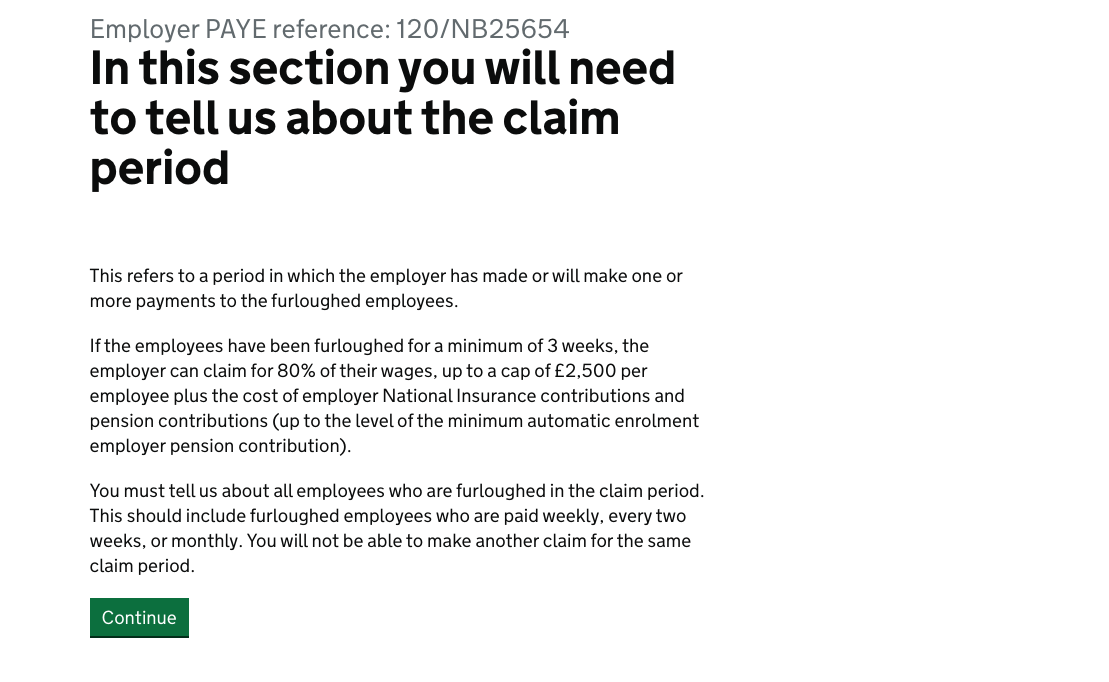

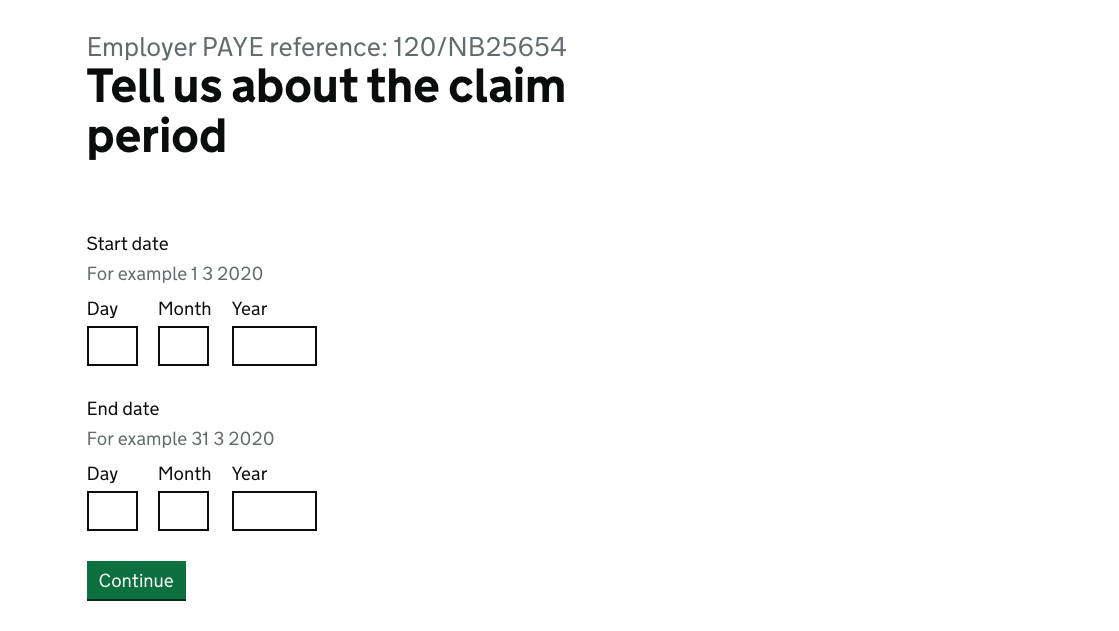

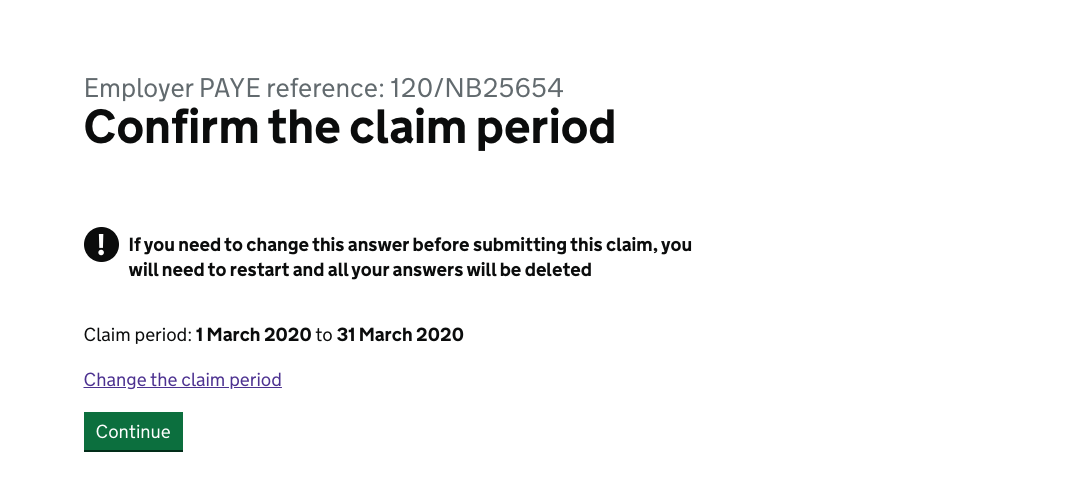

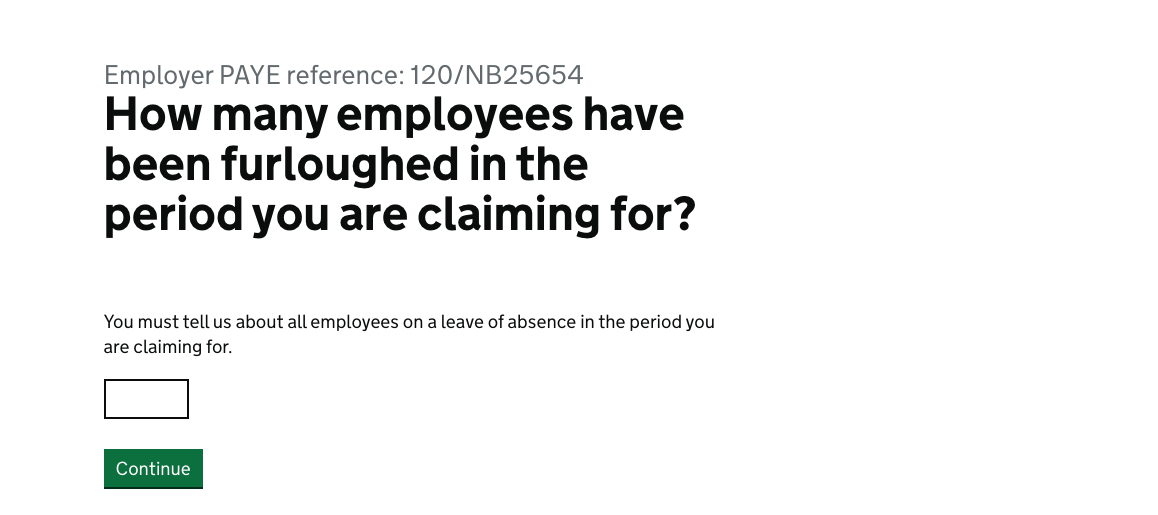

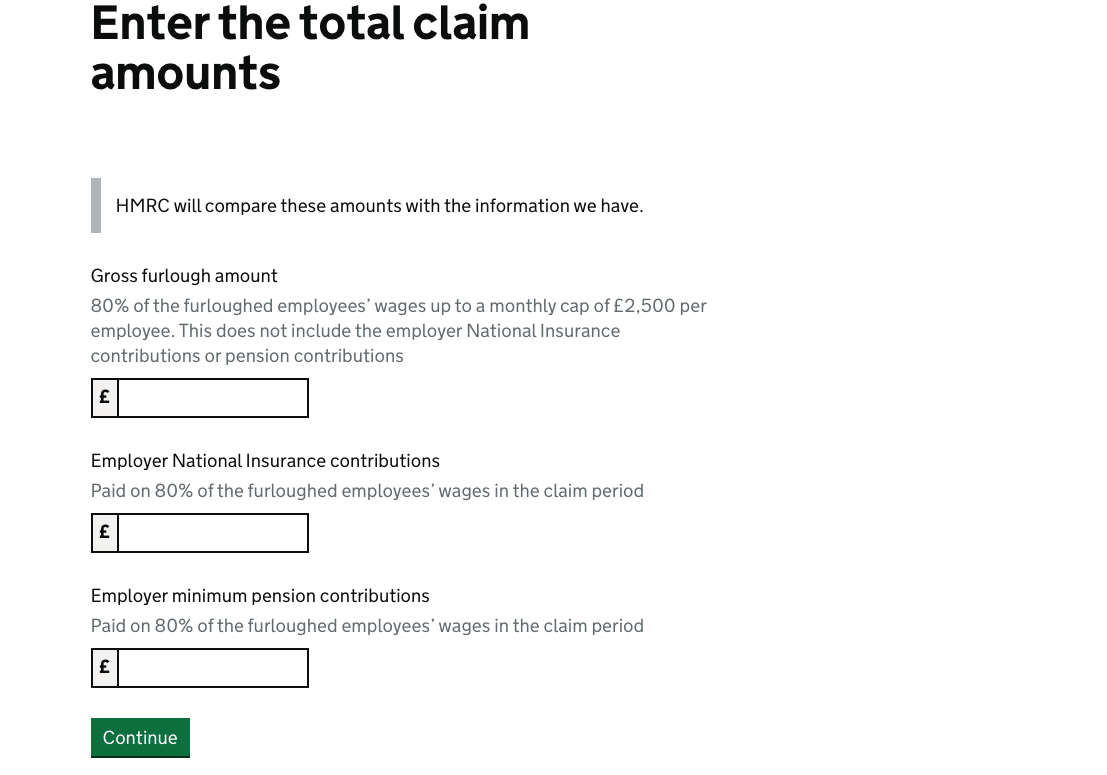

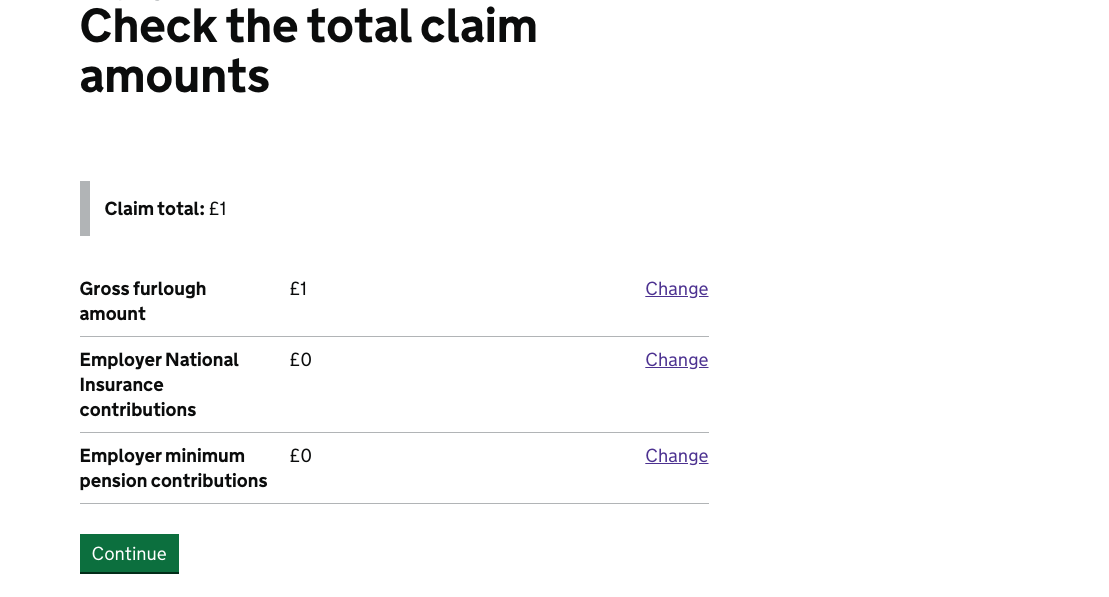

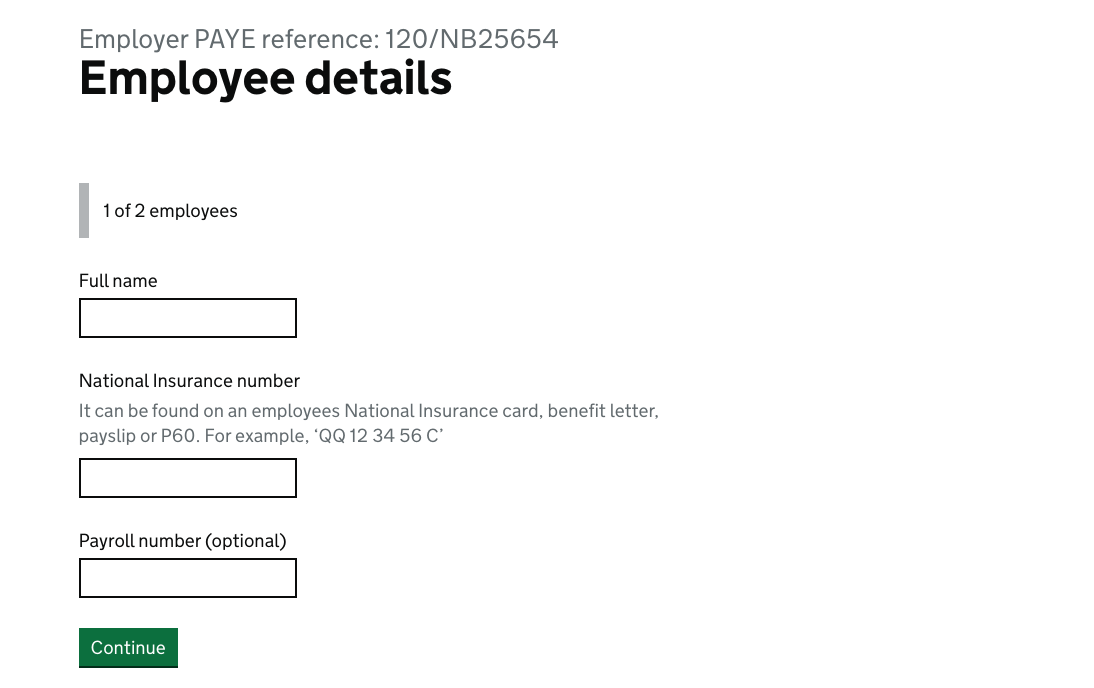

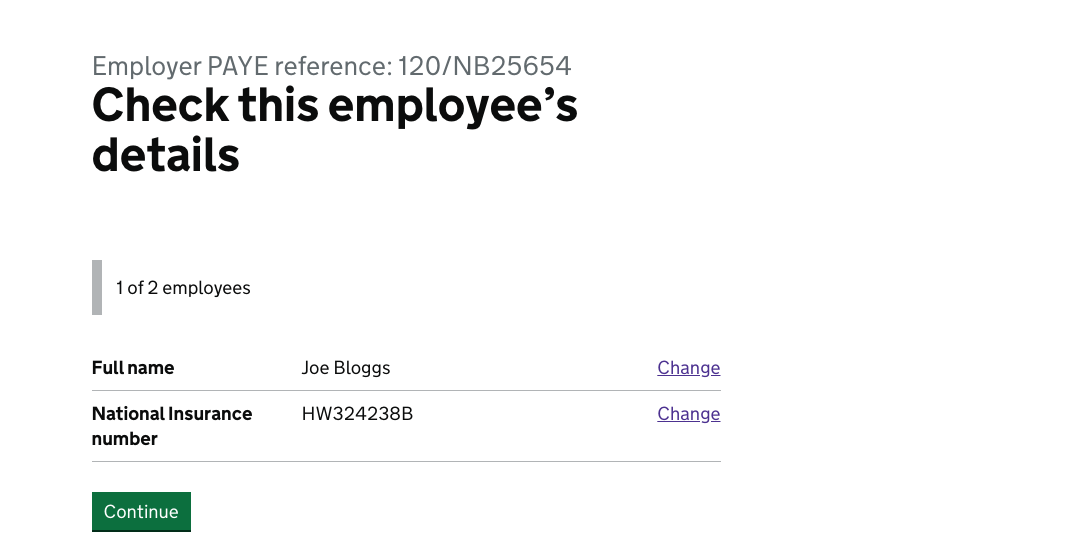

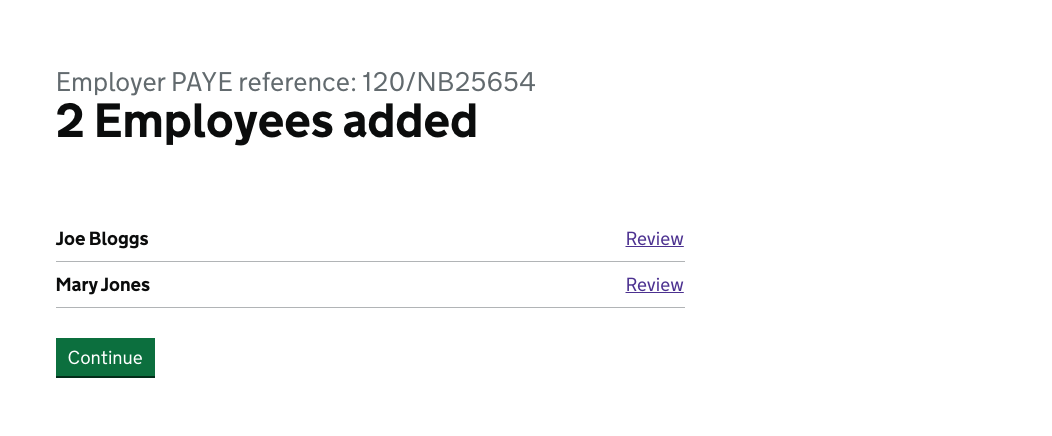

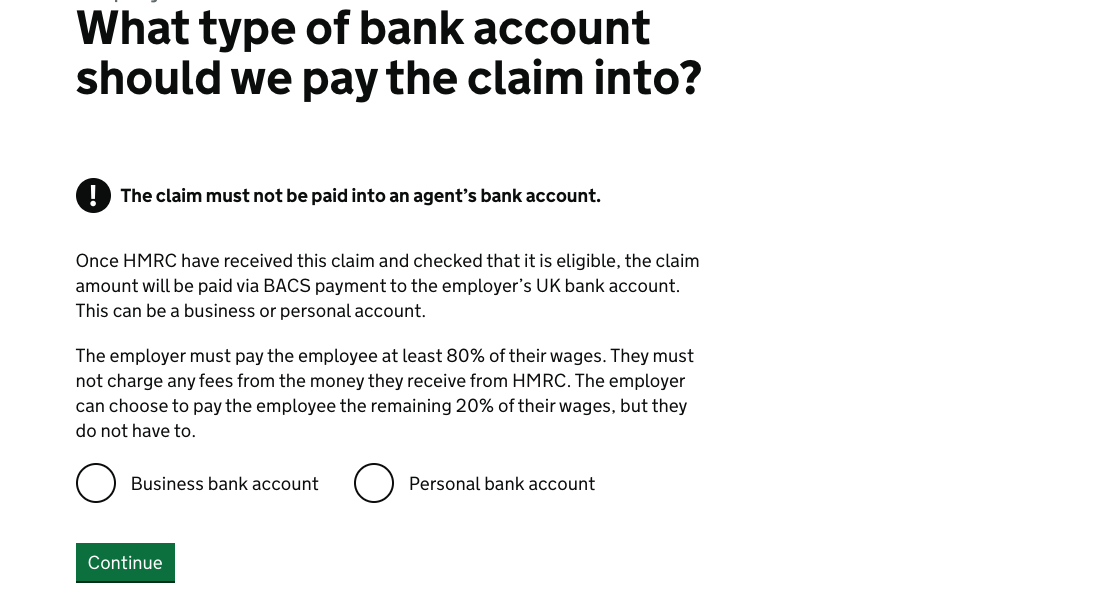

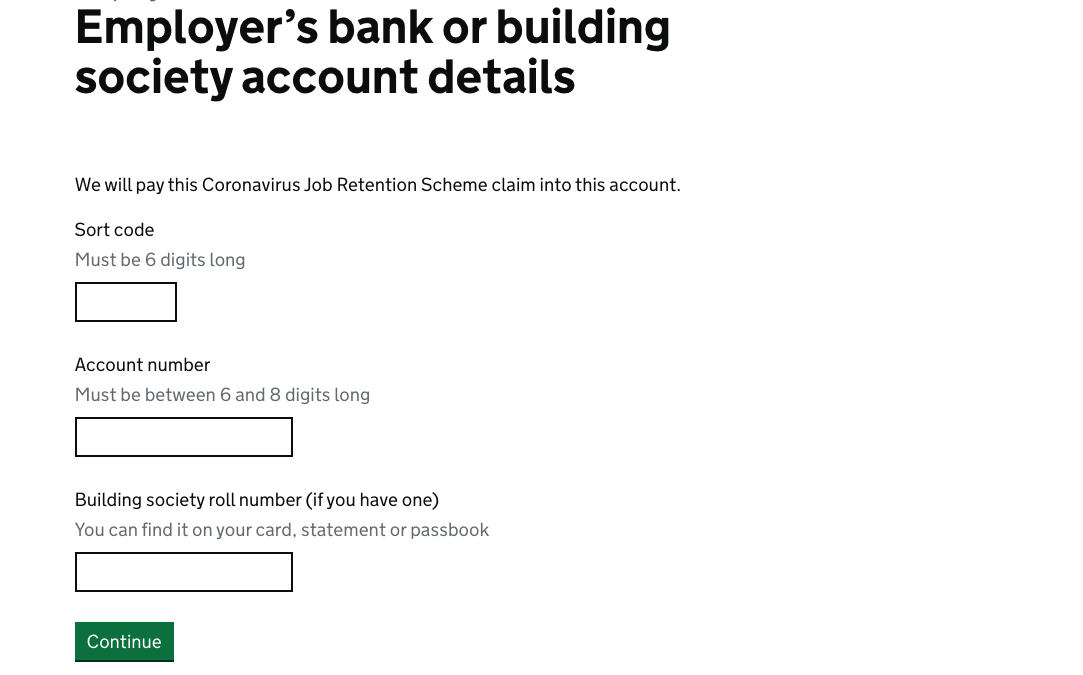

The following are examples of the screens you will complete when making your claim.

Please note: dummy information has been used for demonstration purposes and therefore some screens may differ depending on your own selections. The example is also based on there being less than 100 furloughed employees in the sample company.

The remaining screens which follow will ask you to confirm and submit your claim.

Once you have submitted the claim, you will see a confirmation screen where a claim reference number will be provided.

Please print the confirmation screen or note down the claim reference number provided as you will not receive an email confirmation.

After Making your Claim

- Do keep a note or a print-out of your claim reference number – you won’t receive a confirmation SMS or email.

- Retain all records and calculations for your claims, in case HMRC need to contact you about them.

- HMRC will verify your claim and you will receive the funds in six working days. If you wish to receive payment, for example by 30 April, you will therefore need to complete your grant claim by 22nd April.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.