Employment Allowance

Since 6th April 2014, a NIC Employment Allowance is available to claim by eligible employers.

The Employment Allowance for tax year 2019-20 remains at £3,000.

Please note: since 6th April 2016 single-director companies are not eligible to claim the National Insurance Contributions Employment Allowance. The main reason for this change is to make the Employment Allowance more focused on businesses that are creating and sustaining employment and as a result where a director is the sole employee of a limited company this company is excluded from availing of the Employment Allowance. These regulations apply in England, Wales, Scotland and Northern Ireland.

Further guidance on single director companies is available here.

**** Employers that were eligible in 2018/19 but cease to be eligible in 2019/20 will have to notify HMRC of this ineligibility via the Employment Payment Summary (EPS). Please see below for assistance on how to notify HMRC of this.

Eligibility

You can claim the Employment Allowance if:

- you are a business or charity (including community amateur sports clubs) paying employers' Class 1 National Insurance

- you employ a care or support worker

The Employment Allowance is to be set against an employer’s liability for secondary Class 1 National Insurance Contributions (NICs) only, not against other NICs such as primary (employee’s) Class 1, Class 1A or Class 1B contributions.

You cannot claim the Employment Allowance, however, if you:

-

employ someone for personal, household or domestic work (eg a nanny or gardener) - unless they’re a care or support worker

-

already claim the allowance through a connected company or charity

- are a service company working under ‘IR35 rules’ and your only income is the earnings of the intermediary (such as your personal service company, limited company or partnership)

- are a public authority, this includes; local, district, town and parish councils

- carry out functions either wholly or mainly of a public nature (unless you have charitable status), for example:

NHS services, General Practitioner services, the managing of housing stock owned by or for a local council, providing a meals on wheels service for a local council, refuse collection for a local council, prison services, collecting debt for a government department

You do not carry out a function of a public nature, if you are:

- providing security and cleaning services for a public building, such as government or local council offices

- supplying IT services for a government department or local council

To check your eligibility and for further information about the Employment Allowance go to Employment Allowance Eligibility.

Claiming the Employment Allowance in BrightPay

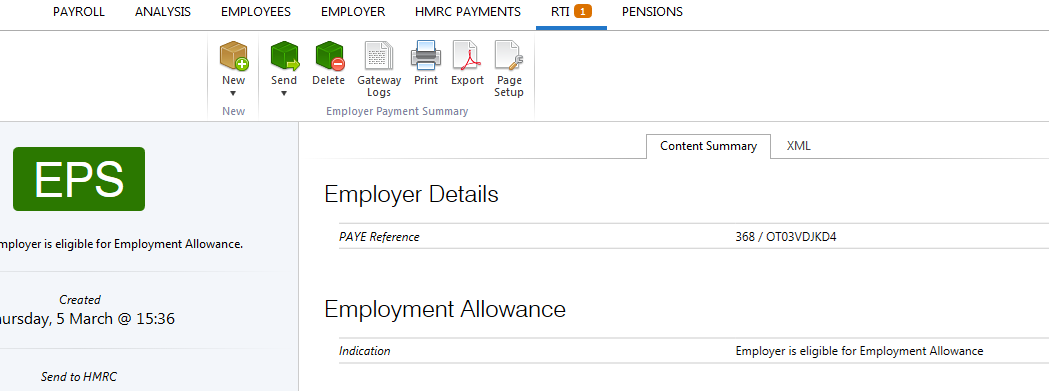

The claim process for eligible employers is very straightforward and is administered via BrightPay, and is merely a flag on the Employer Payment Summary (EPS) submission via RTI, notifying HMRC that they are claiming the employment allowance. There is no requirement to enter a claim value within the actual EPS submission.

To prepare an EPS for submission you must first set up your HMRC Payments schedule.

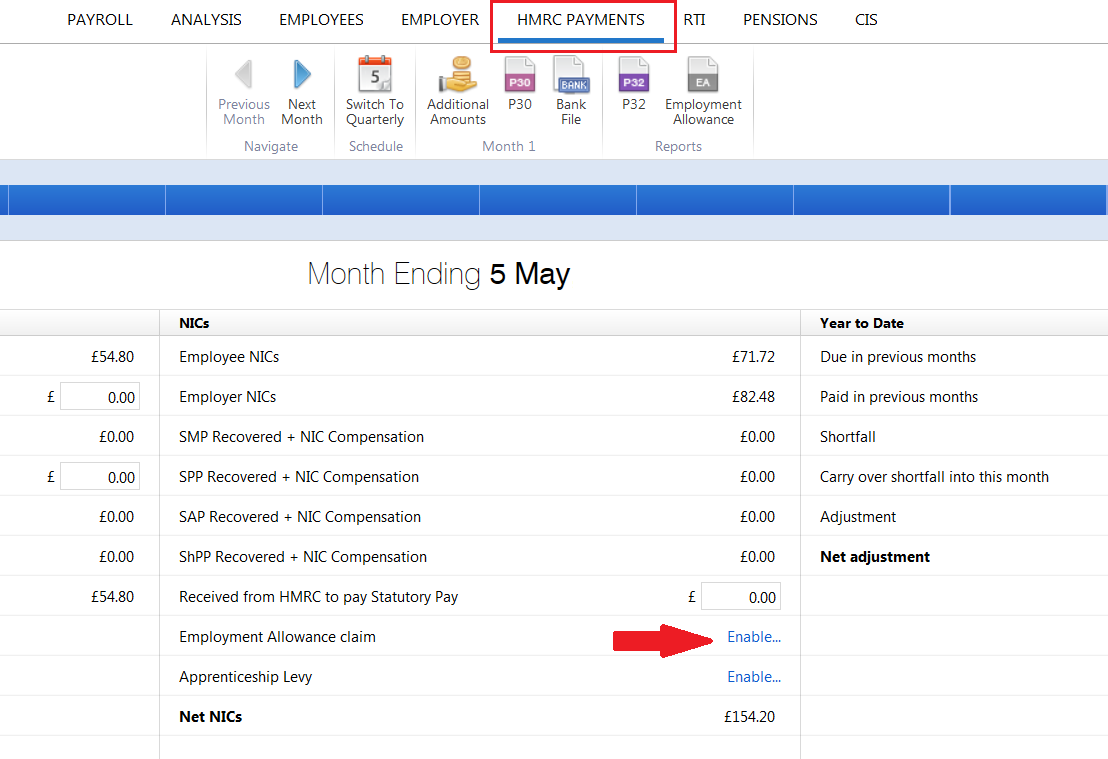

- Choose HMRC Payments

- Choose the agreed payment frequency between you and HMRC, monthly or quarterly

- Under NIC, you will find the option for Employment Allowance Claim

- To claim the Employment Allowance, select Enable

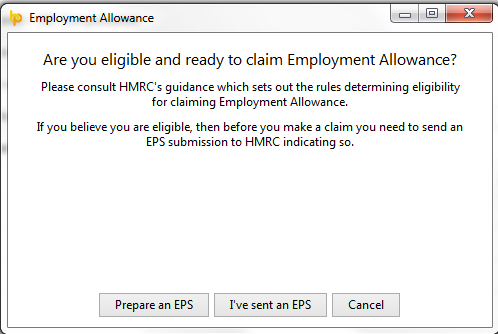

- The claim for the Employment Allowance is made via an EPS. Simply click Prepare an EPS and submit to HMRC:

- Once the EPS has been submitted and accepted by HMRC, click back into HMRC Payments and click the Enable button again

- Click 'OK'.

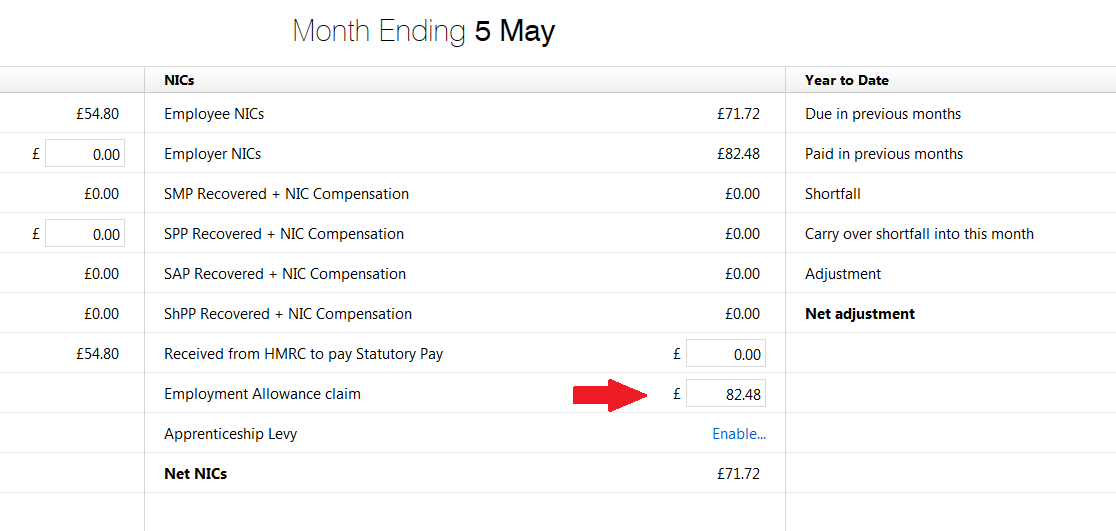

- The Employment Allowance will now be automatically calculated in line with the employer's Class 1 National Insurance liability each tax period, up to the maximum total of £3,000 in the tax year.

Stopping the Employment Allowance

Since 6th April 2016, single-director companies are not eligible to claim the National Insurance Contributions Employment Allowance. The main reason for this change is to make the Employment Allowance more focused on businesses that are creating and sustaining employment and as a result where a director is the sole employee of a limited company this company is excluded from availing of the Employment Allowance. These regulations apply in England, Wales, Scotland and Northern Ireland.

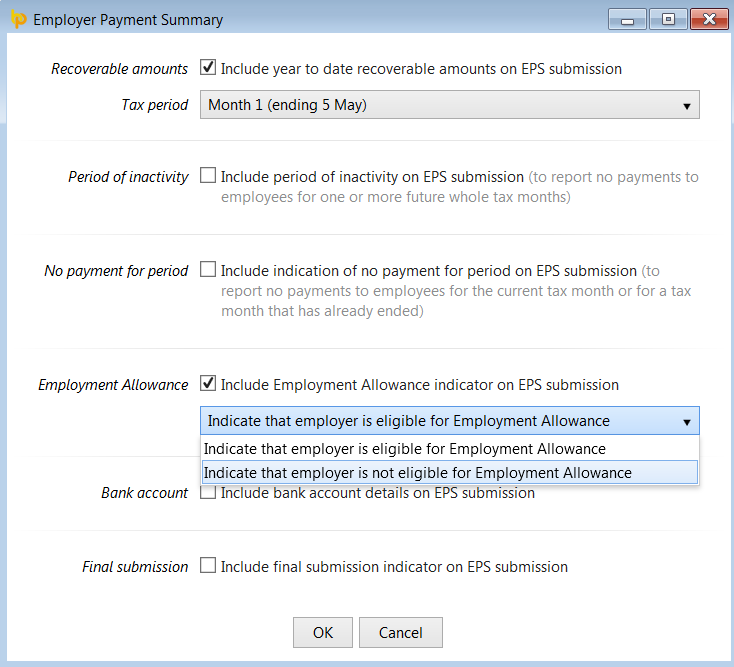

Employers that were eligible in 2018/19 but cease to be eligible in 2019/20 must notify HMRC of this ineligibility via the Employment Payment Summary (EPS).

- Select RTI on the menu bar

- Click 'New' on the menu toolbar and select 'Employer Payment Summary (EPS)'

- Tick the 'Employment Allowance' marker

- Select 'Indicate that employer is not eligible for Employment Allowance'

- Click 'OK' to submit to HMRC when ready.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.