Postponing Employees in BrightPay

You can use postponement to delay automatic enrolment for some or all employees for up to three months. This means you won’t need to assess any employees you postpone until the last day of their postponement period, at which point you must automatically enrol any who are eligible.

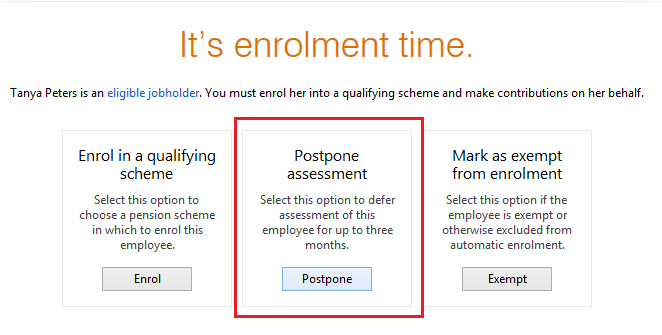

To postpone an employee, within their Automatic Enrolment utility, select Postpone:

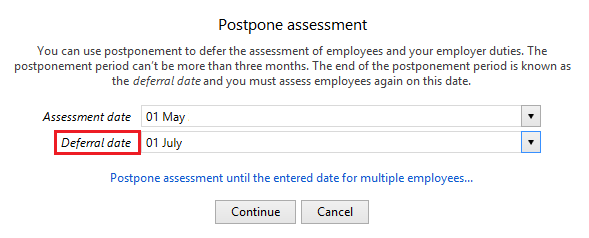

Enter the assessment date and deferral date applicable to the employee:

BrightPay will validate the date entered to ensure that it is no more than 3 months from the duties start date.

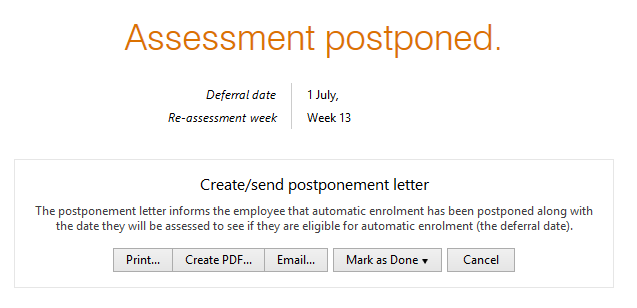

If postponement is used, you must provide the employee with a statutory postponement notice which BrightPay will automatically generate for you to give or email to the employee.

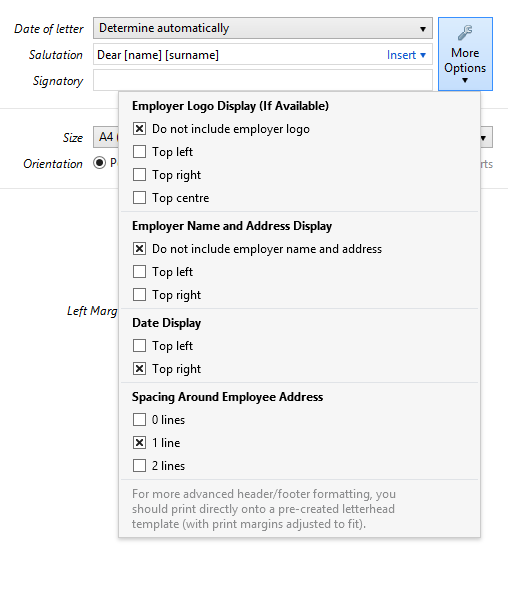

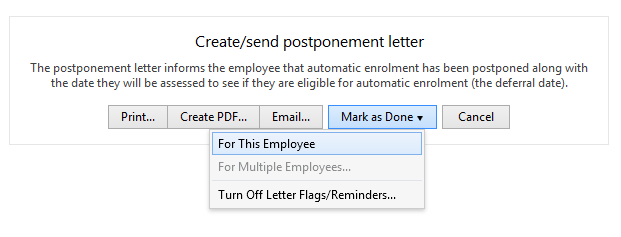

Simply click Print/ Create PDF/ Email and enter the date (if applicable) and signatory to be added to the letter. If printing or exporting the communication letter, further customisation of the letter is available within the 'Options' menu.

Once the postponement notice has been given or emailed to the employee, simply Mark As Done:

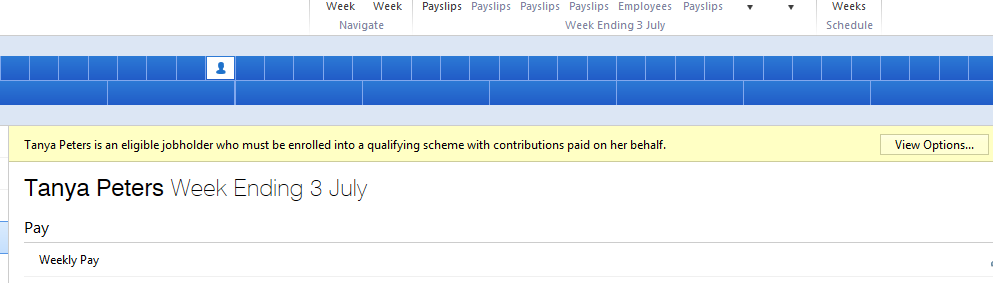

As soon as the employee's deferral date is reached in the payroll, BrightPay will automatically assess the employee again for you and notify you that you have automatic enrolment duties to perform for them:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.