Coronavirus Job Retention Scheme - Processing Furlough Pay in BrightPay

The Coronavirus Job Retention Scheme is a temporary scheme open to all UK employers for at least three months starting from 1 March 2020. It is designed to support employers whose operations have been severely affected by coronavirus (COVID-19).

Employers can claim for 80% of furloughed employee's usual monthly wage costs (up to £2,500 a month) plus associated Employer NICs and minimum automatic enrolment employer pension contributions on that wage.

The scheme is open to all UK employers that had created and started a PAYE payroll scheme on 19 March 2020.

We recommend fully familiarising yourself with HMRC's comprehensive Coronavirus Job Retention Scheme guidance, which can be accessed here

Processing Furlough Pay in BrightPay

20-21 BrightPay provides functionality to calculate and apply furlough pay to an employee's payslip.

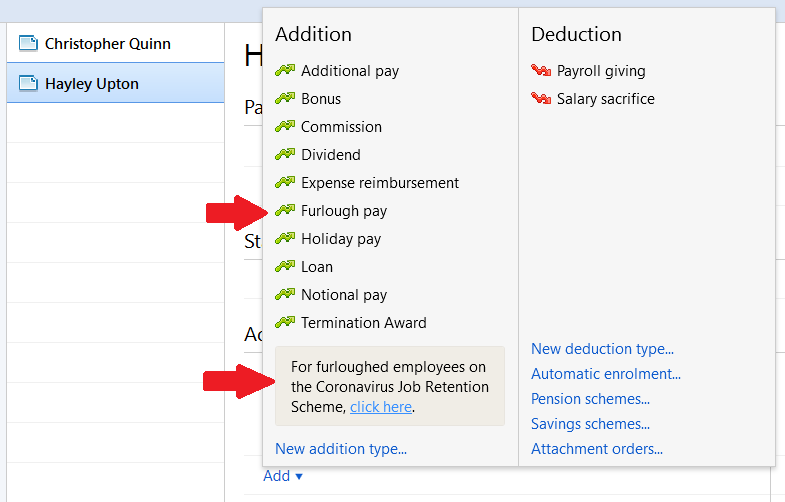

- Within Payroll, select the employee from the left hand listing to access their payslip

- Under Additions and Deductions, click Add, followed by either Furlough pay or 'click here' within the Coronavirus Job Retention Scheme box:

- Before proceeding, check that:

a) You, as an employer, are eligible to claim (i.e. you are an allowed organisation with a PAYE scheme in existence on/before 19th March 2020)

b) the employee is eligible to be claimed for (i.e. hired on/before 19 March 2020 and no longer undertaking any work) - If eligible, click Yes, I am eligible to proceed

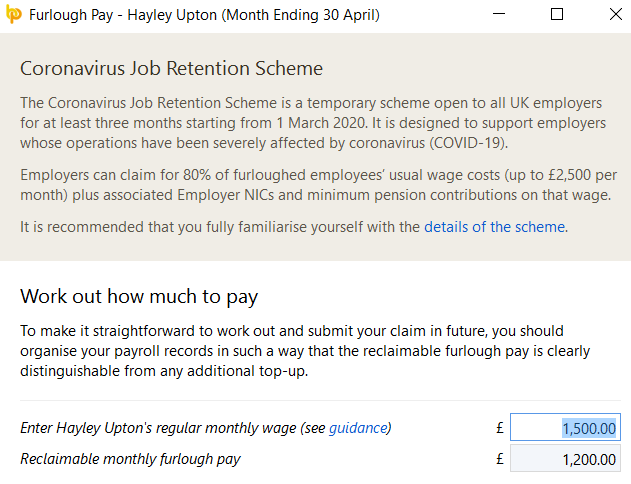

Brightpay will now assist you in working out how much to pay your employee:

- Enter your employee's regular periodic salary (see HMRC's guidance if required) in the field provided

Using this figure, BrightPay will now automatically work out the applicable reclaimable furlough pay.

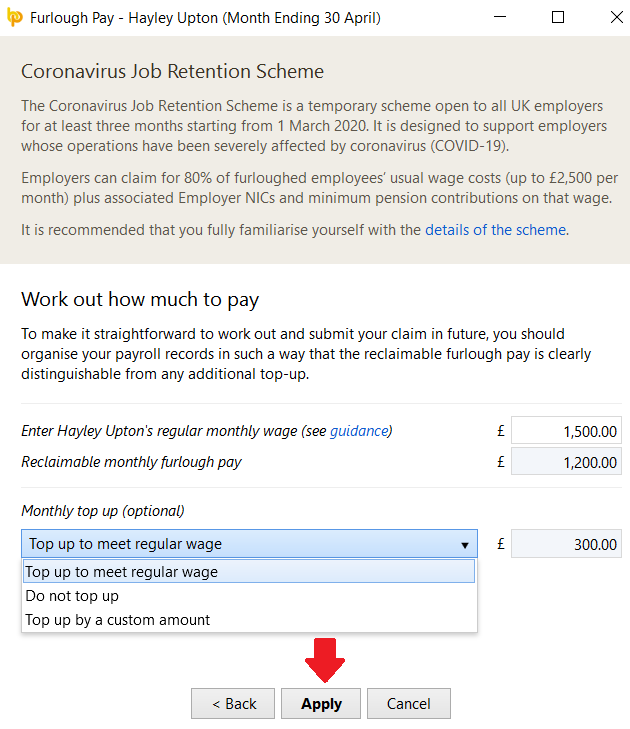

Employers operating the Coronavirus Job Retention Scheme must, at a minimum, pay their employee the lower of 80% of their regular wage or £2,500 per month. An employer, if in a position to do so, can also choose to top up an employee’s salary beyond this, but is not obliged to under the scheme.

- Using the drop down menu, select the applicable 'top up' option form the listing:

a) that you wish to top up to meet the regular wage

b) to not top up

c) that you would like to top up by a custom amount

Based on your selection, BrightPay will now ascertain the amounts to apply to the employee's payslip, as per the example below:

- Click Apply to proceed.

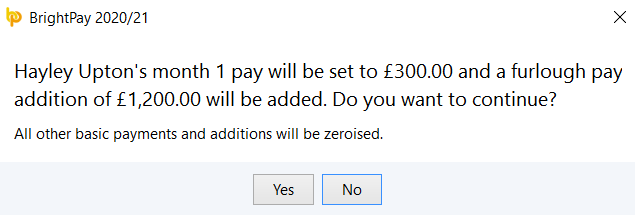

- Your employee's applicable amounts will now be displayed for you to confirm.

It will also be brought to your attention that all other basic payments and additions will be zero-ised.

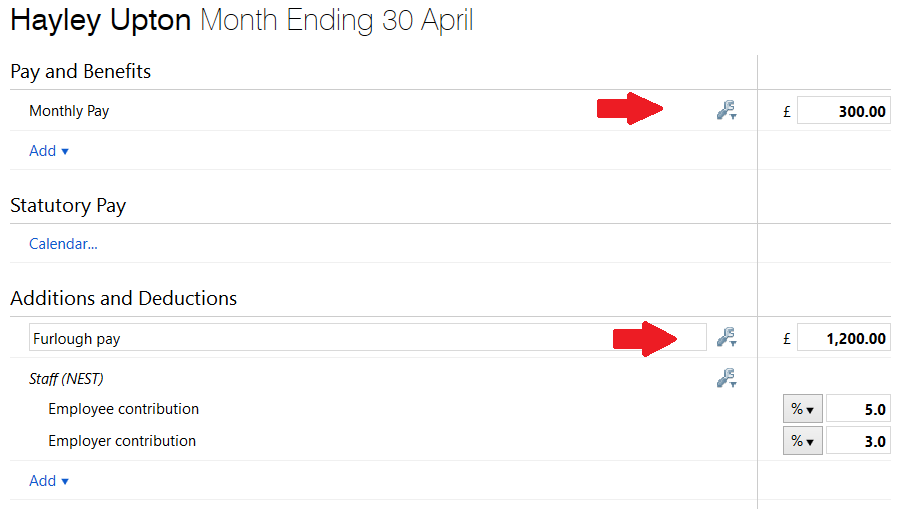

Your employee's payslip will now be automatically updated with the applicable pay items:

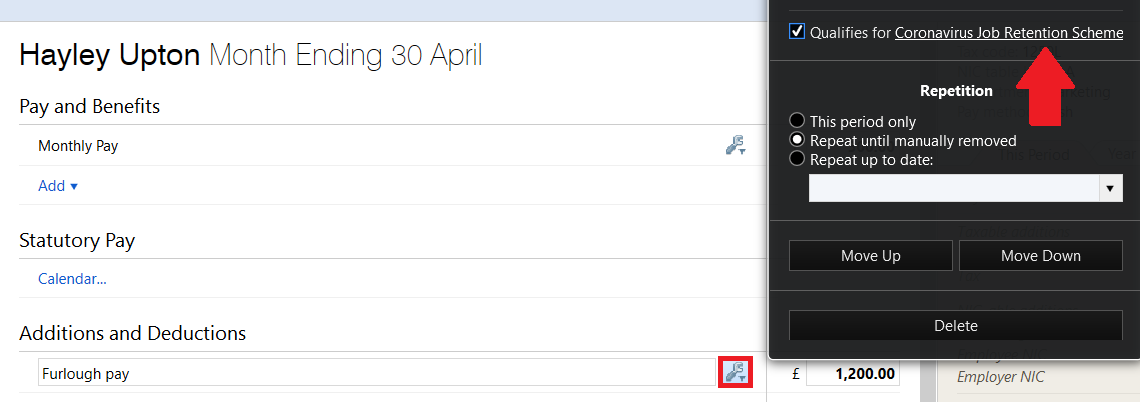

- Should you wish to access the furlough pay calculator again before finalising the payslip, simply click the Edit button, followed by the Coronavirus Job Retention Scheme link:

- Repeat the process above for further employees, if applicable.

Important Notes

- The furlough pay calculator in BrightPay caters for whole pay periods only. Where an employee has been furloughed part way through a pay period, a manual adjustment will thus be required by the user. For assistance with calculating pro-rated furlough pay, please consult HMRC's comprehensive guidance.

- In the event that you have already set up your own ddition type for furlough pay using a description which contains 'furlough', 'coronavirus' or 'covid', BrightPay will recognise this addition as being under the Coronavirus Job Retention Scheme. Therefore, there will be no requirement for you to remove this addition type and add it again using the above process.

How to Claim from HMRC

Employers will need to make a claim for their wage costs through a HMRC online portal.

This portal will become available to use from Monday 20th April 2020.

HMRC have published a simple step by step guide for employers on how to make a claim which can be accessed here .

Furloughed Workers - Employment Issues to Consider

Changing the status of employees to a furloughed worker remains subject to existing employment law. Generally, where an employee’s contract contains a layoff or short term clause employers should be able to place employees on furlough leave. Where there is no such clause, it is best advised to get agreement from the employee.

Additionally, a 20% reduction in salary will be a change in terms and conditions of employment. Where employers are not topping up the government payment, they should also seek agreement from the employee.

Given the current situation and the alternatives for those employees should they not agree, one can expect that most employees will agree. That said, prudent employers will seek to get their employees agreement as part of their furlough leave process.

Template letter to employees being place on furlough leave..

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.