Statutory Pay Calculation & Schedule Report

Statutory Pay Calculations

BrightPay uses the full statutory week method when calculating & applying statutory pay calculations.

Weekly Payroll Example:

An employee's statutory leave period begins on a Wednesday. Therefore the last day of their statutory leave week will be a Tuesday.

Their statutory payment (SMP, SAP, SPP, ShPP) will thus first become payable in the weekly pay period in which the first Tuesday of the leave period falls.

Monthly Payroll Example:

An employee's statutory leave period begins on a Wednesday. Therefore the last day of their statutory leave week will be a Tuesday.

Their statutory payment (SMP, SAP, SPP, ShPP) will thus first become payable in the pay period in which the first Tuesday of the leave period falls.

BrightPay will then establish how many Tuesdays fall in the monthly pay period and apply the weekly statutory rate to the number of Tuesdays there are.

Statutory Pay Calculation & Schedule Report

As soon as parenting leave is applied on an employee's calendar, BrightPay will automatically calculate the employee’s average weekly earnings to determine whether they qualify for the applicable statutory payment (and if so, how much), as well as create the payment schedule.

To view the details of an employee's statutory parenting leave, the calculation of their average weekly earnings and their payment schedule, users can access the employee's Statutory Pay Calculation & Schedule Report at any time.

This report can be accessed in several places:

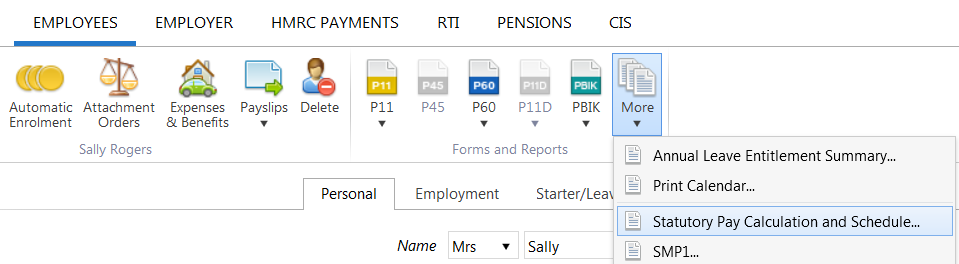

a) Within 'Employees', select the employee in question, followed by 'More > Statutory Pay Calculation & Schedule...'

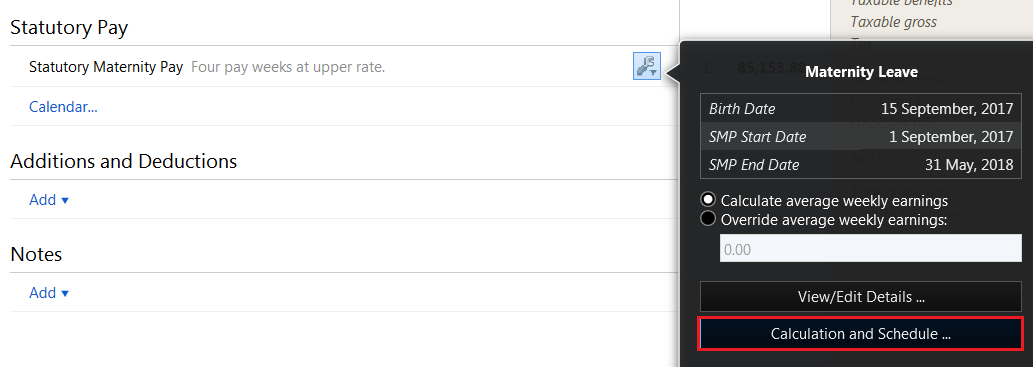

b) Within 'Payroll', click the Edit button next to the statutory payment amount, followed by 'Calculation & Schedule ...'

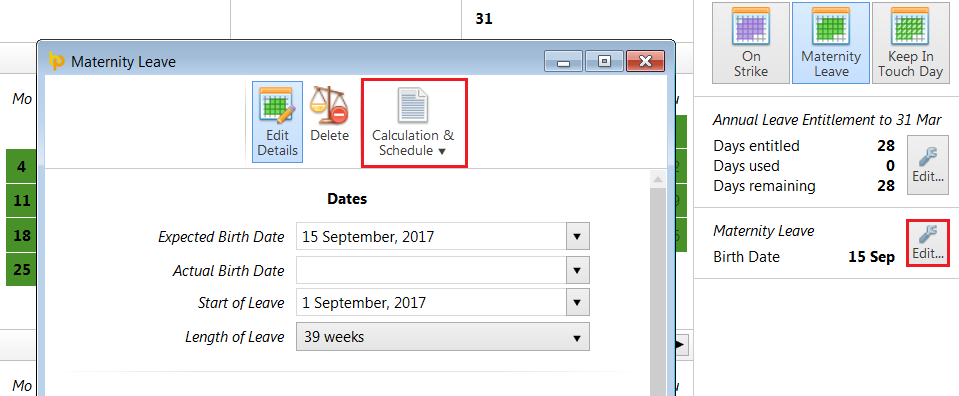

c) Within the employee's calendar, click their parenting leave Edit button, followed by 'Calculation & Schedule'.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.