Agent Settings

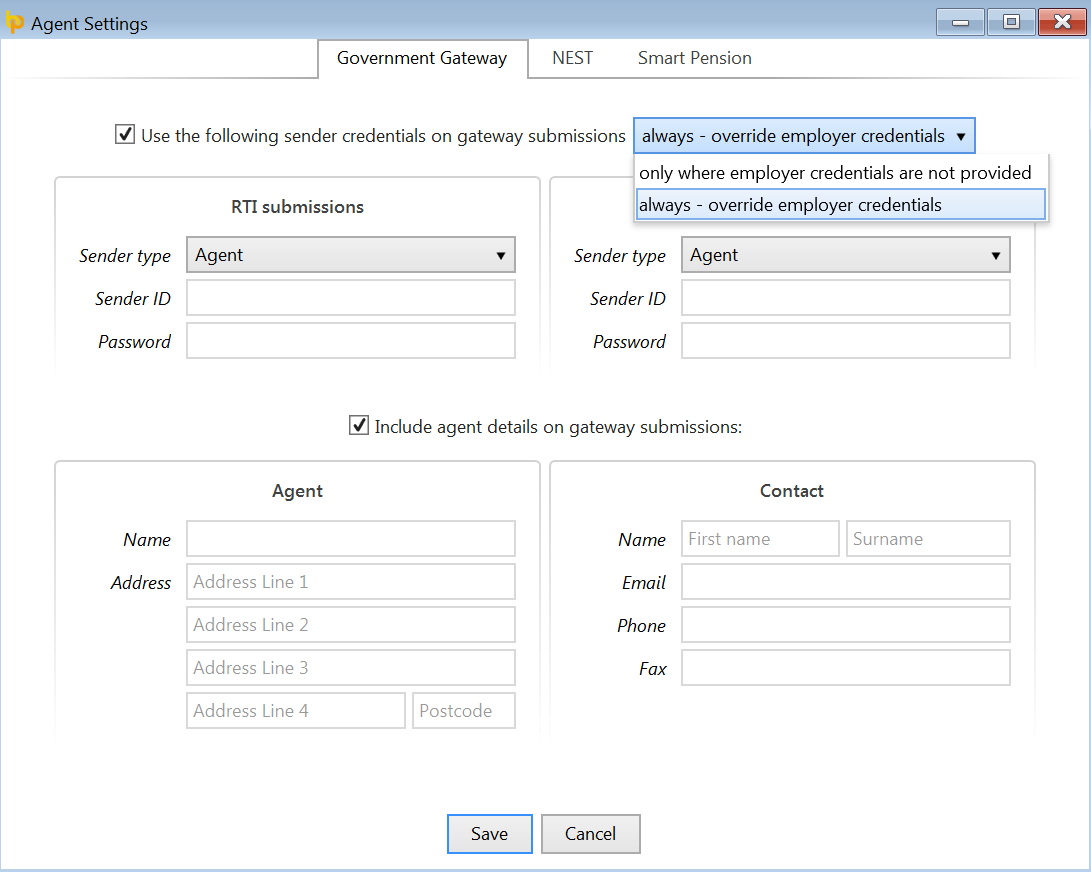

Government Gateway - Sender Credentials

Bureau users can use the 'Agent Settings' utility to instruct BrightPay to use their own sender credentials and include agent details on all RTI submissions.

- To instruct BrightPay to use agent credentials, go to File > Agent Settings > Government Gateway.

- Tick to indicate that you wish to use the sender credentials on gateway submissions - you can choose to 'always - override employer credentials' or use 'only where employer credentials are not provided'.

- Enter the relevant information > 'Save'.

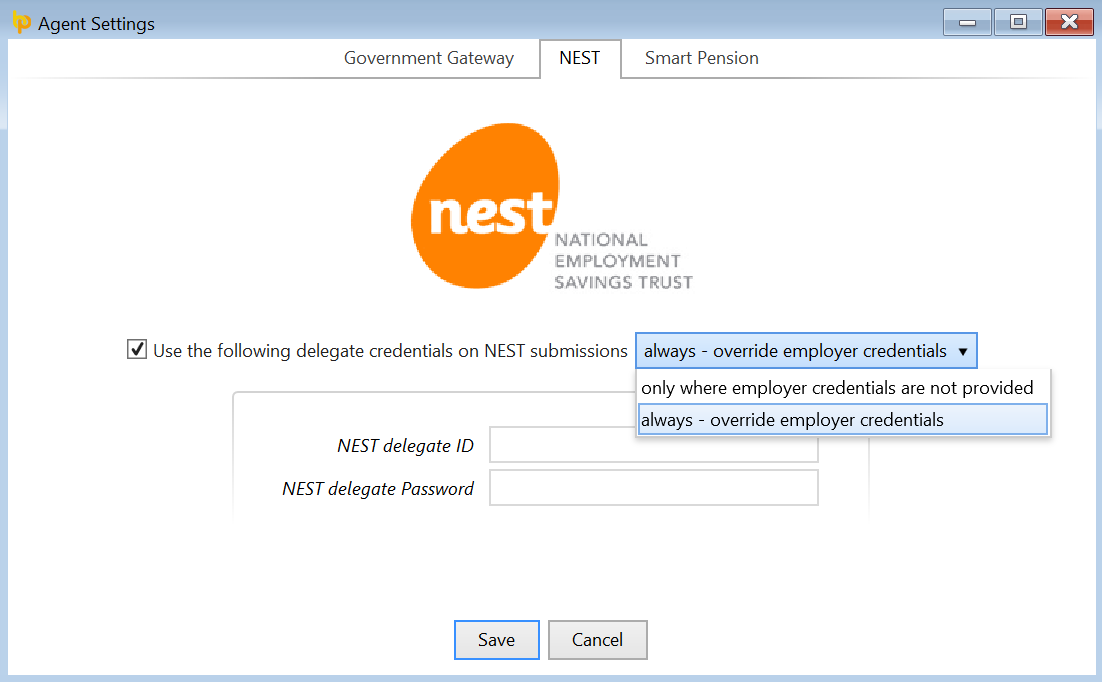

Nest - Delegate Credentials

Bureau users can use the "Agent Settings" utility to instruct BrightPay to use their own Nest delegate credentials on all Nest submissions.

- To instruct BrightPay to use the delegate credentials, go to File > Agent Settings > Nest.

- Tick to indicate that you wish to use the delegate credentials on Nest submissions, you can choose to "always - override employer credentials" or use "only where employer credentials are not provided".

- Enter the relevant information > 'Save'.

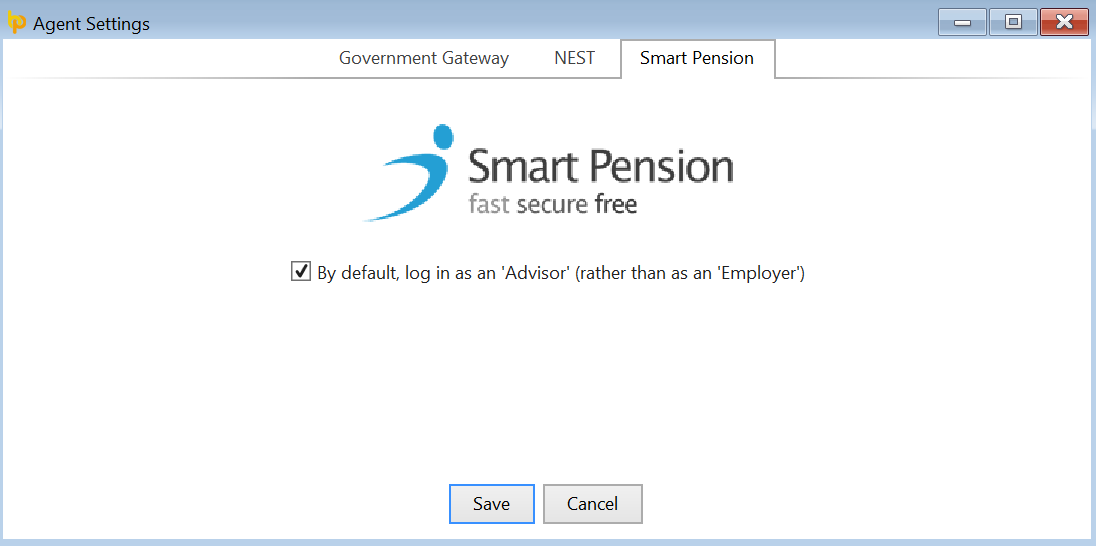

Smart Pension - Advisor Credentials

Bureau users can use the "Agent Settings" utility to instruct BrightPay to allow them to log into Smart Pension as an 'Advisor' by default.

- To instruct BrightPay to do so, go to File > Agent Settings > Smart Pension.

- Tick to log in as an 'Advisor' (rather than an 'Employer')

- Press 'Save'.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.