CJRS & BrightPay - Calculating & Processing Furlough Pay in BrightPay

The Coronavirus Job Retention Scheme is a temporary scheme open to all UK employers from 1st March 2020 to 31st March 2021. It is designed to support employers whose operations have been severely affected by coronavirus (COVID-19).

- Up until 30th June 2020, employers can claim for 80% of furloughed employees' usual wage costs (up to £2,500 a month) plus associated Employer NICs and minimum automatic enrolment employer pension contributions on that wage.

- From 1st July 2020, employees can return to work part-time while still receiving furlough pay.

- From 1st August 2020, employer NIC and pension contributions are no longer claimable.

- In September, the rate reduces to 70%.

- In October, the rate reduces to 60%

- From November onwards, the rate returns to 80%

We recommend fully familiarising yourself with HMRC's comprehensive Coronavirus Job Retention Scheme guidance, which can be accessed here .

Processing Furlough Pay in BrightPay

20-21 BrightPay provides functionality to calculate and apply furlough pay to an employee's payslip.

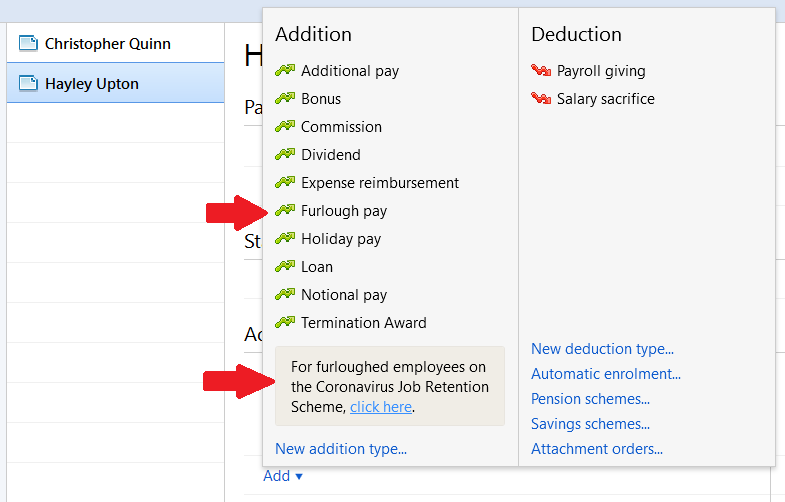

- Within Payroll, select the employee from the left hand listing to access their payslip

- Under Additions and Deductions, click Add, followed by either Furlough pay or 'click here' within the Coronavirus Job Retention Scheme box:

- Before proceeding, check that both the employer and the employee meet all the relevant CJRS eligibility requirements. If eligible, click Yes, I am eligible to proceed

Brightpay will now assist you in working out how much furlough pay to pay your employee:

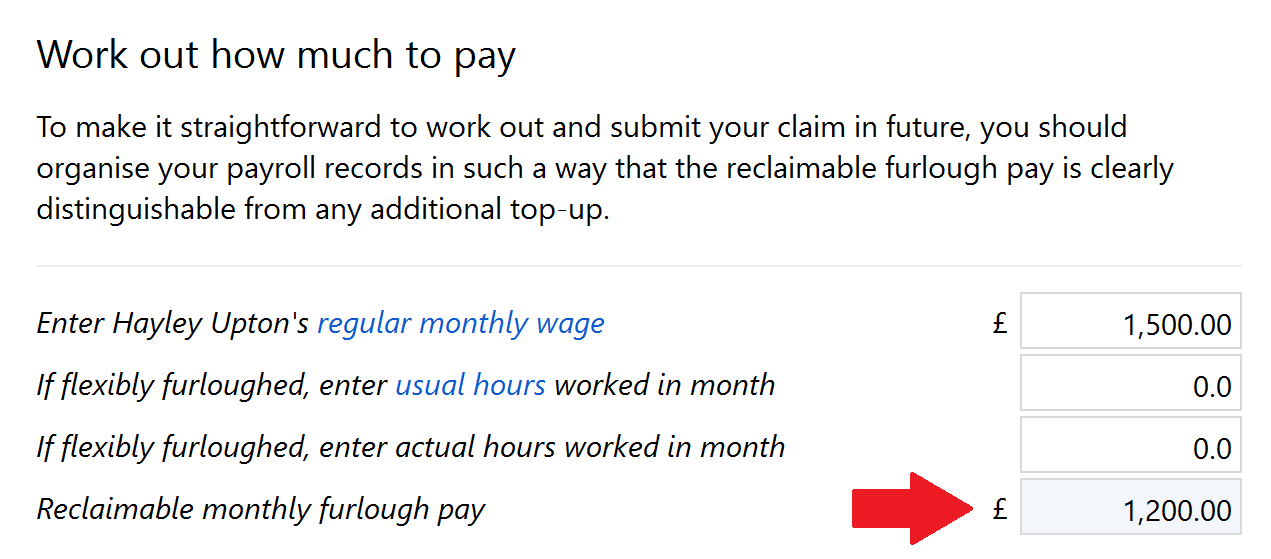

- Enter your employee's regular periodic wage (see HMRC's guidance if required) in the first field

a) If the employee is fully furloughed, BrightPay will now calculate the employee's reclaimable furlough pay:

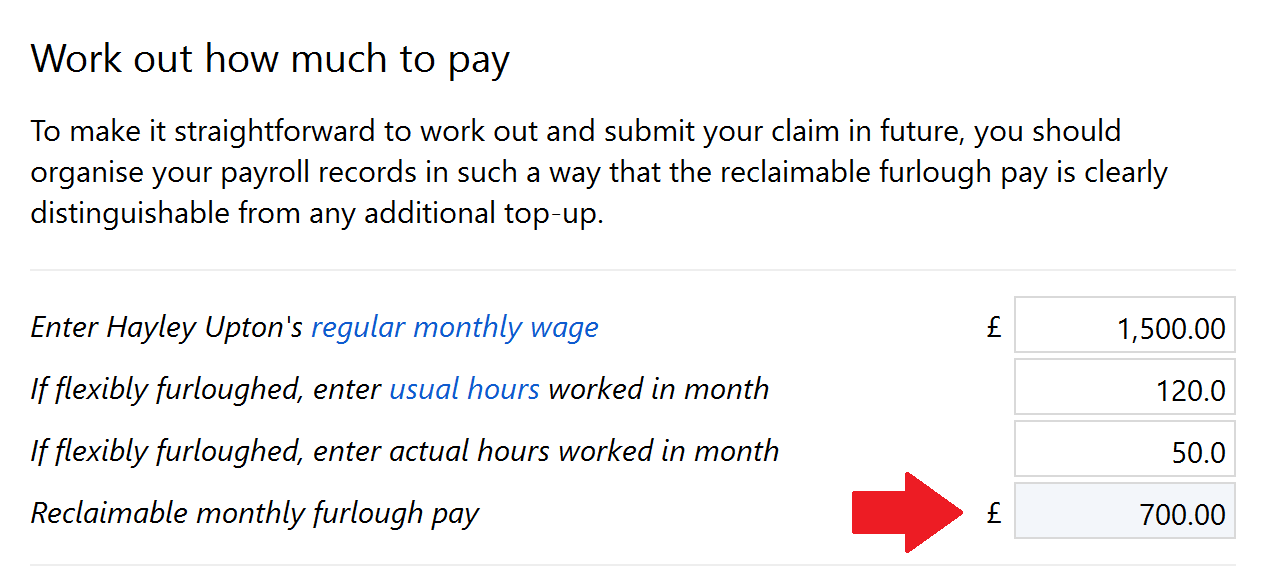

b) If the employee is flexibly furloughed, enter their usual hours (see HMRC's guidance, if required) and their actual hours worked in the pay period in the fields provided.

Based on the hours entered, BrightPay will now ascertain the employee's reclaimable furlough pay:

Please note: on ascertaining the reclaimable furlough pay, BrightPay is programmed to take the requirements for each calendar month into account (e.g. 70% for September, 60% for October).

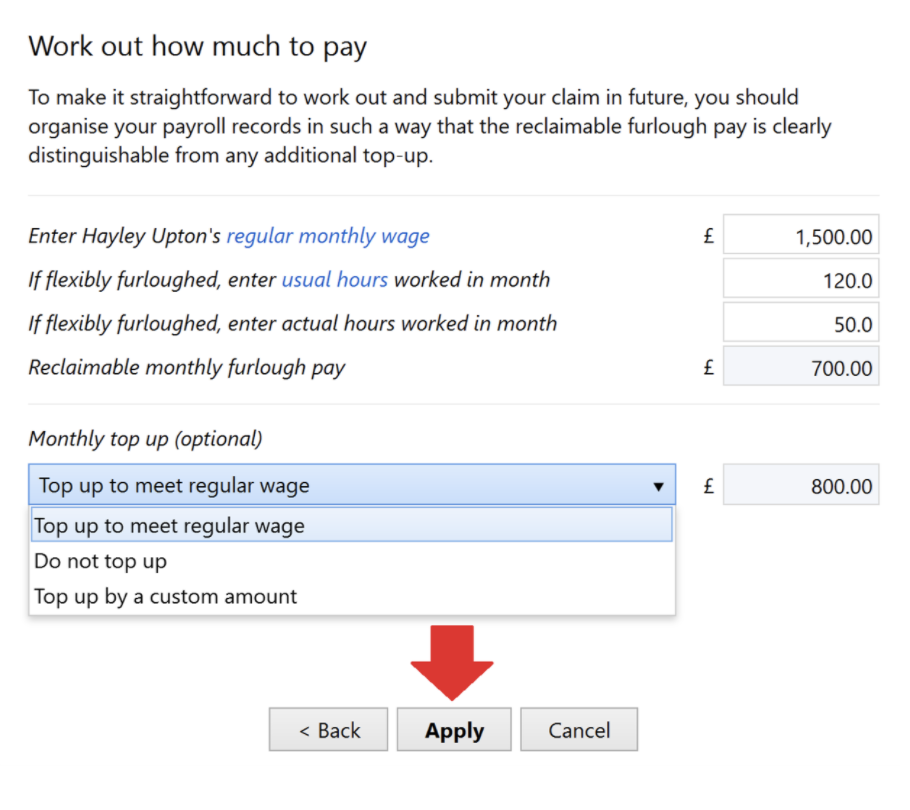

- Next, select the applicable 'top up' option from the listing using the drop down menu, as per your requirements:

a) that you wish to top up to meet the employee's regular wage

b) to not top up

c) that you would like to top up by a custom amount

Based on your selection, BrightPay will now ascertain the amounts to apply to the employee's payslip, as per the example below:

- Click Apply to proceed.

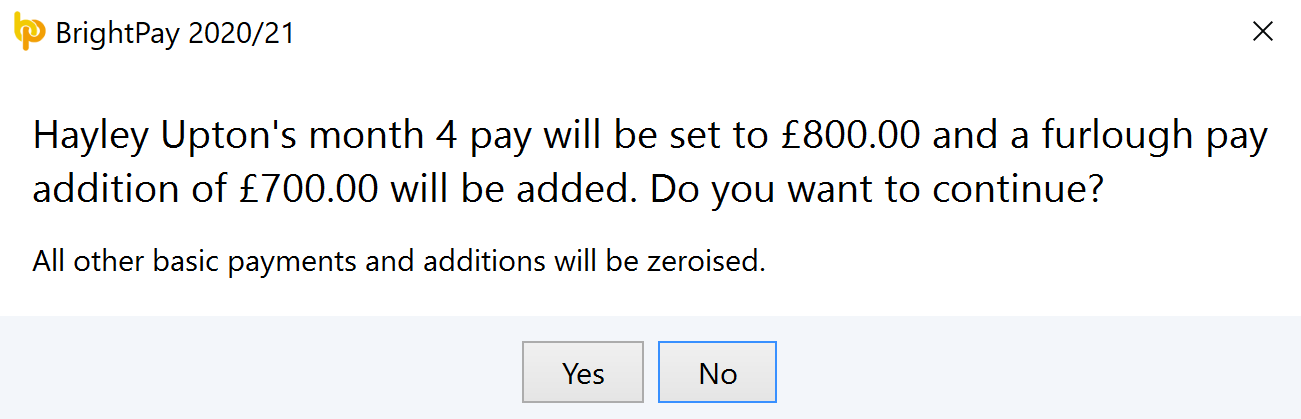

- Your employee's applicable amounts will now be displayed for you to confirm.

It will also be brought to your attention that all other basic payments and additions will be zero-ised.

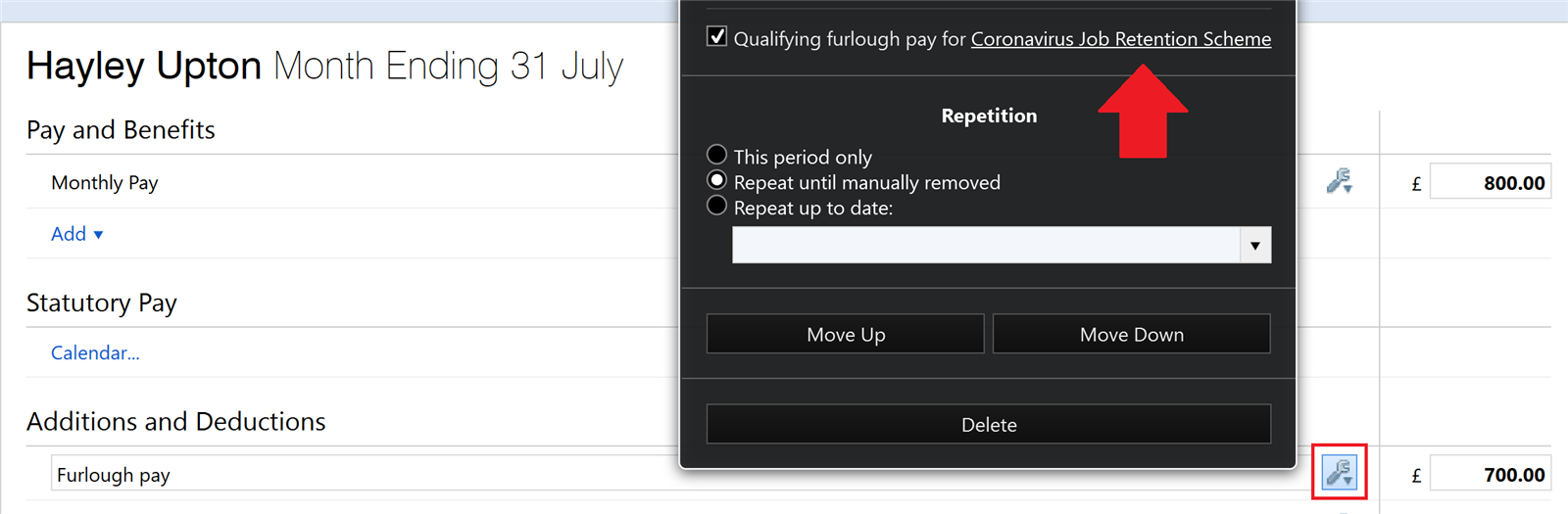

Your employee's payslip will now be automatically updated with the applicable pay items.

- Should you wish to access the furlough pay calculator again before finalising the payslip, simply click the Edit button, followed by the Coronavirus Job Retention Scheme link:

- Repeat the process above for further employees, if applicable.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.