Importing Employers - List of Employer Data that can be Imported into BrightPay

Clients moving to BrightPay from another payroll software can import all employers into BrightPay using a CSV file.

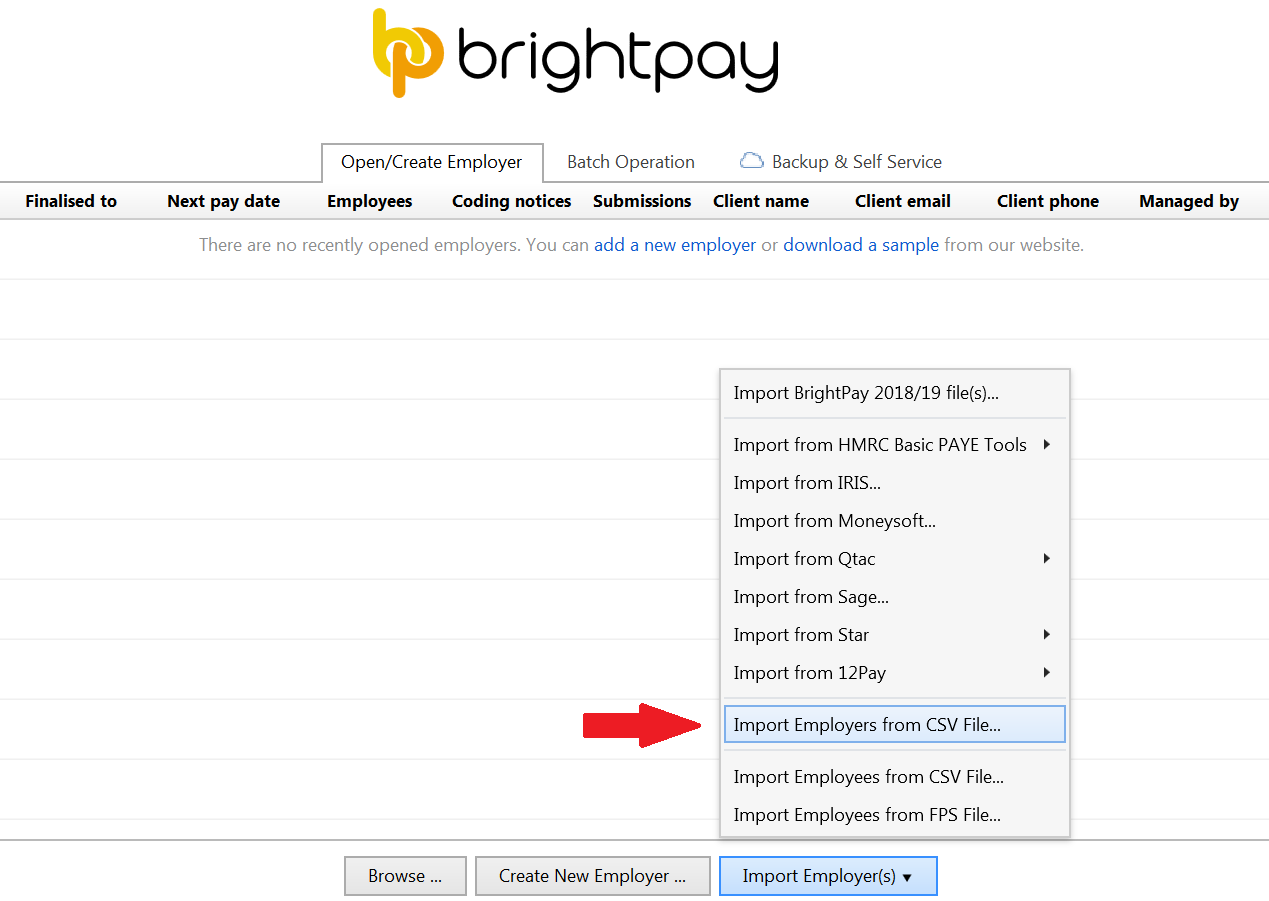

To import employers, simply click on the ‘Import Employer(s)’ button at the bottom of the ‘Open Employer’ screen and select 'Import from CSV File...'

1) Browse to the location of your employer CSV File

2) Select the required file and click 'Open'

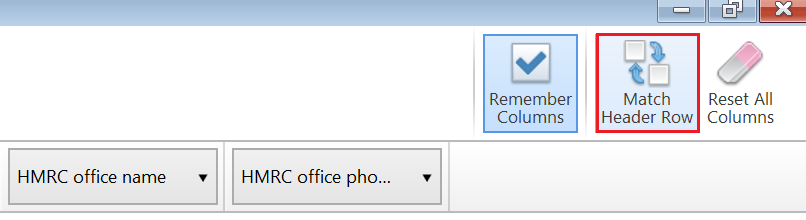

3) The employer information will be displayed on screen. For each column, choose the data it represents. Ignore any columns and uncheck any rows you do not wish to be imported.

To assist with column selection, simply select 'Match Header Row'. BrightPay will try and match as many columns as it can for you.

Please note: should you have more than one employer CSV file to import simply instruct BrightPay to 'Remember Columns'. BrightPay will subsequently remember the column selection used in the previous import when next importing a new employer CSV file.

Alternatively, should you wish to reset your column selection, select 'Reset All Columns'.

Employer fields which can be imported into BrightPay using CSV file format are:

Name

PAYE Reference

Accounts Office Reference

Automatic re-enrolment date

Is exempt from Auto Enrolment

Auto Enrolment Declaration of Compliance date

Trading name

Address line 1

Address line 2

Address line 3

Address line 4

Postcode

Country

HMRC office name

HMRC office phone number

Unique Tax Reference

Corporation Tax reference

BACS Service User Number

Qualifies for Small Employers' Relief

HMRC contact title

HMRC contact name

HMRC contact middle name

HMRC contact surname

HMRC contact phone number

HMRC contact fax number

HMRC contact email address

HMRC Sender ID

HMRC Sender Password

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.