Updating Existing Employee Details from a CSV File

20-21 BrightPay provides the option to import updates for existing employees using CSV file.

This is a useful feature for bureaus who wish to update employee data sent to them from clients, for example, address changes, rate changes, updated bank details, leave dates, etc.

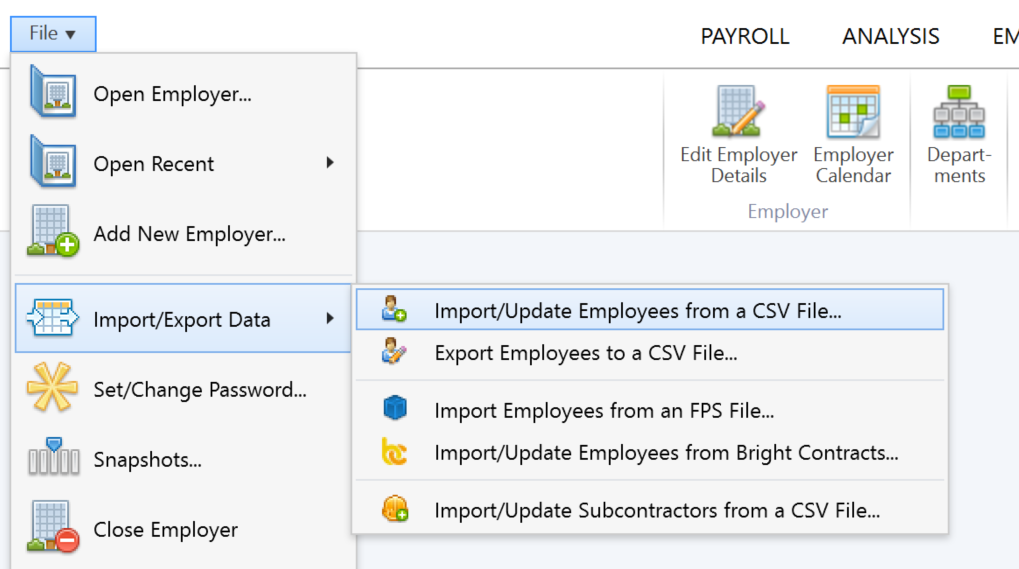

To use this utility, go to File > Import/ Export Data > Import/Update Employees from a CSV File...

1) Browse to the location of your Employee CSV File

2) Select the required file and click 'Open'

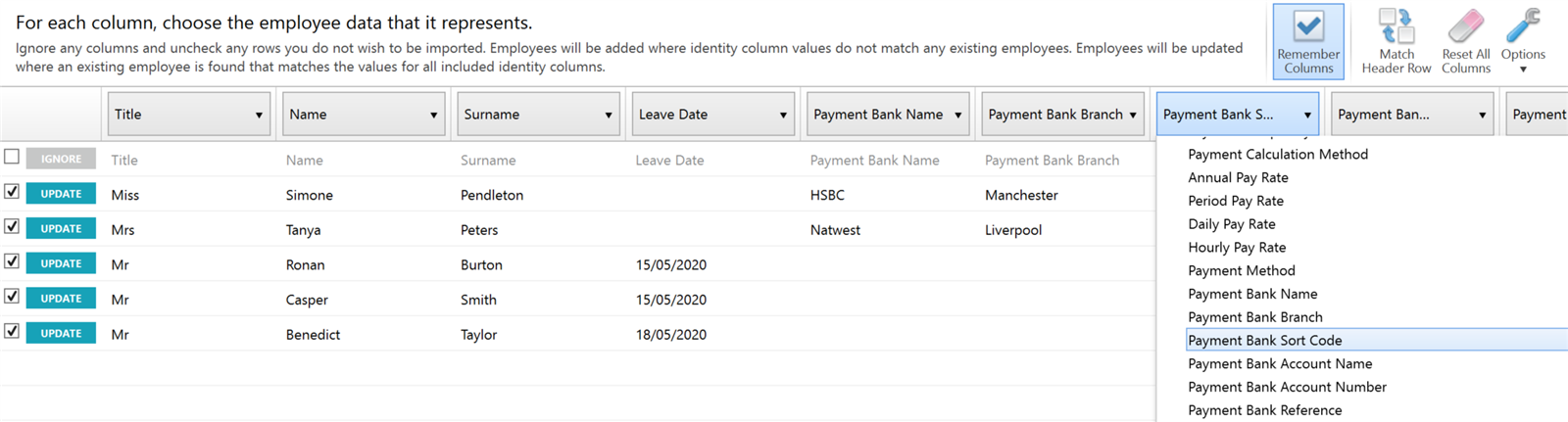

3) Your employee information will be displayed on screen. For each column, choose the employee data it represents. Ignore any columns and uncheck any rows you do not wish to be imported

Important Note:

In order for BrightPay to match row data against existing employees, it will use the 'identity columns'. These 'identity columns' are:

- Name

- Surname

- Works Number

- National Insurance Number

At least one of the above columns must be selected by the user to trigger a match attempt. Rows will be deemed to match only if the values for all selected identity columns equal those for the employee.

- To assist with column selection, simply select 'Match Header Row'. BrightPay will try and match as many columns as it can for you.

- If you would like BrightPay to remember your column selections for any similar CSV imports you may perform in the future, simply instruct BrightPay to 'Remember Columns'. BrightPay will subsequently remember the column selection used in the previous import when you next import an employee CSV file.

- Should you wish to reset your column selection at any time, select 'Reset All Columns'.

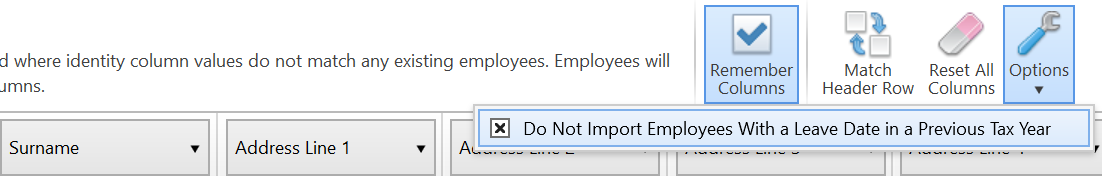

- Should you not wish to add employees with a leave date in a previous year, select this within 'Options'

4) When ready, click Import to update your existing employee information.

Points to Note

- Invalid updates will be prevented (e.g. attempting to change an employee's start date after their payslip has been finalised).

- Where the employee has a currently open pay period, relevant updates will be applied to that period and going forward (e.g department changes)

- This utility cannot be used to change employee data that is classed as an 'identity column' i.e. name, surname, works number and national insurance number.

Employee data which can be imported in to update existing employee records are:

Personal Details:

Title

Middle Name

Gender

Date of Birth

Marital Status

Nationality

Passport Number

Contact Details:

Address Line 1

Address Line 2

Address Line 3

Address Line 4

Postcode

Country

Foreign Country Name

Email Address

Phone Number

Employment Details:

Tax Code

Week/Month 1 Basis

National Insurance Table

Is a Director

Director Start Date

Director End Date

Is Using Alternate Director NI Calculation

Is Exempt From Employer NICs

Student Loan Plan

Student Loan Start Date

Student Loan Stop Date

Postgraduate Loan

Postgraduate Loan Start Date

Postgraduate Loan Stop Date

Leave Year Start Date

Department

Is Annual Leave Carried Over from Previous Year

Number of Annual Leave Days Carried Over from Previous Year

Number of Annual Leave Hours Carried Over from Previous Year

Number of Days Holiday in Year

Typical Number of Hours in Working Day

Is Monday a Typical Working Day

Is Tuesday a Typical Working Day

Is Wednesday a Typical Working Day

Is Thursday a Typical Working Day

Is Friday a Typical Working Day

Is Saturday a Typical Working Day

Is Sunday a Typical Working Day

Starter/Leaver:

Start Date

Starter Declaration

Seconded to Work in UK

Is EEA Citizen

Is EPM 6 Scheme

Taxable Pay in Previous Employment

Tax in Previous Employment

Leave Date

Is Deceased

Payment:

Payment Frequency

Payment Calculation Method

Annual Pay Rate

Period Pay Rate

Daily Pay Rate

Hourly Pay Rate

Payment Method

Payment Bank Name

Payment Bank Branch

Payment Bank Sort Code

Payment Bank Account Name

Payment Bank Account Number

Payment Bank Reference

FPS Details:

Payroll ID (RTI)

Contracted Hours Per Week

Is Irregular Payment Pattern

Is Non-Individual

Is Flexibly Accessing Pension Rights

HR:

Job Title

Starting Salary

Next Review Date

Document Password

Medical Information

Notes

Additional fields which can be imported if a MID-YEAR setup:

SSP to Date (Mid Year)

SMP to Date (Mid Year)

SPP to Date (Mid Year)

SAP to Date (Mid Year)

ShPP to Date (Mid Year)

SPBP to Date (Mid Year)

Gross Pay to Date (Mid Year)

Taxable Pay (including Free Pay) to Date (Mid Year)

Free Pay to Date (Mid Year)

Tax to Date (Mid Year)

NIC-able Pay to Date (Mid Year) (Current NI Table)

Earnings to LEL to Date (Mid Year) (Current NI Table)

Earnings from LEL to PT to Date (Mid Year) (Current NI Table)

Earnings from PT to UEL to Date (Mid Year) (Current NI Table)

Employee NI Contributions to Date (Mid Year) (Current NI Table)

Employer NI Contributions to Date (Mid Year) (Current NI Table)

Total NI Contributions to Date (Mid Year) (Current NI Table)

National Insurance Table (Preceding)

NIC-able Pay to Date (Mid Year) (Preceding NI Table)

Earnings to LEL to Date (Mid Year) (Preceding NI Table)

Earnings from LEL to PT to Date (Mid Year) (Preceding NI Table)

Earnings from PT to UEL to Date (Mid Year) (Preceding NI Table)

Employee NI Contributions to Date (Mid Year) (Preceding NI Table)

Employer NI Contributions to Date (Mid Year) (Preceding NI Table)

Total NI Contributions to Date (Mid Year) (Preceding NI Table)

Student Loan Deductions to Date (Mid Year)

Postgraduate Loan Deductions to Date (Mid Year)

Employee Pensionable Pay to Date (Mid Year)

Employer Pensionable Pay to Date (Mid Year)

Employee Pension to Date (Mid Year)

Employee Additional Voluntary Pension to Date (Mid Year)

Employer Pension to Date (Mid Year)

Net Pay to Date (Mid Year)

Take Home Pay to Date (Mid Year)

Cost to Employer to Date (Mid Year)

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.